| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Best Time in History to Buy a HouseBy

Friday, January 28, 2011

Right now, is the best time in history to buy a house in America.

Today, I'll show you why... based on a few cold, hard facts.

First off, mortgage rates are lower than they've ever been in American history...

Most investors have only seen a couple decades of mortgages rates on a chart. But my friends at Global Financial Data have databases – including real estate data – that literally go back centuries.

I had dinner with the Global Financial Data team over the weekend. And they told me about their "Winans International" real estate indexes, with housing prices back to the 1800s and mortgage rates going back over a century. I had to share it with you...

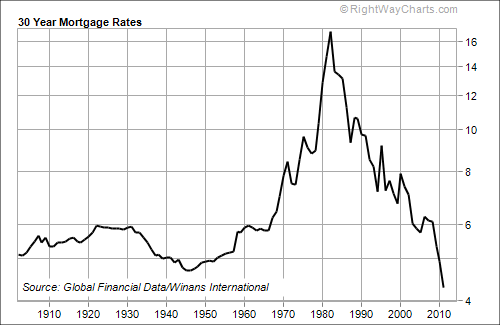

Take a look at this chart of mortgage interest rates since 1900:

As you can see, current mortgage rates are the lowest in U.S. history.

When were mortgage rates even close to this low in the past? Just after World War II...

And what happened, just after World War II, when mortgage rates were this low? The greatest postwar boom in housing prices – by far.

Take a look. Mortgage rates bottomed in the mid-1950s, and house prices bottomed about the same time. Then the greatest boom in home prices in our lifetimes started.

Today we have record-low mortgage rates. And we have another thing in our favor...

Homes are more affordable than ever.

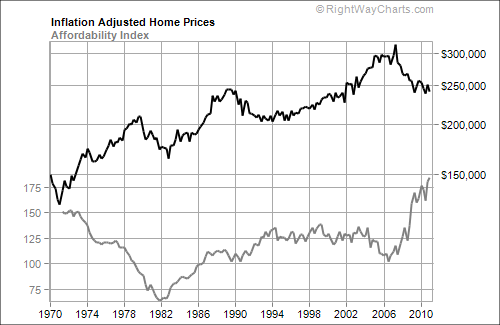

Based on the 40-year history of the Housing Affordability Index... houses are more affordable than they've ever been. Take a look...

"Affordability" takes three factors into account: home prices, your income, and mortgage rates.

Home prices have crashed. And mortgage rates are at record lows. But incomes (nationwide) haven't fallen nearly as much... So homes are now more affordable than ever.

"Most people" out there will only tell you the bad news about housing... That's the way it goes in a bear market. People drive looking in the rearview mirror.

Meanwhile, we have some darn compelling facts out there...

Home prices have fallen by a third... and mortgage rates are the lowest in history. Therefore, U.S. homes are more affordable than they've ever been.

You can listen to "most people." Or you can choose to ignore them and stick to these facts.

Based on these facts alone, now may be one of the best times in American history – even the very best time – to buy a house.

Good investing,

Steve

Further Reading:

Last year, Steve bought a river-front Florida property half a mile away from the Atlantic Ocean... and only paid $20,000 for it. In this DailyWeath, he introduces a method that will return your money tenfold on property investments.

"With home-price crashes and record-low mortgage rates, residential real estate is as affordable as it's ever been in America," Steve says. "It is CHEAP." See what the lowest mortgage rates in history mean for you here: How to Get a 20% Discount on a Florida Mansion.

Market NotesWHY INDIA IS A GREAT PLACE FOR TRADERS The message from today's chart is that for traders, emerging markets are a lot more fun than the U.S.

The biggest macroeconomic trend in the world is the resurgence of massive Asian economies like China and India. While you hear plenty on how these two countries (which together have 10 times more people than the U.S.) are getting richer, they're still dirt poor compared to developed nations like the U.S. This gives them enormous potential to grow over the coming decades. But big growth always brings big growing pains. It always brings wild swings in investor sentiment. It always brings booms and busts. For a picture of these booms and busts, we have a performance chart of the past seven years in India's stock index (black line) versus the S&P 500 (blue line).

As you can see, owning Indian stocks has been a wild ride compared to the S&P 500. Indian stocks skyrocketed during the bull market in the mid-2000s. They crashed in the 2008 credit crisis. They skyrocketed again in the 2009-2010 recovery. While these kinds of moves aren't good for an investor's mental health, they produce incredible opportunities for traders to buy at pessimistic bottoms and short at hype-driven tops.

|

In The Daily Crux

Recent Articles

|