| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Next Major Move for the Dollar Starts NowBy

Tuesday, October 11, 2011

One month, investors think the U.S. dollar is headed into the toilet... that it'll be worthless in no time.

The next month, they think the opposite... They think the U.S. dollar is the only safe haven out there when everything else in the investment world is headed into the toilet.

Investors thought the world was going to hell in late 2008 and March 2009. So they clamored for dollars... and the dollar hit new highs. Today, with fears about Europe and the euro, investors have clamored for dollars again.

I believe times are about to change for the dollar...

It's time for the dollar to fall again.

The main reason is simple... At the moment, there's nobody left to buy dollars. Anyone who wants the U.S. dollar already has it.

Let me show you a few ways I track this...

First is "sentiment." In short, when sentiment reaches an extreme, it's time to consider doing the opposite. Right now, investor sentiment surrounding the dollar is about as optimistic as it gets.

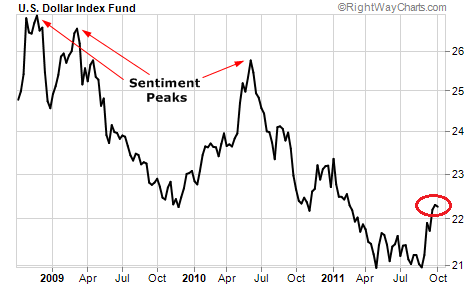

Sentiment about the dollar has only been more optimistic than today just three times in the last five years. And in all three instances, it marked a peak in the dollar. Take a look...

It is possible that sentiment (as measured by Jason Goepfert's www.SentimenTrader.com) could reach a higher level – that the peak in the dollar is not here yet. But we should be close.

While sentiment for the dollar is at a high for this year, sentiment for all the other major currencies (except the yen) versus the U.S. dollar is at lows for the year.

Each time dollar sentiment got this high, we saw a major short-term peak in the U.S. dollar. The Dollar Index fell dramatically over the following two months.

The story is the same when you look at the actual dollar "commitments of traders"... Large speculators currently have their smallest bets this year on the euro, the British pound, the Canadian dollar, and the Aussie dollar.

Based on the commitments of traders, investors have finally given up on all of these currencies versus the dollar. Based on this, the next move in all these currencies versus the dollar should be up.

The U.S. dollar is not a good value right now... paying no interest. It is widely loved as a safe haven, at the moment. And so far in October, the U.S. Dollar Index is down. So the trend might be starting to confirm the fundamentals.

It's the opposite of the three things we look for in an investment: cheap, hated, and in an uptrend.

With history as our guide, the U.S. dollar index could lose 5%-10% of its value over the next two months.

But what's the best way to bet against the dollar right now? Do you actually want to buy the euro?

No. The safest way to bet against the dollar is to own gold. When the value of the dollar falls, the value of gold (priced in dollars) goes up.

We're seeing our favorite signs line up for a coming fall in the U.S. dollar over the next two months... Trade accordingly.

Good investing,

Steve

Further Reading:

Master trader Jeff Clark expects the dollar could give up as much as 50% of the gains it's made this fall. "And when the dollar does finally start to fall," he writes, "it should happen fast." But he's expecting one more push higher before that happens. If you're a trader, you can find his full argument here: What To Do If You Miss The Bottom.

"History doesn't repeat exactly in the financial markets," Steve writes. "But it does rhyme. If this is the bottom in consumer confidence, solid gains in stocks should lie ahead..." Read more here: Stocks Could Soar 40% in Six Months.

Market NotesTHE "BASICS" STRATEGY HOLDS UP DURING THE PANIC Despite the August market crash and the euro crisis, it's business as usual for one of our "sell the basics" leaders.

Regular readers know that when it comes to investing in high-growth emerging markets like Brazil, India, and China, we tend to avoid hot gadgets and Internet stocks. We recommend "the basics" approach of owning dominant global companies that sell things like soda, beer, and cigarettes to these markets. "Boring" products like these enjoy steady, unrelenting demand... There's scant risk new technology will make having a beer after work obsolete. Plus, well-run companies in these industries generate huge cash flows and big dividends.

One of our favorite "basics" leaders is Philip Morris International (NYSE: PM). A longtime recommendation of our colleague Dan Ferris, PM is the international offshoot of U.S. cigarette powerhouse Altria, which makes it the largest international vendor of cigarettes in the world... and a direct play on the world's growing middle class, much of which is in Asia. Dan's readers are earning a dividend yield of approximately 6% on their original purchase price.

As you can see from today's chart, Philip Morris sold off a bit during the market crash. Shares fell from $70 to $65. But this 7% drop is small compared to the 15%-35% declines many stocks suffered. Selling the basics isn't exciting... but it's working... even during the panic.

|

In The Daily Crux

Recent Articles

|