| Home | About Us | Resources | Archive | Free Reports | Market Window |

Gold Stocks Have NEVER Been This Cheap...By

Thursday, October 22, 2015

Gold stocks soared 600% from 2000 to 2004...

Before then, gold stocks had fallen 84% from 1996 to 2000.

The question is, are gold stocks cheaper today than they were back then?

The answer is YES. Let me explain...

Most investors know that gold is far from its 2011 highs. But I don't think folks understand how far gold stocks have fallen.

The benchmark gold-stocks index – the NYSE Arca Gold Bugs Index (HUI) – is down 75% in four years. Meanwhile, the price of gold only fell 30% in four years. That's a big divergence. And it has led to a major extreme in the gold-to-gold-stocks ratio.

This ratio is simple... It's the price of the HUI Index divided by the price of gold. Gold stocks are cheap compared with the price of gold when the ratio is low. And they're expensive relative to gold when the ratio is high.

With gold stocks crashing 75% and gold only falling 30%, this ratio recently hit an all-time low. Take a look...

This ratio hit an all-time low in October 2000. It took another 14 years – until last October – before it reached a new all-time low. It has reached new lows consistently since this past June. Of course, this isn't a perfect "value" measure for gold stocks. It doesn't take mining costs into account – or any other business costs, for that matter. But it does offer a simple, big- picture view of the industry.

Importantly, the two major bottoms in this ratio led to incredible returns. You can see these bottoms clearly on the above chart – in 2000 and 2008.

If you'd bought gold stocks at each of those bottoms and held for three years, you would have made 418% and 226%, respectively.

We can't know exactly when we've hit bottom. But this shows how much gold stocks can soar when they get going. And after a 75% decline, these kinds of gains are absolutely possible when the next move higher begins.

Importantly, the next move could be here – today. The easiest way to own gold stocks is through the Market Vectors Gold Miners Fund (NYSE: GDX). It's up 20%-plus since last month's low.

We can't know for sure if this is the next big move in gold stocks. But they've been crashing for four years, they're now dirt-cheap, and in the last month they've been moving higher.

This is a somewhat risky bet. But consider shares of GDX today. This is exactly the setup I look for when investing. Check it out.

Good investing,

Steve

Further Reading:

Earlier this month, Steve shared his conversation with gold expert Rudi Fronk, the CEO, chairman, and founder of Seabridge Gold. Learn why it's a good idea to own some gold today right here: The Basics of Gold, From the Man Who Has the Gold.

Before you invest one dime in natural resources like gold, this classic interview with master resource investor Rick Rule is a must-read. In it, he reveals everything you need to know to master the resource market's cyclicality. If you catch one of these big cycles at the wrong time, you can lose a fortune. But if you catch one early, you may never have to work again...

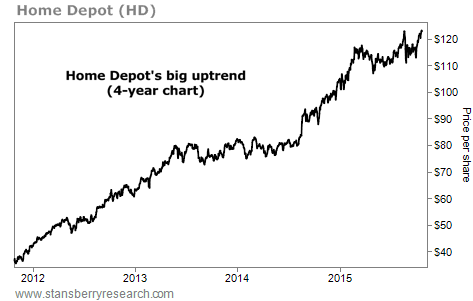

Market NotesA GREAT SIGN FOR THE HOUSING BULLS Today's chart tells us the housing boom isn't showing any sign of slowing down...

Longtime DailyWealth readers are familiar with Steve Sjuggerud's bullish stance on real estate. He says housing is a great asset to own right now... and there's still plenty of upside left today.

Over the years, we've looked at a variety of housing-related stocks to gauge the sector's success. These include Mohawk Industries (flooring), American Woodmark (cabinets), and Sherwin-Williams (paint). But perhaps one of the best indicators of all is home-improvement giant Home Depot (HD).

Home Depot is the largest home-improvement chain in America, with more than 2,200 stores. It sells the things we need to remodel kitchens, build backyard patios, and make home additions. In other words, when people buy houses, they head right over to Home Depot.

As you can see from the chart below, the company is in a steady, long-term uptrend. Shares are up nearly 250% over the past four years and are a chip shot away from a new 52-week high. Home Depot is one of the many indicators supporting Steve's bullish housing thesis right now.

|

Recent Articles

|