| Home | About Us | Resources | Archive | Free Reports | Market Window |

One of the Market's Ultimate Income Streams Just Got BiggerBy

Wednesday, March 14, 2012

On March 1, you probably missed one of the most important pieces of investment news so far this year...

This was just before the market began its three-day, 2.2% "hiccup." And most traders were so worried about seeing their volatile, low-quality stocks sink in price, they didn't even notice how a small group of investors received a 9% raise.

While the "herd" was in a lather, this group was sleeping well at night... knowing its income was about to take another big step higher... just like it's done every year for 38 years.

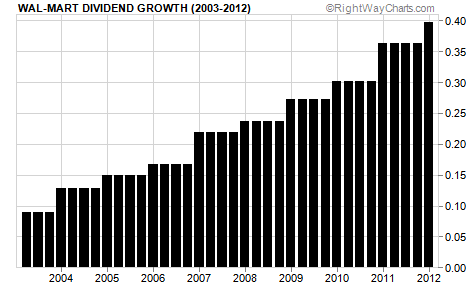

This group is known as "owners of Wal-Mart common stock." The news was Wal-Mart's latest dividend increase, which will push the annual payout up from $1.46 per share to $1.59... a 9% jump. Keep in mind, that's on top of the 21% increase from the year before... and the 11% increase the year before that... and so on.

You can see the relentless rise in the chart below. It shows Wal-Mart's quarterly dividend payouts for the past 10 years:

Over the past five years, Wal-Mart hasn't paid out less than 30% of its earnings in dividends. So it could double the current dividend and still have more room to grow it.

But you might think Wal-Mart's current dividend yield of 2.6% means this news isn't worth your time.

You'd be wrong.

For one thing, the same qualities that have allowed the company to increase its dividend every year for decades – the steady, cash-gushing nature of Wal-Mart's business – means it's much less vulnerable to broad market drops than your typical stock.

You can see that quality at work in its August performance. While the benchmark S&P 500 stock index lost 17% of its value, Wal-Mart fell less than 10%... and had fully recovered by early October. The S&P took another four months.

For another thing, the safe, growing dividend acts as a "magnet" to pull the share price higher. And it's really been kicking in lately. My colleague Brian Hunt pointed this out in a recent issue of his Market Notes...

Over the last six months, Wal-Mart's shares are up 27%. This says some people are starting to acknowledge the importance of Wal-Mart's excellent near-term and long-term dividend growth potential. But the "ho-hum" reaction to Wal-Mart's recent announcement tells me the crowd hasn't woken up to this idea... yet.

You can "wake up" right now, though. If you're done fretting whenever the market takes a hit... if you want to sleep well at night no matter what the market does... if you want to see your income rise every year... relentless dividend-raisers like Wal-Mart are the kind of stocks you need to own.

Good investing,

Dan Ferris

Further Reading:

Read up on some of Dan's favorite dividend-payers here: cigarette maker Altria, household product manufacturer Procter & Gamble, and software giant Microsoft.

And for another way to earn safe, steady income streams… consider these "boring" dividend-paying companies. If you invest right now, you could reap triple-digit gains in the next two to three years. Learn more here: Triple-Digit Returns are Still Possible in this High-Yield Sector.

Market NotesTHE DAILYWEALTH "LAW OF VOLATILITY" AT WORK It didn't take long for investors to forget about risk... but the DailyWealth "law of volatility" will remind them.

There are few sure bets in the financial markets... and few definitive "this is the case, and it always will be" statements we're comfortable making. But one we'll stick by forever is, "Calm periods of rosy headlines and softly rising prices will always be interrupted by periods of wrenching volatility... and vice versa." That's just the way the world works. Statisticians call it "reversion to the mean."

For a picture of this "always the case, always will be" phenomenon, we present the past three years of the Volatility Index (the "VIX"), the most popular gauge of market volatility and investor fear. When the VIX is low (below 18), it indicates investors have few worries and see blue skies ahead. When the VIX is high (above 30), it indicates panic and confusion.

In early 2010, investors were enjoying the "good times" of the market recovery. The calmness was shattered by the flash crash (spike "A"). In mid-2011, investors were enjoying another calm period... which was shattered by the European debt crisis (spike "B"). As you can see in the lower right hand corner of our chart, the VIX has plummeted in the past three months. It's just a matter of time before a new crisis catapults the VIX higher.

|

In The Daily Crux

Recent Articles

|