| Home | About Us | Resources | Archive | Free Reports | Market Window |

Here's Why I'll Never Use a Discount BrokerBy

Wednesday, July 17, 2013

My colleagues at The Palm Beach Letter, Tom and Tim, think I'm a spendthrift. Why?

Because I use a full-service broker.

They use online discount brokers. They tell me that I'm crazy to pay some guy a ton of money to do what I can do myself.

They may be right. But these guys (in case you've never golfed with them) are real cheapskates. I could tell you stories...

Instead, let's talk about stockbrokers. Let's talk about what these guys are supposed to do, what they actually do, how much you think they are charging you, and how much you are actually paying.

There are basically two types of stockbrokers: full service and online discount.

A full-service broker gives financial advice, makes stock recommendations, answers your questions, supervises your account, and executes orders.

An online discount broker just executes your orders.

Full-service brokers usually charge you 1%-2% of the assets that they are managing for you each year. If, for example, you have $100,000 with them, they will charge you $1,000-$2,000 to manage it.

Some full-service brokers offer commission-based accounts. With these, you pay the broker a fixed amount on each transaction.

Online discount brokers charge a small fee for every transaction. If you don't trade, you don't pay anything.

If spending as little as possible is your objective, an online discount broker is the way to go.

But for many people – particularly older people – having someone you know who will answer your phone calls and explain your monthly statements is a considerable value.

I use a full-service broker. And I pay him good money. But I ask a lot of him. (For one thing, he is responsible for keeping up with the portfolios we put together for Palm Beach Letter subscribers.)

To do that, he has to read all the issues and execute all the recommendations in a timely and consistent manner. If he ever reads a recommendation that falls outside of my super-risk-averse orientation, he notifies me and we discuss it.

My broker also provides me with a customized monthly report broken down by portfolio. (I designed it so I can understand it.) He comes to my office whenever I want (usually once a month) to go over everything. He answers all my questions thoroughly, gives me any research I ask for, and answers my e-mails and phone calls promptly.

None of what I have described so far is enormously time consuming for him. Nor does it require any particular genius. After all, my broker is not doing original research or making recommendations. He is following the research and recommendations made in The Palm Beach Letter.

But if he didn't guide me through it, I would never do it. I am just not interested in that kind of work. And I feel that my time is better spent doing other things.

So I'm happy to pay my broker's commission based just on keeping me up to speed with my Palm Beach Letter colleagues. But he does much more than that.

For one thing, he manages a proprietary options strategy I dreamed up for my Palm Beach Letter "Legacy stocks." Again, without his help, I'd never do this.

He provides the same high level of personalized service to my three boys and my mother-in-law – even though their accounts are much smaller.

I'm not much interested in talking about the financial markets, but when something happens that will affect my stock account, he makes sure I am forewarned. For example, we recently spent 20 minutes talking about the dramatic change in the Fed's bank lending rate and what that would likely mean to my stock and bond portfolio.

(I didn't make any changes because The Palm Beach Letter's asset allocation model – which I also follow – protects me from most market swings.)

And every so often, he brings me a sweet deal on an IPO – something he can get for me because I'm such a "good" client.

I feel safe with my broker because he respects my sentiments. He knows I'd rather make a slightly lower rate of return when the markets are strong if that can protect me from getting stomped when the markets turn against me.

He also adheres to my never-lose-money rule by monitoring my asset allocations and by minimizing volatility in my accounts.

As you can see, I get a lot of value from my relationship with my full-service broker. And that's why I'm happy to pay his fee. He charges me 1% of the total dollar value of my stocks and options each year but not for the value of my bonds or cash.

In other words, if I have $5 million in stocks and options and another $5 million in cash and bonds with him, I pay him $50,000 per year.

That's a lot of money. If you figure out the cost over 20 years, including the effect of compound interest, it would be several million dollars. Tim and Tom think it's a sin to fork over that kind of money when you can do the work yourself. I could do it, but I don't want to do it. Like I said, my time is better spent doing other things.

If you have a lot of money, make a lot of money, and don't want to manage your stocks, you should consider getting a good full-service broker like mine.

But if you don't have a lot of money, don't make a lot of money, or actually enjoy following The Palm Beach Letter's recommendations and executing your own transactions, you should definitely consider using an online discount broker.

Best,

Mark Ford

Further Reading:

"How do you feel now about the professionals who are working for you?" Mark asks. "Have you realized you may be getting less from them than you deserved?" Mark's common-sense guide to evaluating your professional relationships gives you the tools you need to overcome "expert" intimidation... and make sure you're the one in charge. Find it here: How to Talk Your Broker into Submission.

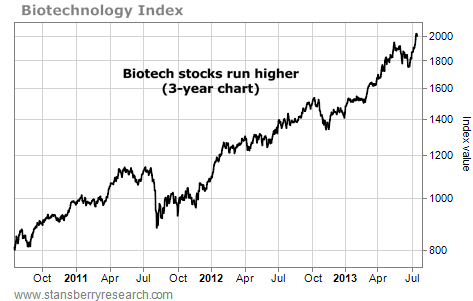

Market NotesTHE STEALTH BULL MARKET IN BIOTECH REACHES ANOTHER NEW HIGH Today's chart shows that it's still a big "stealth" bull market in biotechnology...

Regular readers know we see biotechnology as one of the market's greatest "boom and bust" sectors. With its promise of individualized medicine, cancer cures, and miracle drugs, the biotech sector easily captures imaginations and huge speculative money flows. As Steve has written several times, if you catch a good biotech boom, you can make extraordinary gains.

Like most assets, biotech stocks were hammered in the 2008-2009 credit crisis. But as you can see from today's chart, biotech is enjoying a big trend.

You can track the biotech sector with the Nasdaq Biotechnology Index. It's sort of the "Dow Industrials of biotechnology." This index bottomed at around 650 in 2009. Since then, it has strung together a series of "higher highs and higher lows" to advance 200%. This month, it reached a new multiyear high. This uptrend isn't making big news yet... but it will.

|

In The Daily Crux

Recent Articles

|