| Home | About Us | Resources | Archive | Free Reports | Market Window |

What You Need to Know About Rising Interest RatesBy

Monday, October 28, 2013

When will the good times in the stock market end?

The conventional thinking is that the party will end when the Federal Reserve takes the punch bowl away... when it stops artificially stimulating the economy.

But is that right?

I don't think it is...

Right now, stocks are soaring and real estate is hot. But that's in part because the Fed has cut interest rates to zero, and it has been pumping money into the economy to keep the party going.

Most folks believe that as soon as the Fed's stimulus stops, the party will be over. But history tells a different story...

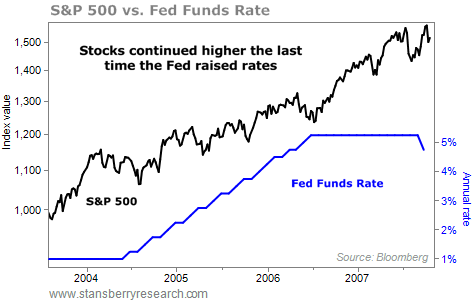

The last time the Fed took the punch bowl away was in 2004... It raised interest rates from 1% in 2004 to 5% in 2006.

What happened to stocks around that time? Take a look...

The stock market soared from around 1,000 to around 1,500 – a 50% gain.

Now think about that...

Interest rates soared. And so did the stock market.

What happened?

Just like today, the Fed had cut interest rates to incredibly low levels to try to boost the economy.

It worked... The economy started to recover.

So the Fed felt it could move interest rates from an extremely low level to a more normal level.

The Fed hiking rates was a signal to everyone that the economy was back on track – that it didn't need help from the Federal Reserve anymore. People bought stocks… And the stock market soared.

Could the same thing happen again today? Absolutely...

Let me be clear... I don't expect the Federal Reserve to raise rates any time soon. I believe we'll see low rates through 2015 at least.

But even when the Federal Reserve starts to raise interest rates, it doesn't have to mean the end of rising stock prices.

I expect investors to interpret this move just as they did in 2004-2006 – as a signal that the economy is finally back on its feet again.

In short, you want to own stocks now.

The conventional thinking is that the party in the stock market will end when the Fed takes the punch bowl away. I think the conventional thinking will turn out to be wrong...

Don't sell when you hear that rates are finally going up... Chances are, people will figure it means the economy is finally "better" – and stock prices will keep on rising.

Good investing,

Steve

Further Reading:

Find three of Steve's favorite stock market opportunities right here:

We Have Seen the Bottom in Gold Stocks

I believe we've likely seen the bottom for gold stocks... And this could be the beginning of a major leg higher... Triple-Digit Upside in this Safe, Simple Trade

If you're simply bold enough to buy when people think China will never amount to anything and sell when people believe China is about to take over the world, you can make a lot of money in Chinese stocks. What the 100%-a-Year Man Says Today

Emerging markets are now cheap, hated, and seem to be just starting an uptrend. I see exactly what I want to see to invest... Market NotesNEW HIGHS OF NOTE LAST WEEK

American Financial Group (AFG)... insurance

American International Group (AIG)... insurance Aflac (AFL)... insurance Becton-Dickinson (BDX)... medical devices Blackstone Group (BX)... private equity Kohlberg Kravis Roberts (KKR)... private equity Interactive Brokers (IBKR)... brokerage firm American Express (AXP)... credit cards Visa (V)... credit cards Discover Financial Services (DFS)... credit cards MasterCard (MA)... credit cards Google (GOOG)... search engine Time Warner (TWX)... media and entertainment Walt Disney (DIS)... entertainment Wynn Resorts (WYNN)... casinos Amazon (AMZN)... online retailer Best Buy (BBY)... electronics retailer Walgreens (WAG)... drugstores Constellation Brands (STZ)... booze Starbucks (SBUX)... expensive coffee Ford (F)... cars and trucks Delta Air Lines (DAL)... airlines FedEx (FDX)... shipping United Parcel Service (UPS)... shipping Schlumberger (SLB)... oil services KBR (KBR)... oil and gas infrastructure Chicago Bridge & Iron (CBI)... natural gas infrastructure Lockheed Martin (LMT)... "offense" contractor NEW LOWS OF NOTE LAST WEEK

|

In The Daily Crux

Recent Articles

|