| Home | About Us | Resources | Archive | Free Reports | Market Window |

This Fantastic News Is a Terrible Sign for the Stock MarketBy

Friday, April 22, 2016

Great news!

Fewer people applied for unemployment last week than at any time since 1973...

This tells us that the U.S. economy is healthier than most people expect.

Specifically, "initial jobless claims" hit a 42-year low – at 247,000 people. Basically, fewer people need jobs.

That's good, right?

Now for the bad news...

The stock market typically performs terribly going forward after "great news" like this – losing money at a double-digit rate 12 months later.

Let me explain...

It may surprise you to hear it, but the stock market typically performs its best after BAD news on the employment front...

When the initial-jobless-claims number is high (which means a lot of people are out of work), stocks actually perform incredibly well going forward...

We quickly ran some numbers on this, and the initial results are amazing... When a lot of people need work – say 500,000 or more – stocks dramatically outperform over the following 12 months.

Going back to 1973, whenever initial jobless claims were 500,000 or more, stocks soared an incredible 24% over the next year. (We looked at a four-week average of jobless claims to smooth out the weekly jobless numbers.)

All of those bad extremes in jobless claims happened during recessions. (They happened in 1975, 1980, 1982, 1991, and 2009.)

Today, we are in the opposite situation... Fewer people are filing for unemployment than ever – just 247,000 last week.

Data going back to 1973 show it's rare for this number to fall anywhere near this low. As I mentioned, this is actually bad news for the stock market going forward...

When the jobless-claims number is below 280,000, stocks lose money at a rate of 13% a year. (Again, we looked at when the four-week average was below 280,000, not just the weekly number.)

Don't get hung up on the specific return figures. Pay attention to the overall point...

The U.S. economy, it appears, is healthier than previously thought, based on the latest jobless numbers. And history says that's not a great thing for stocks.

This is one piece of evidence that could mean the end of the great boom in stock prices might be closer than many people think.

Good investing,

Steve

Further Reading:

Last week, Steve showed why taking short positions can be a way to protect your overall portfolio no matter what happens in the market. Learn why shorting, done right, can lead to large returns with much lower risk right here.

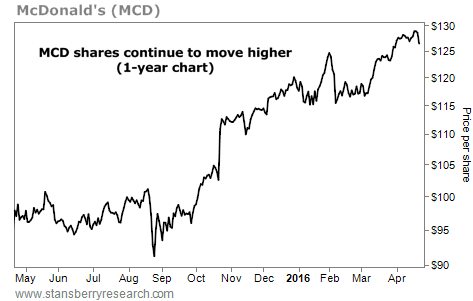

Market NotesNOTHING FANCY... JUST SIMPLE WORLD DOMINANCE The solid run continues for the world's largest fast-food chain...

Regular readers know we view McDonald's (MCD) as one of the best companies to own for long-term investors. Its model is simple and time-tested, and the company enjoys tremendous customer loyalty. If you're hungry, it doesn't get much quicker – or cheaper – than a trip to the Golden Arches.

The World Dominator has more than 30,000 locations throughout 100-plus countries. In the past few years, McDonald's has sold billions of dollars' worth of burgers and fries and generated billions of dollars in profits. It has paid shareholders large, growing dividends for nearly four decades. And to stay ahead of the competition, the company recently launched an all-day breakfast menu.

Despite the market's rocky start to 2016, McDonald's has stayed the course... Shares are up 30% over the past seven months and just hit a 52-week high. Once again, it's proof that owning high-quality, dividend-paying companies works...

|

Recent Articles

|