| Home | About Us | Resources | Archive | Free Reports | Market Window |

Interest Rates Really Could Stay Low for Another 10 YearsBy

Monday, June 9, 2014

Everyone expects interest rates to move higher...

But history shows they COULD actually stay low for years to come.

Don't believe me? Then please, read on...

You might be surprised to hear this... but not a single expert believes that interest rates will go down from here.

OK, there is actually one guy who believes interest rates could fall – out of the 90 different institutions that make forecasts (according to Bloomberg). As a group, those "experts" believe the interest rate on the 10-year U.S. Treasury bond will rise about 1% over the next year. Let me repeat that:

Exactly 1 out of 90 experts expects interest rates to fall over the next 12 months.

In short, the "smart money" is making a one-way bet on higher interest rates this year.

So far, the smart money has proven to be completely wrong... The 10-year bond started the year with a rate of about 3%. Now it's closer to 2.5%.

You would think that when everybody believes something, it must be right... no? But the truth is different in the financial markets...

As my good friend Rick Rule likes to say, "in the markets, you're either a contrarian or a victim." Looks like we have one contrarian and 89 victims out of the Bloomberg experts.

Interest rates in America are at multi-generational lows... They couldn't possibly go lower, right? Wrong again...

Interest rates in the U.S. could easily stay low for years...

Could that really happen? Consider the case of Japan...

Japan experienced a massive stock market and economic bust in the late 1980s. The country has been fighting deflation and slow economic growth ever since. And like the U.S., Japan cut short-term interest rates to near-zero in the mid-1990s.

Since then, Japan's long-term interest rates have headed lower and lower. Just like we're seeing with the "experts" in the U.S. today, the "experts" in Japan have tried to bet against this lower-interest-rate trend for 20 years.

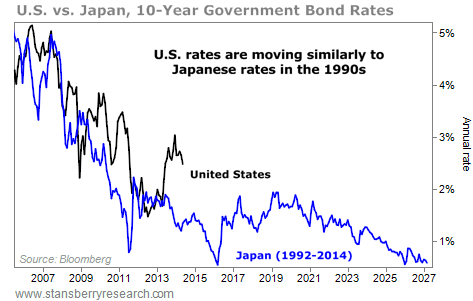

It has been a losing battle – to say the least. The scary thing is, rates in the U.S. today look a lot like Japan's did back then. Take a look...

The chart shows interest rates on 10-year U.S. Treasury bonds in black. In blue, we have interest rates on 10-year Japanese bonds. Japan's deflationary bust happened before the bust in the U.S. – so I've simply shifted Japan's bust forward in time to compare the two. As you can see, our current rate drop in the U.S. is similar to the mid-1990s drop in Japan. And today, more than 10 years later, long-term interest rates in Japan remain well below 1%.

My point is simple... everyone expects interest rates to move higher... But history shows they COULD absolutely stay low for years to come.

I am not predicting they WILL go lower... I am just saying that they COULD.

I also want you to be aware that – if you are betting on higher interest rates today – you are NOT being a contrarian. (Instead, you are a "victim" in Rick Rule's explanation.) The contrarian bet would be to bet on lower rates.

I do agree that – in the long run – interest rates will move higher. But I am not willing to bet with real money when that date will be.

Interest rates don't HAVE to move higher today. Japan's history lets us know that interest rates CAN stay lower than you can imagine, for longer than you can imagine.

In short, I just want you to be aware of one thing: If you are betting on higher interest rates, then you are betting WITH the entire crowd – and that is usually not the most profitable place to be...

Good investing,

Steve

Further Reading:

PIMCO founder Bill Gross, known as The Bond King, also believes interest rates could stay much lower than people realize. "When Gross talks about bonds and interest rates, I listen," Steve writes. "He is not always right, of course. But he has been more right than anyone else across decades. His track record proves it." Get the full details right here.

Last week, European interest rates actually went negative. Steve recently explained exactly what that means for investors. "So what should you do? Follow the blueprint that Draghi is following," Steve writes. "You could make a heck of a lot of money if you do." You can learn which fund Steve recommends right here.

Market NotesNEW HIGHS OF NOTE LAST WEEK

Apple (AAPL)… Big Cheap Tech

Intel (INTC)… Big Cheap Tech

Johnson & Johnson (JNJ)… Big Pharma

CVS Caremark (CVS)… drug stores

Walgreens (WAG)… drug stores

McKesson (MCK)… medical distributor

Allstate (ALL)… insurance

Norfolk Southern (NSC)… railroads

Southwest Airlines (LUV)… airline

Delta Air Lines (DAL)… airline

American Airlines (AAL)… airline

Hess (HES)… Big Oil

Halliburton (HAL)… oil services

Carrizo Oil & Gas (CRZO)… oil and gas production

Continental Resources (CLR)… oil and gas production

Altria (MO)… cigarettes

Cummins (CMI)… diesel engines

3M (MMM)… manufacturing

General Mills (GIS)… cereal

Kellogg (K)… cereal

Tiffany & Co. (TIF)… jewelry

Smith & Wesson (SWHC)… guns

Alcoa (AA)… aluminum miner

Monsanto (MON)… "GMO" seeds

Walt Disney Co. (DIS)… entertainment

Time Warner (TWX)… media and entertainment

Wells Fargo (WFC)… bank

NEW LOWS OF NOTE LAST WEEK

Alpha Natural Resources (ANR)… coal miner

Arch Coal (ACI)… coal miner

Walter Energy (WLT)… coal miner

Cliffs Natural Resources (CLF)… iron-ore miner

Molycorp (MCP)… rare earth minerals

Whole Foods Market (WFM)… expensive groceries

|

Recent Articles

|