| Home | About Us | Resources | Archive | Free Reports | Market Window |

How My Hero Created His WealthBy

Thursday, October 13, 2011

My dad is my hero...

From extremely humble beginnings, he accomplished a great deal in his life. (Check out a brief story on him here.)

My parents started out together from scratch... My mom was a schoolteacher, and my dad was in the Navy. But they managed to do one thing that built them enough savings to retire comfortably. The thing is, it wasn't my dad that did this one thing... It was my mom...

Sometime early on, my mom took an interest in real estate. She got her real estate license, and she was a part-time real estate broker. Growing up, whenever we'd visit somewhere new, my mom would compulsively collect the local real estate brochures. She was always on the hunt.

My mom is conservative... She wasn't interested in the stock market or other schemes that got popular over the decades. She decided the way to build a nest egg (and look after it yourself) was through your own home.

Since my dad was in the Navy, we'd get stationed in some new town every couple years. This gave my mom a chance to "upgrade."

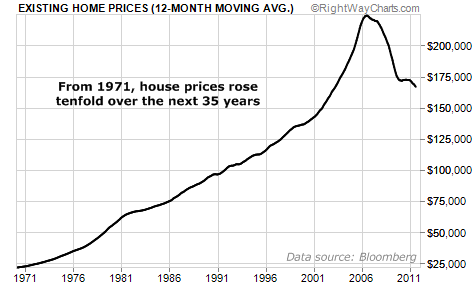

I was born in 1971, so that's probably about when this process started for my mom... They'd sell their house, take all the equity they'd built, and put it toward a down payment on the next house. They would buy as much house as they could afford.

The timing was right... House prices rose tenfold over the next 35 years...

A tenfold price increase is one thing... But with a mortgage (which gives you leverage), their returns were certainly higher. My parents could collect the full increase in their home's price... while only having a fraction – the down payment – invested.

In short, buying right – combined with a little inflation and a little leverage – built my parents a comfortable nest egg.

I tell you this story because the timing is right once again to do what my parents did.

Homes in the U.S. are more affordable than ever right now. Mortgage rates are as low as they've ever been, hovering around 4%. And house prices have fallen more than they have in generations. They're now so cheap, they're selling for less than replacement cost... And you get the lot for free. It's all true.

If you've already traveled down the path my parents went down, congratulations. Pass this note along to your kids or your grandkids.

Now is the time.

If they buy right (which means now) with help from a little inflation and leverage (through a mortgage), they will be able to retire with a solid nest egg. Safely...

Your house isn't like shares of a company that can go out of business. Your house is yours – you control its destiny.

My hero built his wealth this way – safely and slowly – even if it was my mom who masterminded the whole thing.

After five years of bust... and now with record-low interest rates... it's time for the next generation to play this game again.

If you can, do it...

Good investing,

Steve

Further Reading:

"Today, housing is cheap," Steve says. "Mortgage rates are below 4%. And the government has renewed its commitment to force home prices higher. Why fight that?" If you're not convinced yet, find out why Steve is personally pursuing some of the greatest values he's ever seen.

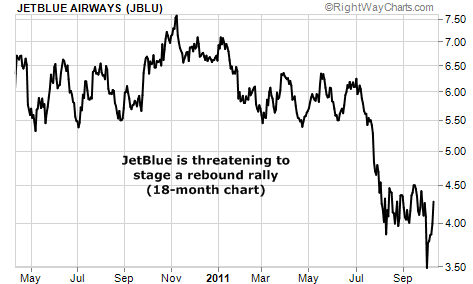

Market NotesTHIS HATED ASSET IS THREATENING TO RALLY After dipping along with the broad market last month, airline stocks are again threatening to rally.

Last month, we noted the "boom and bust" airline sector busted this summer... And it was due for a potentially big rally. Just after our note, the broad market plunged... and took the sector down another 5%-10%.

Airlines are legendarily horrible long-term investments. They sport thin profit margins, they're subject to wild swings in fuel costs, and they require lots of capital expenditures to keep the businesses running. But for traders, they are an attractive sector. Airlines tend to go through big, tradable booms and busts. You just have to buy them when conditions look dark and everyone is bearish… and sell when things look bright and everyone is bullish.

Right now, the crowd is bearish. Airlines have suffered 40%-50% declines in the past year. But as you can see from today's chart of big airline JetBlue, the stock (which trades for less than book value) is close to breaking out to a multi-month high. If the market stages an "end of year" rally, airlines could be good for big "rebound" gains in a short period of time.

|

In The Daily Crux

Recent Articles

|