| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today's DailyWealth is a little longer than we normally publish. But Steve wanted to show you what he's up to in his new trading service True Wealth Systems. We think you'll be surprised... Safe, 500%-Plus Profits Since 1998By

Thursday, September 29, 2011

In the September issue of my new service, True Wealth Systems, I introduced subscribers to a simple system that has returned more than 500%, with relative safety, since 1998...

I'll share that simple system with you today. It is incredibly easy to understand. It should be in "buy" mode for the next two years. And you just have to buy one stock to take advantage of it.

Let me show you how it works...

The latest issue of True Wealth Systems came out in the beginning of September... In that issue, the TWS computers were flashing zero buy signals on world indexes and zero buy signals on any stock market sector. I'd never seen that before.

But they were signaling "buy" in this particular system...

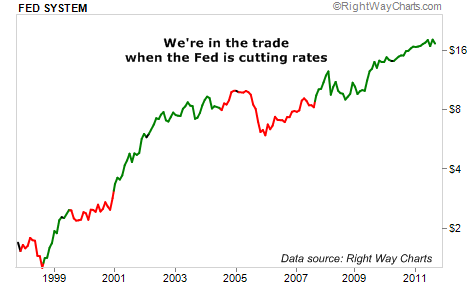

In this system, you buy one particular investment when the Fed cuts interest rates. When the Fed raises rates, you sell. Repeat.

This system is simple. You don't need to be watching CNBC every second to follow it. The Fed has only had five changes in direction since 1998. You can hardly miss the signal... Any moves by the Fed will be all over the news.

It's also safe (or should be for two years). You're not betting on a trendy product or service. You're simply betting on a safe strategy – buying 100%-government-guaranteed bonds. This strategy works well when the Federal Reserve is not raising interest rates. And the Fed has essentially promised it won't raise rates through the end of 2013.

Since the Fed cut interest rates in 1998, most investments have done nothing... Yet this system has performed fantastically.

If you'd bought this investment when the Fed cut interest rates in late 1998 and sold when the Fed hiked interest rates nine months later, you'd have pocketed 46% profits.

The next time around, you'd have made profits of 170%-plus... buying when the Fed cut rates in 2001 and selling when the Fed hiked rates in 2004.

The most recent signal was in 2007... And that's been good for a 62% gain.

So $10,000 invested would have turned into $14,600 the first time around... Then that $14,600 would have grown by 170%-plus to $39,500 the next time around... And that $39,500 would be roughly $63,900 today – up over 500% on the initial $10,000 invested.

This chart shows it... When the Fed is cutting rates (in green), you want to own this month's recommendation. And when the Fed is hiking rates (in red), you want to be out of the trade. It's that simple.

This investment is Annaly (NLY). Here's a table of how the TWS Annaly trade has worked out. (Keep in mind... all of these INCLUDE dividends. Dividends are a crucial part of the big returns in virtual banks like Annaly.)

Right now, we are in a fortunate position...

The Fed has assured us it will not raise rates through the end of 2013. So we have a "free pass" on this trade for two more years. Remember... this indicator will not go into "sell" mode until the Fed raises rates.

We have another simple system for shares of Annaly – for value...

When Annaly trades at a big premium to its liquidation value (we use "book value" as a close guess for liquidation value), you want to sell it. And when it trades close to liquidation value, you want to buy it.

Right now, Annaly trades close to liquidation value. Take a look:

.png) The results of this "value" system are even better than the results of the "Fed" system...

Your wealth compounds at 31% a year in buy mode in this system, versus 27% a year in buy mode in the Fed system. The only problem with the value system is that it doesn't signal as often... It's in buy mode less than 50% of the time.

Historically, when both of these systems are signaling, your wealth has compounded at a 48% annual rate.

Having both buy signals hasn't happened often... It's only happened about 28% of the time. But when we have both signals – when the Fed is cutting rates AND when Annaly is cheap – you REALLY make a lot of money.

Right now, we have both signals.

In True Wealth Systems, we find the simplest systems possible. That's harder than it sounds... Specifically, we find the kernel of simplicity in some extremely complicated financial relationships. While we can create investing systems with bigger results, we stick with simple systems. We believe these will continue to perform going forward.

These two Annaly systems are great examples of what we do... The Fed doesn't change interest rates that often... And when it does, you hear about it. Simple. And the "value" indicator is simple as well.

The simple interest rate system for Annaly has delivered 500%-plus profits since 1998. And the gains are even higher when you have both the interest rate system and the value system saying "buy."

So I have two suggestions for you today...

Buy Annaly now... Historically, it has compounded wealth at 48% a year in conditions like today.

And consider coming on board with True Wealth Systems. I think you'll like what we're up to... You can learn more about a subscription here.

Good investing,

Steve

Further Reading:

"For our True Wealth Systems service, we have tested just about every academic system under the sun, from the super-simple to the extremely complicated," Steve writes. It's hard to believe, but this "dumb" system actually beats most systems. It beats the markets over most long-term time frames, with much less risk.

Learn more about this "Holy Grail" system here: I Hope You Can Apply This Investing Lesson Faster Than I Did.

Market NotesYOU HOLD THE BAG AND KEEP THE STORY, WE'LL TAKE THE CASH Today's edition points out one of the great follies of investing... and drives home one of our "big themes" here at DailyWealth.

The folly is how novice investors inject hopes and dreams into their money management. This causes many folks to put wealth into things like "clean energy" companies with great stories and little chance of profit. It makes them feel good to invest in a solar panel maker that pays no dividend, for instance... rather than a boring, well-managed, dividend-producing firm like ExxonMobil or Coca-Cola.

We're all for pristine water and air... and puppies, too. But we're realists. We know the problem with solar energy is a thing called "night." We know collecting safe dividends for many years is the ultimate way to get rich in stocks. And we know "boring" is usually better with long-term investments.

For a comparison of these ideas, we've plotted the performance of major solar panel maker Trina Solar (black line) versus Coke (red line). The "feel good," exciting idea, Trina, is down more than 70% this year. Coke, the boring dividend payer, is up 20%.

|

In The Daily Crux

Recent Articles

|

||||||||||||||||||||||||||||||