| Home | About Us | Resources | Archive | Free Reports | Market Window |

We Could See LOWER Interest Rates in Early 2017By

Friday, December 23, 2016

"It's finally behind us. We've finally seen the bottom in interest rates."

How many times have we heard that before? How many times have experts "called the bottom," only to see rates fall once more?

It's happening again today…

Interest rates soared in recent months... to a multi-year high. Most people expect that trend to continue.

But chances are good that long-term interest rates will fall, not rise, in 2017.

Let me explain why…

Long-term interest rates have been falling for decades. Ten-year U.S. government bonds paid roughly 5% in interest a decade ago. Today, they pay around half that.

Despite the long-term downtrend, most people are convinced that rates will head higher from here. They think we've seen the ultimate bottom.

Folks said the same thing three years ago. Interest rates bottomed in the summer of 2012 at around 1.5%. They doubled to around 3% by the end of 2013.

Hitting 1.5% had to be the ultimate bottom in rates, right?

Wrong.

It was wrong back then for the same reason it's likely wrong today: Most people believed it.

This is the crux of using sentiment in investing – when everyone believes in one outcome, the opposite tends to happen.

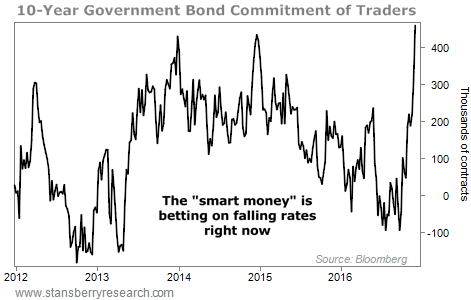

That is what's happening in the government bond market today. We can see this by looking at where the real-money bets are right now. And we can see them through the Commitment of Traders (COT) report.

The COT report shows the real-money bets of futures traders (the "smart money"). Right now, the smart money is betting on lower rates… which is exactly what we saw in 2013. Take a look...

The smart money expects higher bond prices (which means lower interest rates). You can see that the COT reached a similar top at the end of 2013. And 10-year government bond rates then fell from around 3% to below 2% over the next 13 months. They eventually reached a new all-time low this summer.

Will we see a new all-time low in the coming months or years? I don't know. But that's not important. What's important is that everyone expects higher rates to continue.

Today, the trade of betting on higher long-term interest rates is crowded... And when a trade gets this crowded, the opposite tends to happen.

That's why we could see long-term interest rates fall – not rise – in early 2017.

Good investing,

Further Reading:

"For years, I've been extremely bullish on the stock market. And I still am, over the next year or two," Steve writes. "However, in the short term, one of our top indicators is giving us a big warning sign..." Get the story here.

Steve recently told DailyWealth readers about one of the best "cheap, hated, and in an uptrend" opportunities in the market today. Read more here: 'Our Top Trade of 2017,' Says Top Wall Street Firm.

Market NotesTHE 'PICKS AND SHOVELS' OF THE TECH INDUSTRY Today, another look at the power of investing in "picks and shovels"...

Longtime DailyWealth readers know we often extol the virtues of investing in picks and shovels. These are the companies that sell equipment and services that are vital in their industries.

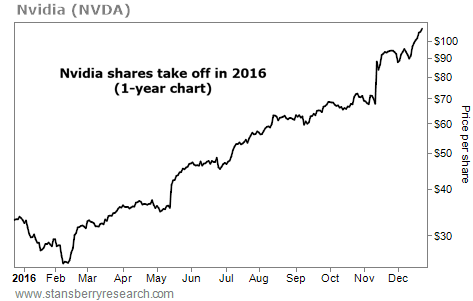

One good example is Nvidia (NVDA). The semiconductor company counts Alibaba, Amazon, Facebook, Google, and Microsoft among its biggest clients. Its computer chips are in everything from video games to smart cars. And it has a head start on the booming world of virtual reality.

As you can see, business has been good for Nvidia. Over the last year, the company grew its revenues by more than 30% and its earnings per share by more than 70%. So it should come as no surprise that shares are on the rise. Nvidia stock is one of the biggest winners of the year, up more than 225% in 2016 alone. It's more proof that investing in "picks and shovels" works...

|

Recent Articles

|