| Home | About Us | Resources | Archive | Free Reports | Market Window |

Now Is When You Make the Truly Big MoneyBy

Thursday, March 29, 2012

"You make the truly big money when most sectors and countries are all rising together. That is what a legitimate, rip-roaring bull market looks like."

I wrote that in the January issue of True Wealth Systems. Later that month, we got our "wish."

Twenty-three of the strategies we follow in True Wealth Systems switched into "buy" mode. I believe that was the start of a legitimate, rip-roaring bull market...

When a huge number of those True Wealth Systems indicators switch from "sell" to "buy," you really want to own stocks.

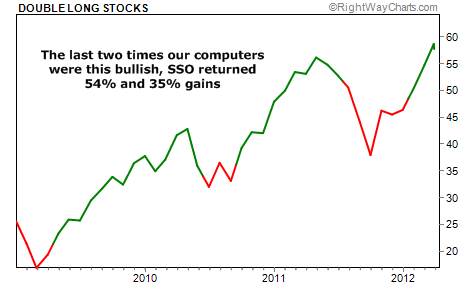

It happened back in April 2009. The indicators stayed in buy mode until a large number switched to sell in May 2010. If you'd bought and held shares of SSO (a double-long fund of U.S. stocks) during that time, you'd have made 54%.

It happened again in September 2010... And most indicators stayed in buy mode until June 2011. If you'd held shares of SSO during that time, you'd have made 35% in nine months.

It's happening this time around, too. Since the end of January, SSO is up about 14%.

With so many buy signals in January, I believe we're in the middle of a run in stocks "where the truly big money is made."

The trade is still "on" in the stock market. Yes, it's up A LOT in just a couple months. But based on history, there's plenty of upside from here...

Most countries and sectors are rising together. This is when the truly big money is made in investing. We will see hiccups along the way... Investors will get too optimistic and the market will put them back in their place.

Don't get rattled...

The right path today is to set your trailing stops so you know your downside risk... and then, you stay on board in your investments as long as you can stand it.

Good investing,

Steve

Further Reading:

With the recent run-up in stocks, it seems the whole world is cautious. Many media outlets are predicting a pullback. If you're worried about that possibility, read this essay from our sister site, Growth Stock Wire: How to Think About an Imminent Correction.

Market NotesEUROPEAN BANKS ARE RALLYING... IT'S MAGIC! The message from today's chart: It's amazing what a trillion or so dollars in "free money" will do for bank stocks...

Last year, stock, currency, and commodity markets were rocked by the "Euro crisis." While there are lots of fancy explanations why the crisis occurred, the "common sense" explanation is this: Many European governments have promised too many things to too many people. And they've taken on impossible debts and unfunded obligations. When "borrow and spend" programs are taken to the extreme, you eventually run out of other people's money.

In advance of the crisis, we warned readers of the big downside breakout in one of Europe's largest banks, giant German bank Deutsche Bank (NYSE: DB). During the worst of the crisis, DB plummeted 45% in less than two months. Its European banking peers suffered similar losses.

In the wake of the crisis, European leaders put their heads together and came up with a plan to "paper over" Euro debts. This plan has offered over a trillion dollars, conjured from thin air, in cheap loans. As you can see, this giant injection of liquidity has "rescued" DB. Shares have bottomed... and just struck a new multi-month high. For now, the trend in European banks is up.

|

In The Daily Crux

Recent Articles

|