| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why I Wasn't 'Loyal' to My BrokerBy

Friday, November 15, 2013

Some time ago, I discovered – very much to my surprise – that my broker at Raymond James was "no longer with the company."

"What does that mean?" I asked.

"He's just not with us anymore."

"So why wasn't I told?"

"We were just about to notify you."

It miffed me a bit that they didn't contact me right away. Among other reasons, I had open trades that needed managing. What if something fell through the cracks?

A few days later, I had a meeting in my office with the branch manager and a young man who was to be my old broker's replacement. They apologized for not notifying me immediately, explaining that the situation was "difficult and personal," and then proved to me that my account was being tended to properly.

That was half of the reason for their visit. The other half was to convince me to keep my money with them.

Investment firms generally prohibit their agents from trying to take their "books" of clients with them when they move to other firms. But it is difficult to do that, for reasons I don't need to bother you with here.

When a top-earning broker leaves, a turf war begins. The broker and the firm begin a mating ritual with the broker's best clients, starting with the "whales." The goal is to grab or retain as many of the big fish as they can.

I knew that. And I knew that my old broker would soon be asking for a meeting to make his pitch. And several days later, he did. But when he did, I refused the meeting. I told him I was sticking with Raymond James and going to employ his replacement.

Why I did that is the subject of this essay.

My broker is a bright person. He knows the markets. He understands the game. And as a top earner in his office, he was indisputably a good salesman. But what is more important is that I trusted him to do a good job.

Because of that trust, I mentioned him in an essay I did on municipal bonds. And that mention brought him millions of dollars' worth of business. He was happy to get that business and told me so. I told him, "Just take good care of my readers." I believe he did.

But there was one little thing about him that always irked me. He had a tendency to talk when I wanted him to listen. I might call him up to ask a specific question about some of my bonds. His answers came in a staccato tempo full of terminology I didn't fully understand.

When I'd attempt to interrupt him for clarification, he would talk over me. I don't know why he did that. It was a habit he couldn't break, even when I spoke to him about it. It was disconcerting, but it wasn't a huge problem. I believed he had my best interests at heart, and he was producing good results. So I let it slide.

But then, one day, I received a notice saying I had bought shares of Facebook's initial public offering (IPO). I was shocked. Facebook is exactly the kind of company I would never buy. Why had he done this? I called him up to ask why. He told me that my son, who also had an account with him, had asked him to buy some for him. It wasn't easy to buy Facebook's IPO at the time. But he gave some to my son, and he also gave some to me. He thought he was doing me a favor.

That really shook me. On the one hand, I realized he was trying to do me a favor. On the other hand, I wondered how he could possibly think that I'd ever want to own a stock that had a P/E ratio of 99. I decided there could be only one answer. For all his many good qualities – and they were numerous – he wasn't a good listener, and he hadn't really listened well to me. He didn't really understand that I wasn't a speculator. He never fully understood my antipathy toward risk.

I don't want to overstate this. I never felt – nor do I feel now – that my broker was in any way irresponsible or untrustworthy. I give him good scores on both counts. I believe he is smart and earnestly does his best to give his clients good returns. But his poor listening skills were a problem for two reasons:

Those thoughts were in the back of my mind when I met Dominick, the young man who was going to be managing my account "if" I decided to leave it with Raymond James. After the introductions and pleasantries were over, the manager presented Dominick's credentials, which were solid, and recommended his character and so on. I was a bit worried about his youth. He looked to be in his early to mid-30s. But my worries were diminished almost entirely when he began speaking. The first thing he said to me was something like, "Mr. Ford, I've been studying your accounts and their history. I know where your portfolio is right now. What I'd like to know is where you want to go with it. And what else I could do to make you happy with me as your broker."

Wow! That was a very good opening. He was young, but he was saying all of the right things. He had the initiative to have studied my accounts before we met, and he had no intention of telling me what to do. He wanted me to tell him how he could help me.

This, in my view, is the right way to relate to your broker. Having any other sort of relationship is unhealthy and potentially dangerous to your wealth. You are the owner of your wealth, not your broker. You pay him. He works for you. You are his boss. He should treat you like his boss.

You may be thinking, "Gee, I don't think I want to be my broker's boss. He's the guy who knows about investing. I don't know enough to tell him what to do. And I certainly don't want to insult him by bossing him around when he knows and I know that I don't know what I'm doing."

Do you ever have such thoughts about your broker? If so, you need to change things. And quick.

It doesn't matter that you know less about stocks and bonds than he does. It doesn't matter that you feel like a small fry because you don't have $10 million in your account. It doesn't matter if all your questions feel "stupid." If you aren't the boss of that relationship, you are in trouble.

I answered Dominick's very good questions by explaining my ideas about wealth-building to him and even handing him a stack of my published books about business and wealth-building. In the weeks that followed, he was in touch with me at least twice a week.

We reviewed my entire portfolio, made key changes to restructure it in accordance with my asset-allocation preferences, and agreed on buying and selling parameters, so we could work more fluently in the future.

I am very happy with everything he's done. And what makes me most happy is that he is working for me and not the other way around.

Even after so many years of being in the financial information business yet making a lot of money by ignoring industry conventions, I still find myself deferring to brokers when they start pitching investment ideas. I shouldn't, but I sometimes do. And if I sometimes do, I can only imagine the pressure someone else – who hasn't had my experience or success – must feel when being pitched.

If you have ever felt like that, this story was for you. But don't beat yourself up about it. Remember, you don't have to be an investment expert or wise to be a successful broker. You simply have to be a persuasive talker. Brokers are professional persuaders. You should think of them that way.

If they can talk you into a submissive attitude, it makes their job (selling you) that much easier. If you defer to them, the way I was doing with my old broker – even if it is only out of politeness – you are at a potentially dangerous place. You might be talked into making a hasty decision that you'd later regret.

What I'm saying is that you should never, ever allow a broker to be in charge of the conversation. You're the boss. He should listen to you. Now, this may seem like a difficult thing to do when you feel like you don't know what to do. But isn't that why you subscribe to newsletters? You are paying us to tell you what to do.

My feeling is that you shouldn't let brokers give you investment ideas. That's our job. As newsletter writers, we spend a lot of time and money coming up with the recommendations you are getting in all of our various investment portfolios. You have, with us, more good ideas than you probably can use.

Use your broker to execute trades or to help you solve technical problems or to answer specific, technical questions. Make sure he is listening to you – not the other way around.

Best,

Mark Ford

Further Reading:

"There are certainly financial advisors and money managers who are smart and caring and do a good job," Mark says. But "the financial industry is adept at keeping its customers in the dark about what they are spending." Find out What You Should Ask Your Money Manager Today – Right Now.

For today's DailyWealth readers, we've unlocked an exclusive interview with Mark from Stansberry Radio. Learn the difference between passive and active income... how Mark launched dozens of thriving businesses, some of which have grown well beyond $100 million... and his No. 1 secret to success. Listen for free (or download the transcript) right here.

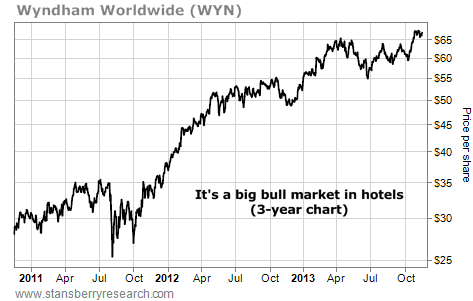

Market NotesBEFORE YOU BUY THAT BUNKER IN MONTANA... Before you sell every stock you own and go live in a bunker in Montana, remember, Wyndham Worldwide (WYN) is still soaring. And that's a sign "things can't be all that bad."

Over the past few years, we've pointed to the soaring shares of banks, home improvement firms, and transportation stocks as proof the U.S. economy couldn't be doing all that bad. We've also featured commentary on Wyndham. What happens with this company is extremely important...

Wyndham is one of the most important stocks you've never heard about. It's the world's largest hotel chain. Brands here include Super 8, Howard Johnson, Ramada, and Days Inn. Wyndham owns several "upscale" hotel chains as well.

The profits and share prices of hotels rise and fall with America's propensity to take business trips and vacations. As you can see from today's chart, the stock has enjoyed a big uptrend since late 2011. Just yesterday, the stock hit a fresh all-time high. It's boom times for hotels... which tells us "things can't be all that bad!"

|

In The Daily Crux

Recent Articles

|