| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Greatest Opportunity Ever Is Just About to Pass You ByBy

Friday, February 10, 2012

You are foolish if you don't do everything you can to take advantage of this. It is probably the greatest opportunity for you for the next 10 years.

And it is here now.

Time's "a-wasting" actually... You're about to miss the best moment, if you don't get on it, right now. The "V" bottom (as I call it) – where you can get the very best prices – is passing you by as I type.

I can't know this for certain, of course... But I'm more convinced of what I'm saying here than I have been about any other investment in my two decades of studying investments.

My friend, the time has come. It is time for you to buy a house, preferably a primary residence.

No excuses. No delays. Just figure out how to make it work.

Already have a house? Go get another, and rent out the one you're in.

Upside-down in what you've got? Do what Karen Farley did...

Farley was upside-down by $200,000 in her house and hadn't made a mortgage payment in a year. Her mortgage company sent her a letter, saying "You could sell your home, owe nothing more on your mortgage, and get $30,000."

Farley told Bloomberg news, "I wondered, why would they offer me something, and why wouldn't they just give me the boot? Instead, I'm getting money." According to Bloomberg, Farley is "also approved for an additional $3,000 through a Federal incentive program."

Farley gets her $30,000 check today. She'll use the money to cover moving costs and a deposit on the next place she lives in. No joke. (The full Bloomberg story is worth reading.)

It's not just Farley, of course... Literally millions of upside-down homeowners are eligible for these deals.

Banks desperately want to get rid of these properties, at any cost, NOW. And the government desperately wants to help homeowners, NOW. It's doing everything from passing out checks to reducing mortgages and more. Here's the latest.

Yes, you can sit back and complain that these people who lived beyond their means are getting off way too easy... But the smarter thing to do is to go out and take advantage of this situation...

The deals happening right now are ridiculous.

A friend of mine just bought a five-bedroom, three-bath house in a decent neighborhood for $70,000. He bought it in a foreclosure auction. He's going to put a coat of paint on it and price it below market value for a quick sale at $129,000.

This is just one example. The point is, banks are finally willing to get rid of stuff. And investors (like my friend) are willing to step up. Buyers and sellers are finally seeing eye-to-eye. This is it. This is your moment. The opportunity for the really great deal is just about to end.

I believe this is the greatest opportunity you will have in the next 10 years in investing – as far as risk versus reward...

You see, your downside risk is extremely low, as houses are selling way below their replacement cost and you're essentially getting the earth itself "for free."

With homes dramatically below replacement cost AND with mortgage rates at record lows (below 4% for a 30-year mortgage), houses in the U.S. are more affordable than they've ever been.

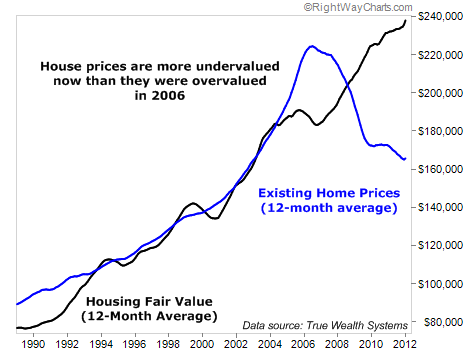

We all know the recent housing bubble was the greatest in American history. But what most people don't understand is that houses are more undervalued right this second than they were overvalued during the bubble.

The median home price is about $165,000 in the U.S. right now. In order for homes to return to "normal" values, they'd have to rise 55% to $256,000. (I'm assuming mortgage rates and incomes stay flat, and that affordability returns to "normal" at 130 on the affordability index.)

That's a gain of $91,000. If you'd bought that home with a 20% down payment, you'd have put down $33,000 to make a gain of $91,000. Not counting any other costs, that's a profit of 175%.

This gain will happen. I have no doubt in my mind. The only question is when. Will it take three years... five years... or 10 years? I don't know. But it will happen.

Even better, if you buy this property as your primary residence, you basically have nothing to lose. Even if I'm completely wrong, and home prices go nowhere, you at least lived there "rent free" for a few years.

But if I'm right, as your primary residence, this 175% profit would be completely tax-free. (Gains on your primary residence are basically the last legitimate tax-free shelter.)

I actually believe you should do better than this...

If you buy right now – I mean RIGHT NOW – you should still be able to get in at "below market" prices. You could get a property from a desperate seller, likely a bank. The better value you get up front, the higher your return percentage will be when things return to "normal."

And yes, things will return to "normal" in housing...

Housing is cyclical – we go through periods of overbuilding and underbuilding. Now is the time in the cycle when you want to buy.

When will things return to normal? Again, I don't have that answer... Nobody does. But it will happen.

How much louder can I say this? This moment is the greatest opportunity ever to be an American homebuyer. It is the best moment in history. We may never see opportunity this great in our lifetimes.

You can buy a home and make a 175% tax-free gain by simply assuming things return to "normal." If I'm wrong, and prices go nowhere, you got to live rent-free for a couple years. As far as risk versus reward, I don't know how you can beat that today.

The thing is, YOU have to do it. YOU have to get out there. YOU have to roll up your sleeves and make it happen.

People WILL do it... and soon. But they're not doing it yet. GO BEAT 'EM TO IT.

Best of luck to you... I know it's nerve-wracking and exciting at the same time to consider doing this. But your downside really is limited, and your upside potential is definitely there... it's just a question of when. I strongly believe it'll be worth it.

Now go! Get on it!

Good investing,

Steve

Further Reading:

Catch up on Steve's full argument for buying real estate here...

It's finally happening in America. Right now is the moment to make your deal. But this moment will pass... quicker than you think...

"With housing more affordable than ever, and mortgage rates lower than ever, we have incredible upside potential."

Market NotesTHE TREND IN HOTELS IS UP! If you need extra proof that things are getting "less bad" in the stock market and the economy, you need to see today's chart.

Over the past three months, we've run a handful of charts that display how things – while not "great" – are getting "less bad." For example, we've noted the solid price strength in the important U.S. financial stock fund (XLF), Home Depot, and transportation stocks. Make sure to count the price action in Wyndham Worldwide as a sign as well...

Wyndham Worldwide is one of the most important stocks you've never heard about. It's the world's largest hotel chain. Brands here include Super 8, Howard Johnson, Ramada, and Days Inn. Wyndham owns several "upscale" hotel chains as well.

The profits and share prices of hotels rise and fall with America's propensity to take business trips and vacations. As you can see from today's chart, Wyndham has climbed from $32 to $43 per share (a 34% gain) in just four months. This tells us that businesses and families are plenty able to take trips right now.

No one can say exactly how long this big trend will last, but for right now, the trend for the economy in general is UP.

|

In The Daily Crux

Recent Articles

|