| Home | About Us | Resources | Archive | Free Reports | Market Window |

Two Irrefutable Signs of America's New Energy DominanceBy

Friday, August 24, 2012

Yesterday, I showed you how new investments in energy production are now bearing fruit...

U.S. natural-gas production reached a new high last year. U.S. oil production, which had been in decline since the 1970s, will reach a new high in five years.

In a recent report for Harvard University's Kennedy School of Government, global oil expert Leonardo Maugeri explains it is as if the oil capacity of several Persian Gulfs has been discovered in the United States.

That's why we expect the U.S. to become the world's leading and most reliable source of hydrocarbons – both oil and natural gas. And that's what makes us so unabashedly bullish on the prospects for the U.S. oil and natural-gas industry.

There are two signs we urge you to watch, which validate our predictions...

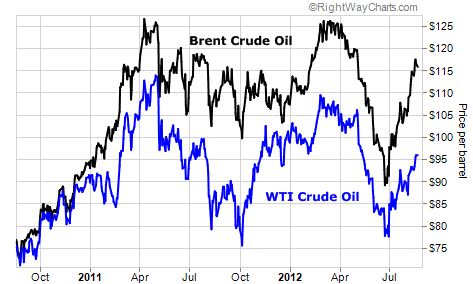

1) The ongoing discount between domestic oil prices (West Texas Intermediate) and the global oil price (Brent). As long as America continues to produce more oil than it needs domestically, it will enjoy a large and growing glut of oil. This will create a discount to world oil prices.

Until recently, there had never been a substantial discount to U.S. crude. If we're right about our prediction, this discount will remain until the U.S. changes its policies regarding oil exports. (Currently, it is against the law to export crude outside the U.S.)

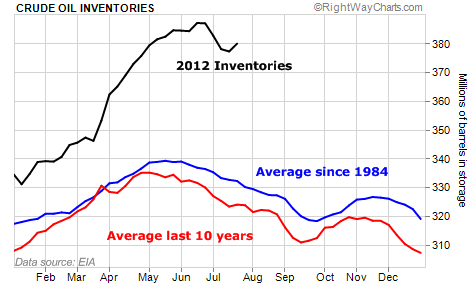

2) The huge growth in oil storage in the U.S. The chart below shows how the amount of oil in storage is now setting new records. This is a sure sign that the price of oil will continue to fall.

I also expect the coming decline in oil prices to cause a short-term wipeout in oil producers that carry large amounts of debt. Investors will be able to step in during these tough times and pick up valuable energy assets for pennies on the dollar.

I'm looking for high-quality assets, where it doesn't cost much to get the oil out of the ground... at a price that gives me the biggest possible discount to the value of the assets. Sooner or later, the price of energy will rebound and/or the company's rates of production and the size of the reserves will increase. At that point, the value of the company's stocks and bonds will soar.

Falling oil prices will spook most investors in the short term. But in the long term, it's a sign that America will become the world's leading oil-producing country.

This new energy boom is good news for our country... It's good news for your family... And it might be the investment breakthrough you need to finally achieve your financial goals.

Good investing,

Porter Stansberry

Further Reading:

Yesterday, Porter explained the significance of this long-term energy boom. "America is on its way to being the world's largest energy producer and one of the largest energy exporters," he writes. "Nobody expects this. But it will absolutely happen." Read the first of this two-part series here: The Most Important Economic Event of Your Lifetime Is Now Underway.

Market NotesAN AMAZING RALLY IN LUXURY HOMES Another week, another new high for Toll Brothers. It's one of the biggest signs that things "can't be all that bad" for the American economy.

This year, we've featured many charts that display how the U.S. economy, while not great, can't be doing all that bad. For example, we've noted the solid price strength in home-improvement chain Home Depot and giant U.S. hotel operator Wyndham Worldwide.

Another major development here is the soaring share price of Toll Brothers (NYSE: TOL). Toll Brothers is America's largest luxury homebuilder. It builds big "McMansion" homes with price tags well over $500,000. In recent quarters, Toll Brothers has reported strong orders and rising profits. This has produced a huge rally in Toll shares.

When we last checked in with TOL, the stock had reached a new 52-week high of around $30 per share. On Tuesday, TOL surged another 5%, to reach a new high of $33. We state once again... as long as stocks like Toll are soaring, we have to say that the U.S. economy, while not great, "can't be all that bad!"

– Brian Hunt

|

In The Daily Crux

Recent Articles

|