| Home | About Us | Resources | Archive | Free Reports | Market Window |

On the Ground in JapanBy

Wednesday, March 16, 2011

Just got a brief e-mail from my brother who lives in Tokyo:

I am fine... I flew standby to West Japan (Kyushu). I'm now in Kumamoto. I am in an unfamiliar city without a hotel reservation at a time when many are fleeing Tokyo.

We spoke on the phone Sunday night, and he told me the story:

When the earthquake first hit, the building started moving immediately. It was crazy... Walking around my office felt like walking on a waterbed. I hustled away from the window, toward the bookshelves. Then books started falling, so I knew I had to get out of there.

I grabbed my coat and keys and started rushing down the stairs. I got stopped on about the 10th floor because of the crowd. At that point, it felt like I was on a crowded boat in a storm at sea, getting tossed back and forth.

I finally made it outside, looking for solid ground. It didn't exist... It felt like I was walking around on Jell-O.

He also explained that an earthquake is different from what we Floridians are used to with hurricanes. He realized it during the worst of the earthquake... "The nice thing about a hurricane is, you know when it's coming, you know roughly how strong it is, and most important, you know when it'll be over."

This is the worst crisis in Japan since World War II...

The positive spin on Japan's tragedy will be that this destruction will cause rebuilding that might kick Japan's economy into gear once again, like it did after World War II.

Unfortunately, it doesn't work that way. In the 1946 book Economics in One Lesson, author Henry Hazlitt exposed the fallacy here... No man burns down his own house on the theory that the need to rebuild it will stimulate his energies.

What's true for one man is true for a country. You can't argue the destruction will be a net benefit to the Japanese economy.

But Japan will rebuild... to get back to where it was.

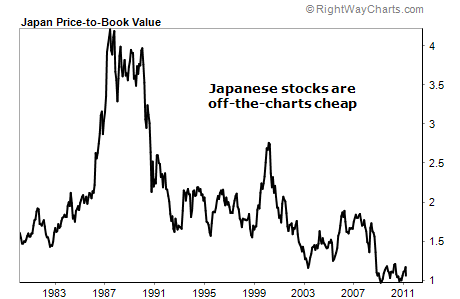

And as I've told you, small stocks in Japan are the cheapest stocks in the world – by far.

They're even cheaper now... Over two days, Japan's TOPIX (a broad stock market index) fell more than it ever has since its inception in 1949.

People are selling first and asking questions later. Japanese stocks as a whole are trading at just 1.06 times book value. (Compare that to the Dow, which goes for 2.75 times book.)

Small-cap Japanese stocks are trading at just 0.7 times book value – or a 30% discount to book value – and 0.34 times sales. This is off-the-charts cheap.

Those are the statistics of the WisdomTree Japan Small Cap Dividend Fund (DFJ).

DFJ is currently a recommendation in my True Wealth newsletter. Your upside potential is hundreds of percent. And in True Wealth, we limit our risk to a 25% trailing stop. We will stick to that trailing stop discipline.

Even with the devastation in Japan, I still believe DFJ has the potential to turn out to be a fantastic investment.

Good investing,

Steve

Further Reading:

Last week's disaster has driven Japanese stocks down double digits. They're not the only ones. As Matt explained yesterday, "the rout is on in the uranium sector." Stocks are down 10%-50%.

If you've got uranium stocks in your portfolio, Matt says, "Don't hold and hope." Here's what you should do instead.

Market NotesMORE GOOD NEWS FROM THE COMMODITY COMPLEX Yesterday, we showed why it's not all bad news for DailyWealth readers: We're "forever" owners of gold for insurance against times like these. And as gold's long-term chart shows, the incredible uptrend is still intact.

Today, we feature more "not bad" news: The "contrarian's commodity," natural gas, is holding steady in the face of a huge commodity correction. A major fuel for power plants, and the heating and cooling of homes, natural gas is so hated and beaten-down that gas bears can't knock the price down much past $4 per thousand cubic feet (mcf). Here's why...

We know from an industry contact that domestic gas production costs are running around $3.50-$4 per mcf. Companies can't make money producing gas when prices are that low. The taps shut down.

This fundamental aspect of the gas market shows up in a bit of "common sense technical analysis." You'll note from the three-year chart below that natural gas simply refuses to fall below the $3.50-$3.75 level... even in the face of this week's awesome selling pressure in the commodity complex.

|

In The Daily Crux

Recent Articles

|