| Home | About Us | Resources | Archive | Free Reports | Market Window |

Huge Income Checks From the World's Most Hated ResourceBy

Wednesday, November 9, 2011

Last month, my colleague Dr. David Eifrig presented a "radical" approach to collecting investment income.

His income approach is brilliant because it allows the investor to collect a huge amount of income, even if stocks the investor is involved in simply move sideways.

This is also the key to one of my favorite ways to earn income from natural resource deposits... one I introduced last year in DailyWealth. If you took advantage of this idea, you've made a lot of money... and I expect you will continue to do so.

The idea is buying what is likely the world's most hated commodity: natural gas.

Natural gas is the clean cousin of crude oil. We use it to fire electrical plants, produce chemicals and fertilizers, and heat homes and factories. Most investors can't stand the thought of investing in natural gas because there's a giant, technology-driven production boom going on right now.

Bears will cite this massive new supply and say there's no way to make money in gas. They're partly right: The supply surge has crushed the price of natural gas. It's down from $14 per mcf (thousand cubic feet) in 2008 to less than $4 now:

However, by owning a special type of company, my readers are enjoying income payments in the 5%-8% range in natural gas and crude oil.

On March 31, 2010, I told readers how to put on a natty trade. That essay was all about these companies, called "royalty trusts."

Royalty trusts aren't conventional oil and gas companies. They are essentially "boring" chunks of land that trade on the stock market. The operators of these trusts simply extract oil and gas from the land and send their shareholders income checks.

Even though natural gas prices are depressed right now, many trusts have such low production costs, they are still able to pay out fat distributions.

On March 31, 2010, the shares of one of my favorite trusts, San Juan Basin, traded for $20.84. Today, its shares trade for $24.79 each. That's a capital gain of 19%. (Modest, but still ahead of the market's 7.5% return.) But the company also paid us $2.38 in dividends. So our total return on our San Juan Trust investment is actually 30%.

What's even more amazing is that San Juan's "boring" business allowed its share price to hold like a rock this fall while other commodity stocks (like copper miner Freeport-McMoRan and oil sands miner Suncor) were hammered:

Keep in mind: San Juan Basin's steady paychecks and extraordinary price strength have come in a depressed price environment for natural gas. Prices have collapsed and are essentially moving sideways right now.

Despite all this, the trust is still an excellent income vehicle. You get paid even if gas goes sideways or a bit lower (which is what I expect over the next year). It's a "radical" approach to investing... But it works.

As I write, San Juan isn't quite cheap enough for a new buyer to take a position... But this company and its fellow trusts are worth following. Should a selloff in these companies occur, it will be a chance to get in... and start earning big distributions.

Good investing,

Matt Badiali

Further Reading:

Growth Stock Wire's Frank Curzio has his own watch list of cheap natural gas companies. These small-cap producers are trading at steep discounts... and have huge upside potential from here. Get the details here: Get Ready for the New Age in Natural Gas.

Last month, Steve said it was time to "back up the truck" on commodities stocks. His subscribers are already up double digits. And he sees plenty more room to grow. Review his two favorite ways to play the commodities sector here: Buying the "Masters of the Universe" in Commodities.

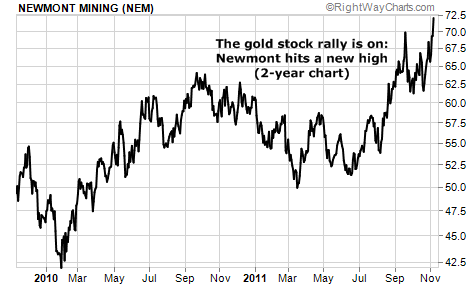

Market NotesA MAJOR BREAKOUT IN THE GOLD COMPLEX As we predicted this summer, cheap gold stocks are moving higher. Just this week, one of the "bellcows" of the sector, Newmont Mining, staged a major upside breakout.

Back in the dark days of December 2008, we tagged gold stocks as one of the market's leading "rebound" candidates. The sector was the definition of "beaten up and left for dead." The "golds" behaved as we expected... and gained more than 100% over the next year.

But as we've noted recently, gold stocks have largely treaded water for the past few years. Folks just don't believe gold prices will stay north of $1,500 per ounce... So they're not willing to bid up the price of gold stocks.

Here at DailyWealth, we'll take the other side of that bet. We expect gold to remain over $1,500 per ounce for a long time. We expect it to climb to over $2,000 an ounce. That's why we're not surprised by the recent price action in mega gold producer Newmont. The stock just surged to a 52-week high, and our expected gold stock rally is on.

|

In The Daily Crux

Recent Articles

|