| Home | About Us | Resources | Archive | Free Reports | Market Window |

53% Upside in Hong Kong StocksBy

Tuesday, March 22, 2016

The property market drives the stock market in Hong Kong...

This is very different from the U.S., where technology, health care, and financials make up a large portion of the stock market. In Hong Kong, property is king.

When property booms, Hong Kong booms.

This is important because Hong Kong residential sales just hit a 25-year low. And based on history, this could lead to a huge rally in Hong Kong's stock market. Gains of 53% in two years are possible, starting now.

As I mentioned, Hong Kong residential property sales have been down... big.

If property is so important to Hong Kong's stock market... and property sales have crashed... you may think now would be a horrible time to invest in Hong Kong's stock market. But you'd be wrong... We always look for contrarian opportunities. And this is exactly that, based on history.

Property sales are down 70% since this time last year. We've only seen five other 70%-plus one-year declines in the past 25 years. And we've seen 17 total 60%-plus one-year declines. But buying after a 60%-plus decline has been a winning strategy. Specifically, it tends to signal major long-term buying opportunities in the Hong Kong stock market.

Take a look at the returns (since 1996)...

With today's setup, history shows that Hong Kong's stock market averages 27% gains over the next year, and 53% gains over the next two years. Importantly, Hong Kong's stock market is moving in the right direction. The iShares MSCI Hong Kong Fund (EWH) is up 15% in a little over a month.

We can't know for sure if this is the start of a major move. But history says that major property sales declines could lead to further gains.

Shares of EWH are the easiest way to capitalize on this idea. Check 'em out.

Good investing,

Steve

Further Reading:

Steve recently showed readers an opportunity in Europe's stock market. "This is rare," he writes. "It has only happened seven times since 1990. But these were great opportunities to buy European stocks." Find out what he's watching closely right here: Double-Digit Gains, Starting Soon, in European Stocks.

"Right now, we have a long-term uptrend back in place and a major short-term breakout for the Japanese yen," Brett Eversole writes. "Both of these point to 8% gains in the yen over the next year." Learn how to take advantage here.

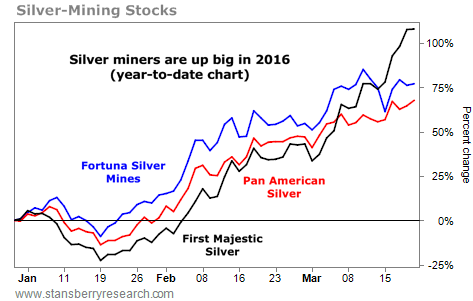

Market NotesDON'T FORGET ABOUT THIS PRECIOUS METAL Today's chart highlights another precious metal rocketing higher in 2016...

On Friday, we discussed the bull market in gold stocks. As we explained, some of the biggest names in the industry are already up more than 50% this year. Meanwhile, silver stocks are posting similarly impressive gains...

Three silver miners that have stood out lately are Pan American Silver (PAAS), Fortuna Silver Mines (FSM), and First Majestic Silver (AG). Because their profits depend on the price of silver, which goes through big booms and busts, these are among the most volatile stocks in the market.

As you can see below, a rising silver price (up about 15% in 2016) has catapulted these three stocks to new highs. This year, AG is up a massive 108%... PAAS has risen more than 65%... and FSM is up 75%. For now, it's a bull market in silver stocks...

|

Recent Articles

|