| Home | About Us | Resources | Archive | Free Reports | Market Window |

There's Still Room for a Double in the Next 12-18 MonthsBy

Tuesday, September 18, 2012

Last month, our True Wealth Systems computers spotted a near-perfect outside-the-U.S. opportunity...

This country has flown under the investment radar for years... mostly because there's no "sexy" story to the place. It's not big like China or India, and it doesn't have a pile of natural resources.

But today, this country's stocks are as cheap as they get... and we have our uptrend. With these two factors, we have the potential to double our money in the next 12-18 months...

Singapore is one of the world's leading financial centers. It has a triple-A credit rating, a sound currency, and true economic freedom. Income per head in Singapore is now roughly US$60,000, versus US$48,000 in the United States.

I still prefer to live and work in Florida... But if you want to generate wealth, Singapore is a place to have some money working for you.

Today, Singapore's stocks are cheap... trading near all-time low valuations. It's hated... as investors have fled. And according to our TWS trend indicator, Singapore has entered a new uptrend.

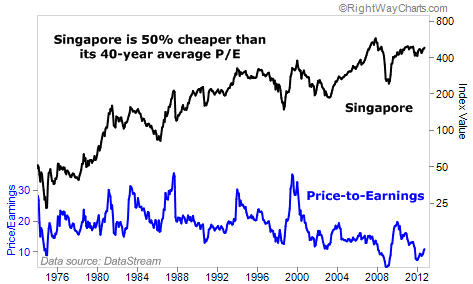

One of the simplest measures of value is the price-to-earnings (P/E) ratio. Last month, the S&P 500 was trading for around 14 times earnings. But Singapore stocks traded at just 9.4 times earnings... a 33% discount to U.S. stocks.

This is near all-time lows based on Singapore's history. Take a look...

Historically, we've only seen valuations this low twice – in early 2009 and late 1974. In both cases, Singapore's stock market nearly doubled in the following years.

And right now, investors outside Singapore have given up on the country's market...

The easiest way to see this behavior is through the major Singapore fund, the iShares MSCI Singapore Index (NYSE: EWS). A decreasing share count is an easy way to see that investors have lost interest in an investment. And since late 2010, the fund's share count has dropped 30%.

It's hard to believe Singapore is still under the radar... But we believe its stock market has just started what could be an incredible rally. In just the last two weeks, Singapore stocks are up 6%... And based on our True Wealth Systems research, we want to own these stocks when they enter an uptrend.

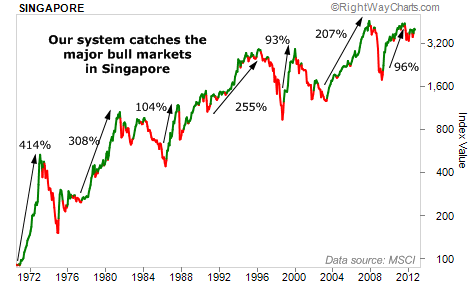

Our simple uptrend system generates 22% annual returns when in "buy" mode (in 40-plus years of testing data). That compares to just 9.3% annual returns from buying and holding the Singapore market.

Our system says "buy" around 60% of the time... including right now. We want to follow that advice. Major bull markets equal BIG returns when you catch them right:

The green line indicates when our system is in "buy" mode, and the red line indicates when our system is in "sell" mode. We are in buy mode now.

By investing in Singapore today, you could potentially double your money over the next 12-18 months. Even better... it's safe and easy. The simplest way for American investors to buy Singapore is through EWS.

Singapore is one of the cheapest markets in Asia. And the uptrend is in place. There's still room for a double from here, within 18 months. It is time to buy.

Good investing,

Steve

Further Reading:

Get more of Steve's favorite "cheap, hated, and in an uptrend" opportunities here...

"You can set up an excellent trade, with limited downside and large upside potential."

There's a reason the world's greatest investor, Warren Buffett, built his Berkshire Hathaway empire around this industry...

"The Aussie dollar is the best value out there of all the major currencies."

Market NotesDOC EIFRIG WAS RIGHT! Doc Eifrig's call on health care stocks is turning out to be a big winner... that's the message behind today's chart.

In May 2011, we ran commentary from our colleague Dr. David Eifrig, editor of Retirement Millionaire. Doc urged readers to buy health care stocks. For years now, Doc has pointed out how the sector is cheap... and has a tremendous tailwind in the form of aging Baby Boomers.

One way to track (and invest in) the broad health care sector is through the iShares Healthcare Fund (NYSE: IYH). The fund is comprised of Big Pharma stocks, medical device makers, insurance companies, and various other health care businesses.

As you can see from today's chart, Doc is being proven right. IYH has climbed from $62 per share to $84 per share in the past two years... and just struck a new all-time high. It's a bull market in health care.

– Brian Hunt

.gif) |

In The Daily Crux

Recent Articles

|