| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Our colleague and friend Dan Ferris is one of the best business analysts we know. And this week, he's sharing his "five financial clues" for finding great investments… These are the same clues he has used to help his Extreme Value readers make hundreds-of-percent gains. Whether you're an experienced investor or just getting started, these could be some of the most important ideas you read this year.

The 30-Second Balance Sheet TestBy

Thursday, September 26, 2013

How much cash would it take for you to feel "secure"?

What if, after paying all your expenses every year, you still had nearly $200,000 to spend however you wanted? Would that make you feel financially safe? Or what if you had enough cash to cover your mortgage five times over? Would that be enough?

There aren't a lot of folks who are that cash-rich. There aren't a lot of companies like that, either.

But I've assembled a short list of high-quality companies that have "fortress" balance sheets. They either have so much cash… or generate so much cash every year… there's very little chance they'll ever run into any financial problems.

And these "sleep at night" companies still have tremendous upside potential…

Over the past two days, I've shown you two of the most important "clues" I use to uncover the world's greatest investment opportunities: the amount of cash flow a company generates and how it uses that cash to reward shareholders.

The third clue I look for when choosing a great investment is: a great balance sheet.

The balance sheet is a financial statement that shows a company's assets and liabilities. Assets are what it owns, and liabilities are what it owes.

There are two kinds of great balance sheets we look for when finding a company that could potentially double or triple your money.

The first is a company that has an enormous amount of cash and relatively little or no debt. You can recognize a company like this in 30 seconds or less.

The best example is Apple, the company that makes iPhones and iPads.

Apple has more than $147 billion in cash. And it has $17 billion in debt. That's a lot of debt, but it's nothing compared to the amount of cash Apple has. Apple could pay off all its debt and still have $130 billion in cash left over.

Imagine having almost nine times as much cash as the debt you have on your home, car, and credit cards.

You'd feel pretty secure with that much cash, wouldn't you?

Well, that's how Apple shareholders ought to feel right now. They can rest assured Apple will never have a financial problem with that much cash on hand.

Microsoft is another great example. It has $77 billion in cash and less than $15.6 billion in debt. In other words, it has almost five times as much cash as debt.

Then there are companies like Expeditors International, the Seattle-based shipping company. It has $1.4 billion in cash... and zero debt.

Debt isn't always a deal-breaker, though – which brings me to the second type of great balance sheet I look for...

In short, sometimes a company has more debt than cash... but the business is so good that it earns enough to easily cover the debt payments.

Wal-Mart is the best example of this.

It has $8.9 billion in cash... and $47.8 billion in debt, over FIVE TIMES more debt than cash.

That's a LOT of debt.

But remember, Wal-Mart is an enormous company. It does more than $460 billion of annual sales. It's got more than 7,000 locations around the world. It's bringing in tons of cash every second of every day of the year.

The fact is, after Wal-Mart pays all its expenses, taxes, and debt payments, it has enough earnings left over to equal eight times its debt payments.

How good is this?

Well, suppose you have $2,000 per month in debt payments.

Then suppose that after paying all those debt payments, plus all your other living expenses – income taxes, everything – you still have eight times $2,000 left over.

So you'd basically have $16,000 a month left over after you paid all your expenses. That means you'd have an extra $192,000 per year you could spend any way you wanted.

You'd be pretty secure financially. And that's how Wal-Mart shareholders should feel.

Procter & Gamble is like that, too.

It has less than $6 billion in cash and more than $31.5 billion in debt. But its earnings cover its debt payments more than 17 times.

So why do I care about this so much?

Well, in Extreme Value, we've logged gains of 103% on Berkshire Hathaway, 131% on Automatic Data Processing, 77% on Intel, 105% on Philip Morris, and over a dozen other double- and triple-digit gains.

And every single one of those companies had a great balance sheet. I've lost count of how many e-mails I've received from Extreme Value readers who tell me they sleep better at night, knowing each business we find is so financially strong.

So to sum up:

Tomorrow, I'll show you another important "clue" I look for in a great business… The laws of economics make it difficult for companies to have this quality. And companies that do are very rare. But I've used it to find some of the highest-returning investments of my career. Good investing,

Dan Ferris

Further Reading:

Dan says one of the biggest mistakes most investors make is "balance sheet risk," or buying companies that use a lot of leverage. "Leverage is dangerous… it can cause you to go bankrupt surprisingly quick if things get bad," Dan writes. Learn more about the biggest risks you face in your portfolio… and how to reduce them… right here.

One thing you won't find represented on a company's balance sheet is its "true economic goodwill." Porter Stansberry says "the trick to economic goodwill is to understand there is this invisible asset that can play a huge role in corporate earnings… It's a huge value that is unseen on your balance sheet." Get all the details about economic goodwill here.

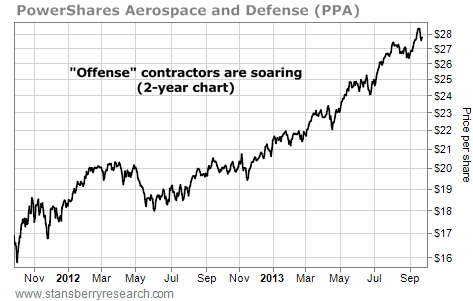

Market NotesA BIG BULL MARKET IN "OFFENSE" CONTRACTORS Today's chart proves it's still a big bull market in "offense contractors"...

Back in June, we noted how the U.S. is involved in so many foreign wars that "defense contractors" should be called "offense contractors." We also noted how many folks have warned against investing in this industry... due to an expected reduction in government spending.

Today's chart shows the expected spending reduction has not arrived. Below is the past two years' price action in the PowerShares Aerospace and Defense Portfolio Fund (PPA). This investment fund is a "one click" way to own a diversified basket of offense contractors. These companies manufacture tanks, fighter jets, submarines, aircraft carriers, and various other things America needs to blow people to smithereens.

Over the last 12 months, four of PPA's top five holdings have reported record sales... And that has propelled PPA to a 71% gain over the past two years. Just last week, shares hit a new multiyear high. Unfortunately, the trend in "offense contractors" remains up.

|

In The Daily Crux

Recent Articles

|