| Home | About Us | Resources | Archive | Free Reports | Market Window |

Should You Buy Stocks Here, Near All-Time Highs? Yes!By

Thursday, July 11, 2013

"Should you buy the stock market here, near all-time highs?" I asked a new young employee...

"Uh, no," he answered.

"Why not?" I said.

"Because it's at a record high," he replied. "I mean, how much higher can it go?"

I think his simple answer is what 99% of Americans would say.

Too bad it's wrong – at least today...

It wasn't wrong before...

You see, stocks hit a record high in 2000, not too far from today's levels, and then they crashed. The same thing happened in 2007.

Today, we're approaching record highs in stocks again... What makes today different from 2000 or 2007?

There is one huge difference between now and then. It's VALUE.

Stocks were expensive then... They are cheap today.

In 2000, stocks were ridiculously expensive... We were in the midst of the dot-com bubble. And stocks were the most expensive they'd been in recorded history. Specifically, stocks traded at a price-to-earnings ratio of near 30 – an unheard-of level in over 100 years of stock-market history.

In 2007, stocks had gotten expensive again... They were trading up to a price-to-earnings ratio above 20. Based on 150 years of history, stocks have had a tough time moving higher when they get that expensive... For example, the Great Crash of 1929 happened just after stocks got over a price-to-earnings ratio of 20.

But today is a different story... stocks are cheap. Here are my numbers from Bloomberg today:

Stocks are a better "relative" value today, too... You see, interest rates are much lower today than they were in either 2000 or 2007...

In 2000, long-term government interest rates were around 6%. With interest rates that high, investors could easily choose to move money out of stocks and into bonds. In 2007, interest rates were around 4.5%. Once again, people could make a choice to get out of stocks and into bonds.

But today, interest rates are so low, who wants a bond? Stocks are the only paper asset worth buying right now.

Sure, stocks are near new highs. But don't let that scare you...

Don't worry about highs... worry about value for your money.

Today is much different than it was in 2000 and 2007. Stocks are a great value today. There's hardly a better financial asset you can buy... regardless of the fact that we're near new highs.

There are plenty of things in life and money to stress about... but a potential new high in the stock market today is not one of those things. Got it?

Good investing,

Steve

Further Reading:

"The BIGGEST STOCKS on the planet are still RIDICULOUSLY cheap," Steve writes. "They are the best investment value today." Steve says to "pick your big continent... pick your big country... pick your big stock. Most likely, it's dirt-cheap!" Get all the details here.

And Steve believes the incredible stock-market boom won't end any time soon. He says the boom isn't about "an improving economy, improving home sales, or improving corporate revenues. It is about stimulus from the Federal Reserve." So the question becomes, when will the Fed's stimulus end? Find out how long this boom will last here.

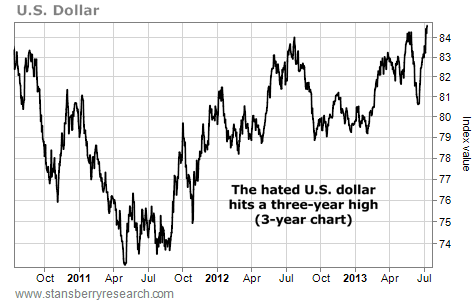

Market NotesYOU WON'T BELIEVE WHAT JUST HIT A THREE-YEAR HIGH Big news from the world of currencies... your cash in the bank just got more valuable.

In our May 21 Market Notes, we noted how most folks believe currency fluctuations don't affect them... or that the whole subject is just too boring to pay attention to. After all, how much can the value of your bank account really swing up and down? The answer is... a lot.

In that edition, we showed how the dollar tends to go through wild fluctuations in terms of the value it will buy around the world. Big, double-digit percentage changes in value tend to take place in the span of months... not years.

Today's chart shows more of these fluctuations. It displays the past three years of the U.S. dollar index... which is the dollar's value against a basket of foreign currencies. It's the value of our bank accounts in terms of global purchasing power. As you can see, our currency's value is volatile, but it just reached a three-year high. It's a bull run in the hated U.S. dollar!

|

In The Daily Crux

Recent Articles

|

|||||||||||||