| Home | About Us | Resources | Archive | Free Reports | Market Window |

Triple-Digit Profit Potential in the World's Cheapest Major MarketBy

Tuesday, September 6, 2011

While Americans enjoyed their Labor Day barbecues, stocks in Europe got torched...

Germany's main stock market index (the DAX Index) fell more than 5% on Monday.

Now, German stocks are record cheap...

You might think of German stocks as "foreign" companies. But many top German companies are household names in America... including BMW, Bayer (the aspirin maker), and Daimler (Mercedes). Others are the world's most important innovators, including Siemens and BASF.

Astoundingly, ALL of these global titans are trading at single-digit forward price-to-earnings ratios... For example, Daimler is trading for 5.7 times forward earnings. Bayer goes for eight times forward earnings.

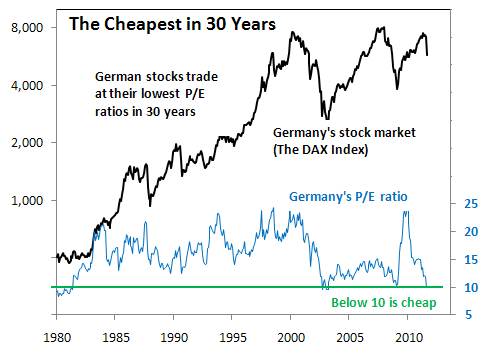

To give you some perspective on this, German stocks have almost never traded at single-digit P/E ratios. In the last 30 years, whenever the P/E ratio dipped below 10 in Germany, triple-digit profits soon followed:

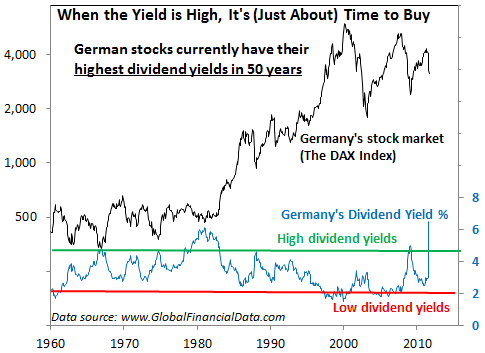

Another measure of value is a stock's dividend yield... The higher, the better.

In Germany, the dividend yield is as high as it's been at any time in the last 50 years. The last time it was this high was in the early 1980s... and German stocks soon soared:

German stocks are cheap today because investors believe Europe is in dire trouble. Many European countries will simply never be able to pay their bills. Major changes have to happen. And that adjustment will be extraordinarily painful.

But Germany should not be lumped in with the rest of Europe...

Germany has been the shining example of how to do it right. Of course, German businesses sell their products to Europe. And the bigger concern now is that German banks are overextended in these troubled European countries. If Europe catches a cold, Germany will certainly sneeze.

In DailyWealth, we keep it simple when we size up investments. We're looking for investments that are cheap and hated, with the glimmer of an uptrend to confirm things are getting "less bad."

In Europe, stocks are hated these days. The situation appears hopeless. And German stocks are record-cheap, as I've shown you today.

However, we are still missing the uptrend. This is a crucial part of our investment criteria...

German stocks were cheap and hated for years in the early 1980s before they turned around. If you'd bought German stocks in 1980 when they were cheap, you'd have lost money for a couple years before they finally took off for triple-digit gains.

German stocks are the cheapest they've been in nearly three decades. History shows us that you can make triple-digit profits if you buy German stocks when they're cheap.

We're interested. But to improve our odds a bit more... as a gauge of when things are getting less bad in Germany... we'll wait to see an uptrend in stock prices.

We will miss the first part of a new bull market in Germany, and that's fine. We're doing our best to buy when it's cheap and when the worst has passed.

Triple-digit profits are likely in Germany some day soon. But there's no urgency to pile in just yet...

Good investing,

Steve

Further Reading:

"The reality is... if you want to buy any investment for pennies on the dollar," Steve writes, "you have to be willing to buy when things appear bleak." He's got an opportunity so tempting, he says he's personally pursuing some of the greatest values he's ever seen.

Market NotesOUR FAVORITE SILVER STOCK IS CLOSE TO A BREAKOUT Rising gold and silver prices aren't just boosting the Gold Bugs Index... they're pushing Silver Wheaton higher as well.

In our September 3 edition, we noted how gold stocks have treaded water for the past 10 months. But the recent 48% increase in gold has pushed the "golds" toward a new upside breakout level.

Today, we look at the past year's trading in our favorite silver stock, Silver Wheaton. It's close to a breakout of its own.

Like most silver stocks, Silver Wheaton enjoyed a big rally early this year. This was during the parabolic rise in silver. When silver sold off, so did Silver Wheaton. Shares fell from $46 to $31. But as you can see from today's chart, Silver Wheaton is moving higher again... and is close to reaching its highest high in four months. If silver prices remain robust (a good bet), this stock will blast much higher in the coming years.

|

In The Daily Crux

Recent Articles

|