| Home | About Us | Resources | Archive | Free Reports | Market Window |

DO NOT Buy This Investment Anymore... The Gains Are DoneBy

Tuesday, January 29, 2013

Most Americans are DESPERATE for interest on their money...

Look, I get it... The bank pays you zero interest. But you've got to eat! So you're looking for a decent interest rate, wherever you can get it. Makes sense.

However, this desperation has driven many unsuspecting Americans into high-yield bonds – also known as "junk" bonds.

Over the last four years, the high-yield bond trade has worked fantastically... If you'd bought the main high-yield bond fund (HYG) in March 2009, you'd be up over 100% in less than four years. (That return includes interest and capital gains.)

I have no complaints about that. Back then, high-yield bonds were a screaming buy. I even recommended them to my True Wealth subscribers. But two weeks ago, I told them to "sell" our high-yield fund... The big gains in high yield are over. Right now, the high risk is not worth the low "yield." Let me explain...

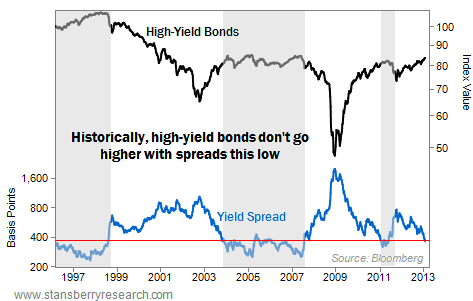

The chart below explains it...

My favorite way to measure when to buy high-yield bonds (and when to avoid them) is to compare the interest on high-yield bonds to the interest on government bonds. (I use 10-year Treasury bonds in the chart.)

When the "spread" – the difference between high-yield bonds and Treasury bonds – is high, you want to buy. As the chart shows, 2002 and 2009 were great times to buy. But today is NOT a good time to buy.

Right now, the spread – which is basically what you get paid for taking the higher risk in these bonds – is tiny.

Based on history, you do not want to own high-yield bonds when the spread is this low.

When the spread is this low, history shows that high-yield bonds could return nothing for years (the gray areas on the chart). These periods are followed by a quick "butt kicking." Take a look...

We don't know when the butt kicking will arrive... But it will arrive.

The butt kicking in high-yield bonds was brutal in 1998. It was brutal in 2007-2008. And it was swift and painful in 2011.

Actually, I don't expect an IMMEDIATE butt kicking in high-yield bonds... My general belief is that more and more unsuspecting investors will end up piling into these bonds, pushing prices even higher (and yields even lower). Investors will do this because they're earning no interest at all in the bank, and they're desperate for interest.

You might be desperate for interest, too... But don't take the bait...

I don't want to own them here. The small reward isn't worth the big risk. The yield is too low. And the premium on the bond prices is too high. The yield looks nice... But at this point, high-yield bonds are pigs wearing lipstick.

Lighten your load on high-yield bonds now. I believe that cash in your mattress – earning zero-percent interest – will likely outperform high-yield bonds from now through the next "butt kicking."

High-yield bonds have had a great run – remember, shares of HYG (the high-yield bond fund) have returned over 100% since March 2009, including dividends. But you can't invest in the past. That run is over.

Today, the risk in high-yield bonds simply isn't worth the reward...

I have recommended my newsletter readers sell our high-yield fund. I suggest you consider doing the same...

Good investing,

Steve

Further Reading:

Dan Ferris agrees: "It's not hard to figure out that investors should be very afraid of bonds right now." But there are other sources of safe high yield in the market today – in companies that can beat even the fattest bond yields. Learn more here: A MUCH Safer, Higher-Yielding Alternative to Bonds.

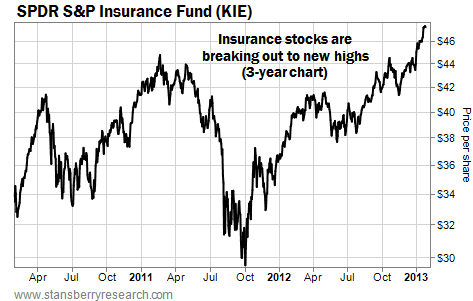

Market NotesONE OF THE WORLD'S GREATEST BUSINESSES IS BREAKING OUT Today's chart shows that it's "good times" for one of our favorite businesses – insurance.

If you've read the commentary in these pages from Porter Stansberry, you know we're big fans of the insurance business. Insurance companies get to collect money from customers today, while agreeing to (possibly) pay claims years down the road. If inflation ramps up, the dollars they collect in premiums are worth more than the dollars they pay out in the future. It's one of the reasons Porter calls insurance "the world's greatest business during inflationary times."

From mid-2010 to late 2012, insurance stocks made little real headway. The SPDR S&P Insurance Index Fund (NYSEARCA: KIE) traded in a volatile sideways pattern. This fund is a diversified basket of insurance stocks, including Assured Guaranty, MetLife, and Allstate.

But as you can see from the chart below, in just the past few months, the KIE has broken out to major new highs. The trend is now up for one of the world's greatest businesses.

– Larsen Kusick

|

In The Daily Crux

Recent Articles

|