| Home | About Us | Resources | Archive | Free Reports | Market Window |

How the "Big Money" Could Push Silver 54% Higher in 2012By

Wednesday, November 30, 2011

The big money is tiptoeing back into silver.

Last month, commodity trading advisors, pool operators, and hedge funds – the "big money" – weren't interested in silver AT ALL...

But as they move back into the market, silver prices could soar. Let me show you what I'm talking about...

Jason Goepfert created SentimenTrader, a service that tracks investor sentiment toward various asset classes. According to Jason, silver just bounced off its most pessimistic reading in four years.

The so-called "commitment of non-commercial traders" hit 10,352. That's incredibly low. The last time sentiment numbers were that low was in August 2007. Six months later, the price of silver was 59% higher. It rose from $12 per ounce to $19 per ounce.

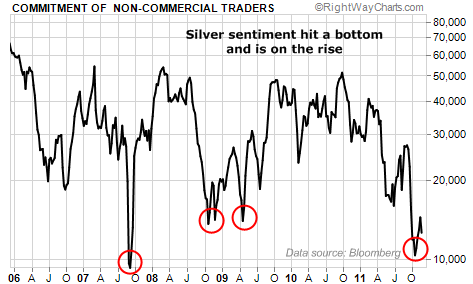

I went all the way back to 2002 and found that silver sentiment bottomed near 10,000 six times... On average, the price of silver rose 33% in the next six months and 54% over the next year. This chart shows the last four times it bottomed...

Here's how the silver price performed after each of the last four times silver sentiment bottomed out...

The best return came after Bottom No. 2, which coincided with the U.S. banking/credit crisis. Silver soared an eye-popping 405%, including its parabolic rise in 2010.

As those numbers indicate, silver is one of the most volatile assets in the world. Over the last year, silver has seen massive price swings, including an 81% rally and two 30% drops. That forced many traders to liquidate their silver holdings in order to meet emergency short-term requirements. (Plus, the debacle at commodity broker MF Global has scared many folks out of the market.)

But the long-term drivers of gold and silver's uptrends are still in place. Enormous and growing Asian economies like China and India are getting richer... and they have deep cultural affinities for precious metals. Plus, the Western world has lived way beyond its means for a long time... the debts and liabilities it has taken on can only be paid back with devalued, debased money. This is bullish for "real money" assets like gold and silver.

With sentiment so negative toward silver (and just beginning to turn back up), it's a great time to take a position in this long-term bull market.

Good investing,

Matt Badiali

Further Reading:

SentimenTrader is one of Steve's go-to resources... In September 2010, Jason Goepert's data indicated there was a 98% chance stocks would be higher in 90 days. Over the next three months, the market jumped 11%. And in January, Steve used the data to successfully predict a sideways pattern in stocks.

"If you like silver over the long term, this is a stock you need to own," Brett Eversole writes. Shares of this company could double in the next couple years... even if the price of silver goes nowhere. Learn how it's possible here.

Market NotesARE YOU EXTRA BULLISH ON ROYALTIES? Today's chart makes the case for royalties.

If you're a longtime DailyWealth reader, you've probably read about the precious metal "royalty model" many times. While companies that employ this model are often lumped in with conventional gold and silver stocks, they are different from your average miner... and that's a good thing.

Royalty earners, like our favorites Royal Gold and Silver Wheaton, don't mine any gold or silver. Instead, they finance lots of early stage mining projects. If things work out, they earn royalties on a mine's future production. This model offers higher profit margins and more diversification than a conventional miner focused on one or two big strikes.

As you can see from our chart below, this model has been beating conventional gold stocks. Our chart plots the performance of Silver Wheaton (black line, up 96%), Royal Gold (green line, up 46%), and the big gold stock fund, GDX (blue line, up 12%), over the past two years. Bottom line: If you're bullish on gold and silver, you should be extra bullish on royalties.

.gif) |

In The Daily Crux

Recent Articles

|