| Home | About Us | Resources | Archive | Free Reports | Market Window |

Stocks Soar When Republicans Control It AllBy

Thursday, November 10, 2016

Starting in 2017, the Republican Party will hold the big trifecta...

The Republicans will control the Senate, the House of Representatives, and the Presidency.

This is an incredibly unusual event... It has only happened twice going back to 1950. (Once for two years, and once for four years.)

So what does it mean for the markets?

I didn't know. So I crunched the numbers to find out.

The answer was shocking...

The conventional wisdom is that "a house divided" works out best for the stock market. The general thinking is that "gridlock in Washington is good."

If different parties have "control" over Congress and the Presidency, then not much gets done. In theory, that's good for Wall Street – fewer laws are passed to regulate businesses.

I get it. But the numbers tell a different story...

Surprisingly, the "trifecta" trumps "the conventional wisdom."

Here are the actual stock market returns when Republicans controlled the Presidency, the Senate, and the House...

These returns are extremely high. That's a 14% compound annual gain! (And these are only price returns – they don't include dividends.) It's not just Republicans...

When the Democrats control all three, stock prices perform better than when there is no trifecta. A Democratic trifecta beats "buy and hold." And it beats the conventional wisdom that bipartisan control is good for stocks.

Stock returns in a Democratic trifecta aren't nearly as high as they are in a Republican trifecta, based on history... But keep in mind, we're dealing with a small number of occurrences for the Republicans.

So how does this affect us today?

Investors are now filled with fear and panic... What's going to happen? What's Donald Trump going to do as president?

The message from history is this: Don't worry so much about it.

The bigger story is the Republican trifecta.

Stocks have performed incredibly well under a Republican trifecta. The last time around (from 2003 to 2006), stocks didn't have a single losing year. In five out of the six years that we've seen a Republican trifecta, stocks have only lost money once (in 1953).

Today's headlines are all about Trump. But the bigger story is about the Republican trifecta. Using history as our guide, you don't need to worry so much...

Good investing,

Further Reading:

Last week, Steve explained that "something else has an even bigger influence on stock returns than which party is in office." This indicator has shown how stocks tend to react based on election outcomes. And the results might surprise you. Learn what Steve expects going forward right here.

"We have presidential candidates promising to bring jobs to this country," Doc Eifrig writes. "It's no surprise that we've lost sight of what drives the economy." Find out how to think about investing in good times and in bad here: Buy These Companies and Ignore the Noise.

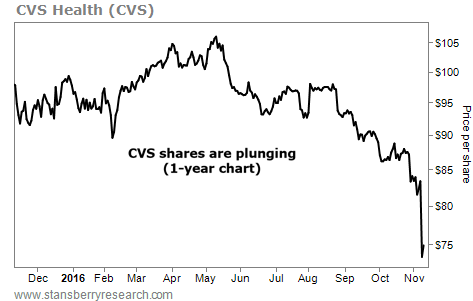

Market NotesTHIS PHARAMCY GIANT SELLS OFF Today's chart highlights a struggling pharmacy...

CVS Health (CVS) is a $78 billion retail and health care company. Its 9,600-plus locations make it one of the largest retail drugstores in the world. And with more than 5 million customers visiting its U.S.-based stores, it's the largest pharmacy benefit manager in the nation.

But lately, its business has hit a rough patch. Earlier this week, in its quarterly earnings release, the company lowered its 2017 profit guidance. In short, CVS expects to lose more than 40 million customers due to increased competition.

Investors have bailed on the company, sending shares to a new two-year low. They're down nearly 30% from their May high. Unless its sales and profits improve in the coming quarters, CVS shares are likely to continue lower...

|

Recent Articles

|

|||||||||||