| Home | About Us | Resources | Archive | Free Reports | Market Window |

An Easy Way to Avoid Volatility... And Still Make Great ReturnsBy

Thursday, November 10, 2011

What's going on out there? What's causing all this volatility in the markets?

And how can we avoid the volatility and still make solid, safe returns?

I posed these questions to my friend Mebane Faber yesterday...

Meb has come up with a "Holy Grail" investment system... It's beaten the stock market over the last four decades... with less volatility than stocks.

Even better, it's remarkably simple. More on that in a minute... First, let me tell you little about Meb...

Meb has spent a lot of time thinking about volatility... Like many great investors, he knows he will make money... So he spends his time figuring out how to earn stock-like returns with as little volatility as possible.

"Stock market volatility is much higher when the market is declining," Meb told me yesterday. "Most of the worst AND best days happen AFTER the market has already started declining."

Meb explained how humans are hard-wired to cause this...

"The part of the brain that is stimulated by cocaine is the same part that fires when you're making money," he said. "But when the market is going down, your brain uses its 'flight' response, causing greater volatility."

So Meb tries to avoid declining markets by riding the uptrends. "The stock market has historically gone up about two-thirds of the time," he says. "And all the stock market return occurs when the market is already 'uptrending.'"

So Meb's simple system captures uptrends in five major asset classes – stocks, bonds, commodities, real estate (through REITs), and foreign stocks. (For the details of Meb's simple system, you can get his book The Ivy Portfolio or read his paper here.)

His simple system has delivered fantastic results... According to his academic paper, his system was up 11.3% a year from 1973-2008, versus 9.8% for the overall stock market.

More importantly, it was dramatically less volatile... His simple system never had a losing year... until 2008, when it lost 0.6%. The stock market lost over 30% that year... as did most other asset classes.

You can easily mimic Meb's simple strategy by buying five exchange-traded funds (ETFs) and checking in monthly to see if you need to rebalance.

But now, Meb has made it even easier... You can simply buy his ETF, the Cambria Global Tactical Fund (GTAA).

Meb drills down to a much deeper level with GTAA... Instead of the five major assets, Meb sizes up dozens of investment classes for potential investment. He sticks with the same logic he uses with his simple system.

Now is an attractive time to get into the fund... as it's actually down year-to-date.

Why is his fund down? As he told me, it's been a challenging environment for trend-following funds in general... There haven't been any uptrends...

While the fund is down for the year, it has fulfilled one part of its promise – it's been a lot less volatile than the stock market. And as of a month ago, it was even beating the stock market.

I believe Meb's system is the right way of thinking... You make the real money in big, long-term trends. And I believe GTAA will capture those big moves.

Meb's simple system is one way to avoid the volatility and potentially beat the stock market over the long run. Check it out today...

Good investing,

Steve

Further Reading:

Meb recently crunched the numbers on dividends and other cash payouts and found something amazing... Get the details here This Simple Stock Market Strategy Would Have Increased Returns 926%.

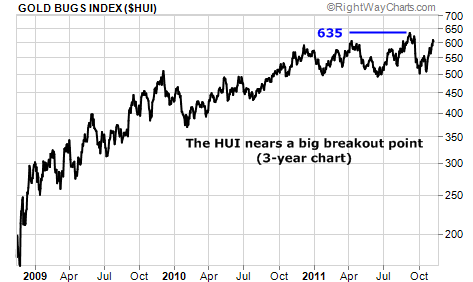

Market NotesA BIG IMPORTANT NUMBER FOR THE "HOO-EY" As we noted yesterday, gold stock bulls received a big piece of positive price action when bellcow Newmont Mining reached a new high of $72.13.

Today, we look at another bullish "line in the sand" level for gold stocks. The number is 635.

While Newmont is a key player in the gold complex, traders like to monitor the Gold BUGS Index for a broad gauge of gold stock action. This index's nickname is the "HUI." (We pronounce it "hoo-ey.")

After enjoying the rebound we predicted back in December 2008, the HUI spent a good amount of time stuck in a sideways range. But as you can see from the chart below, the index popped to a new high in September. This new high – at 635 – was followed by a sharp correction. But in the past month, the HUI has rallied higher, and sits just below 600 right now. Should the index finally clear 635, it's another sign cheap gold stocks are entering the next leg of their bull market.

|

In The Daily Crux

Recent Articles

|