| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why Rising Rates Won't Kill This Bull MarketBy

Tuesday, March 10, 2015

Interest rates are expected to go up later this year – for the first time since 2006!

This is striking fear into the hearts of investors.

(Specifically, the Federal Reserve is widely expected to raise short-term interest rates – something it hasn't done since June of 2006.)

Most investors think that, when the Fed raises interest rates, asset prices (like stocks and real estate) have to fall.

It is true that the Fed will raise short-term interest rates at some point – possibly later this year.

However, this does not mean that stock prices have to fall...

You see, the Fed controls short-term interest rates. But it doesn't control long-term interest rates – those are set by the financial markets.

The conventional wisdom is that – if the Fed raises short-term interest rates, then long-term interest rates would follow them higher. You can see the logic... but it doesn't have to happen.

Just because the Fed raises short-term interest rates, it doesn't mean that long-term interest rates have to go up.

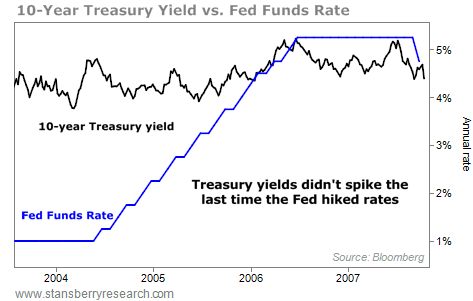

For example, the last time the Federal Reserve raised short-term interest rates, long-term interest rates stayed roughly the same, between 4% and 5%. Take a look:

The Fed dramatically raised short-term interest rates – from 1% to more than 5%. Meanwhile, long-term interest rates stayed roughly the same. (Mortgage rates stayed the same for those years as well, hovering around 6%.) Could something similar happen again this time around? Absolutely.

And here's another important point...

During the last time the Fed was raising interest rates in a major way (2003 to 2007), stock prices actually went up! The S&P 500 went from a value of 1,100 to 1,500-plus.

Stocks didn't start to fall until the Fed CUT interest rates in late 2007.

So I have two important messages for you today...

The last time the Fed dramatically raised short-term interest rates, long-term interest rates (like mortgage rates) barely budged.

The last time the Fed dramatically raised short-term interest rates, stock prices actually went up.

Just this week, long-term interest rates in Germany fell to NEGATIVE interest rates. (That was on government bonds maturing in 2021.) Our reality today is that we live in a low-interest-rate world.

I can't guarantee it, of course. But I think there's a strong likelihood that long-term interest rates won't go up much at all when the Fed finally raises interest rates.

This is why stocks (and real estate) can still soar higher.

In today's low-interest-rate world, even if the Fed raises short-term interest rates, there will still be no alternative for savers and investors... They'll have to put their money into stocks.

So let the talking heads on TV worry about the effects of a rate hike by the Federal Reserve. But don't you worry about it. It won't end this bull market...

Good investing,

Steve

Further Reading:

Steve thinks rates will remain lower than most people think. And the "King of Bonds," Jeff Gundlach, agrees. "Most Americans think interest rates in America have to go up to go back to 'normal,'" he writes. "But we are not in 'normal' times." Get the full story right here.

Yesterday, Steve shared how readers can learn from his latest mistake. "Seriously, you win some and you lose some," he writes. "It's how you handle the 'lose some' part that really matters." Find out Steve's latest lesson here.

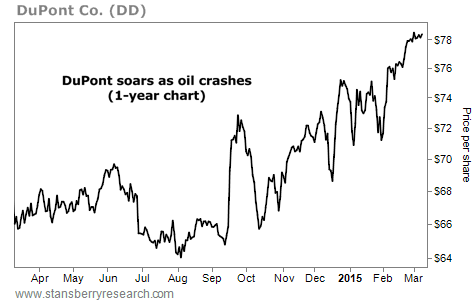

Market NotesCHEAP OIL MEANS BIG PROFITS FOR THIS COMPANY Low oil prices are making life tough for oil producers. But they're great for companies that use lots of oil. For proof, we look at DuPont's earnings and share-price action...

DuPont is one of the world's largest chemical makers. Its chemicals and materials are used in the production of all sorts of things. For example, DuPont makes the "non-stick" Teflon coating on pots and pans, the Kevlar used in bulletproof vests, and the Tyvek weather barriers used on construction sites. Petroleum is a major component of many of its products.

In January, the company announced its earnings in the fourth quarter rose 20% over the prior year. And rising profits have translated into a rising share price...

Since oil began its tumble last summer, DuPont shares are up more than 20%... and just hit a new all-time high last week. For businesses that use lots of oil (like DuPont), cheap oil is a blessing.

|

Recent Articles

|