| Home | About Us | Resources | Archive | Free Reports | Market Window |

Here's What Poor People Don't Know About GoldBy

Friday, March 8, 2013

When gold fell $125 an ounce this past month, did you react like a wealthy man or a poor man?

The difference between the two reactions is huge.

If you picked the right one, chances are good you'll make money as a long-term investor...

For many years, I've urged people to own gold and silver. I've helped thousands of Retirement Millionaire readers make the right precious-metal investments. But I'm an unusual owner of gold and silver.

You see, I think 99% of gold and silver owners are all wrong in the way they view their holdings...

Most folks buy gold and silver and hope they'll make a fortune on it. They listen to "doom and gloom" gurus who claim gold prices are about to explode. Or while watching right-wing television shows, they see commercials promise to make them rich in gold and silver.

So when gold and silver decrease in value – like they have recently – the average precious metals owner stresses out. His "big trade" isn't working.

Again, I own gold and silver... and I urge you to do the same. But I take an unusual approach to my holdings. I hope I lose money on them.

I look at gold and silver the way a homeowner looks at his insurance policy. A homeowner buys insurance against disaster and hopes disaster never comes. He hopes he never has to cash in his policy.

Similarly, I hope I never make money on my gold and silver.

If I don't make money on my gold and silver, that means economies and markets are behaving relatively normally. It means I'm making money on my regular investments, like stocks, bonds, and real estate.

If the world economy goes haywire and gold skyrockets to $5,000 an ounce, sure, I'll make money on my gold... but I'm sure to have a lot of problems along with those profits. I'd rather make money in stocks, bonds, and real estate. I'd rather live in a world where the U.S. dollar isn't plunging in value every month.

For many years, my job at Wall Street bank Goldman Sachs was to develop and implement advanced hedging strategies for wealthy clients and corporations. The goal with these strategies was to protect jobs, wealth, and profits from unforeseen events.

During those years, I learned a big difference between wealthy people and poor people... Wealthy people almost always own plenty of hedges and insurance.

They consider what could happen in worst-case scenarios and take steps to protect themselves. Poor people tend to live with "blinders" on. They play the lottery with their paychecks every other Friday. They keep their retirement funds in just one or two stocks... or they put all their money in a neighbor's crazy business idea, which is incredibly risky.

And they tend to "load up" on things like gold and silver. They place way too much of their portfolio into precious-metal investments. And even worse, they base their decisions on their emotions (usually fear). Don't do that... Instead, think rationally. Think of gold and silver as insurance...

I like to keep 4%-8% of my investable assets in what I call "chaos hedges." Gold and silver are great for this purpose. I keep the rest in stocks, cash, bonds, and real estate. When gold and silver plunge in value, I don't worry. I don't lose sleep.

If you don't own these sorts of hedges yet, I encourage you to buy some... just like a homeowner buys insurance... or just like you'd buckle your seatbelt before driving your car.

Take the wealthy investor's approach, buy gold and silver... and hope the time never comes for you to have to "cash in" the gains.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

Last year, Doc showed DailyWealth readers how powerful it can be to hold chaos hedges in your portfolio… "When investors get nervous about bad economic news... debt crises in Europe... and the specter of runaway inflation in the United States," he wrote, "stocks fall, and gold and silver rise." Learn more here: The Sensible, Low-Stress Way to Own Gold and Silver.

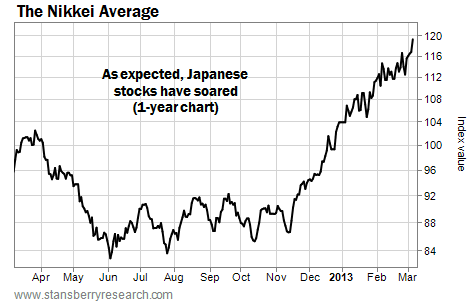

Market NotesAS EXPECTED, JAPANESE STOCKS HAVE SOARED Today's chart shows Steve Sjuggerud was right. The Japanese stock market has entered "blast off" mode.

Back in November, Steve urged readers to buy Japanese stocks. He said the changing of government leaders ensured the country would enact major stimulus programs... and push the value of Japanese stocks much higher.

The best way to track the Japanese stock market is with the "Nikkei" average. It's the "Dow Industrials of Japan." It tracks the share price movements of major Japanese companies, like Toyota, Mitsubishi, and Honda.

As you can see from the chart below, Steve's call was well-timed. The government changeover has occurred. Stimulus efforts are cranking up. The Nikkei has skyrocketed. The index is up 32% in the last four months... and just struck a 52-week high. Expect more upside here.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|