| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Best Place to Park Your Money in this Zero-Percent WorldBy

Tuesday, November 15, 2011

You're thinking about this all wrong...

It's not just you, though. Everyone is missing it completely.

We can't "fix" everyone's thinking... But hopefully, after reading today's essay, you'll be thinking right. Then you can make some REAL money in the markets.

Let me explain what I mean...

How does 50 degrees Fahrenheit and sunny sound to you today? It probably depends on where you are...

If you're in the Florida Keys today, 50 degrees sounds terrible... It's just too cold! But if you're in Iceland today, 50 and sunny sounds fabulous. Time to get out there! See the waterfalls and the geysers, maybe play some golf.

In the stock market, today is 50 degrees and sunny.

You see, stocks today are the best relative value they've been in as long as I have been investing. By "relative" value, I mean relative to anything else that you can put your money into these days.

It might be 50 degrees outside in the stock market. But it's below freezing just about everywhere else... You earn zero-percent interest on money in the bank. You earn 2% if you loan your money to the government for 10 years (by buying government bonds). It's hard to find a decent place for your money.

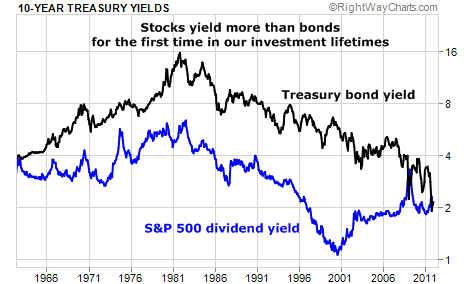

Meanwhile, for the first time in my investing lifetime, the dividend yield on stocks is higher than the dividend yield on bonds. Take a look...

At the stock market peak back in 2000, the yield on stocks was just 1%. At the same time, the yield on bonds was 6%. So the "spread" was five percentage points in favor of bonds.

But now, just over a decade later, stocks yield more than bonds. With the exception of the extreme stock market bust in late-2008/early-2009, this has never happened before. (When it happened in 2008-2009, stocks absolutely soared soon after.)

The story gets much better. Today's dividends could go up dramatically. And the dividends are safe right now.

Right now, companies are only paying out about one-quarter of their earnings in the form of dividends. That's just half what they've paid out over the last half-century.

Since 1960, companies in the S&P 500 have paid out roughly half their earnings in the form of dividends. So today's S&P 500 companies could comfortably double their dividend payouts to get back in line with history. (That would double their dividend yields.)

Instead of increasing their dividend payments in a world where the highest personal income tax rate will soon be 39.6% on dividends, companies are electing to do more "tax-free dividends" than ever, in the form of shareholder buybacks.

Right now, the average dividend in stocks is only 2.1%. That doesn't sound like much. But remember... we live in a zero-percent world. So 2.1% is an outstanding relative value. And with buybacks, it's even better.

Everyone else out there sees "50 degrees" in the stock market and figures they'll stay inside. They see 2% on dividends as terrible.

They're simply looking at it wrong.

Relative to just about anything you can put your money into right now, stocks in the S&P 500 are a steal. That's where you can make REAL money now.

Good investing,

Steve

Further Reading:

Steve found a trading system that has delivered higher returns and, more importantly, much lower volatility than the S&P 500. "That's the Holy Grail for investors," he writes. Learn more here: I Hope You Can Apply This Investing Lesson Faster Than I Did.

Frank Curzio recently told Growth Stock Wire readers to keep their eyes on a group of stocks that got hammered earlier this year. He says these stocks have 25% upside over the next few months. Get the full story here: The Best Stocks to Buy for a Quick 25%-Plus Bounce.

Market NotesCRUDE OIL: A LOT OF RISK FOR NOT MUCH REWARD After surging $20 per barrel in six weeks, crude oil's risk/reward profile is getting skewed to the former...

Like its commodity cousin copper, oil tends to boom and bust along with global economic activity. If the economy is booming, oil tends to trend higher. If the global economy is struggling, oil tends to trend lower.

Although the global economy is in danger of a big slowdown in the coming year, crude oil has staged a huge rally this fall. Prices have climbed from $78 per barrel to $98 per barrel. Many optimistic traders have piled into crude oil in hopes the euro crisis will stabilize. Plus, Iran and its nukes are in the headlines again.

After such an enormous rise, we see plenty of risk in oil for not much reward. Crude is "overstretched" to the upside by all the technical indicators we follow. And at $98, the market is factoring in a rosy, "glass more than half-full" economic environment. Bulls need surprisingly strong growth from Europe and the U.S. to make money from these levels. If that growth doesn't arrive, crude is headed back toward $80 per barrel in a hurry.

|

In The Daily Crux

Recent Articles

|