| Home | About Us | Resources | Archive | Free Reports | Market Window |

No Bubble in Real Estate – Not Even in Los AngelesBy

Friday, March 24, 2017

"Everyone here says Los Angeles is in a housing bubble," my friend in LA said to me this week.

Is it true?

Is American real estate in a housing bubble again, just like it was in 2006?

The short answer is no – not at all.

The smartest thing my friend could do is be bold, ignore "everyone in LA," make the contrarian choice, and buy a house (or two!).

Let's look at LA first – then the nation...

We can most easily see the story in LA with a couple charts...

The first chart is the median price of a house in LA, adjusted for inflation. You can see house prices soared in the mid-2000s... and then crashed:

_L6OMUVZ7CI.png) At this moment, house prices are on their way back up... But importantly, they're still nowhere near their old peak prices. I get why "everyone" thinks LA is in a bubble... $500,000-plus is a lot of money for a house. And that's what they cost in LA today.

But based on history, today's prices are not extreme at all for Los Angeles... particularly when you take today's extremely low mortgage rates into account.

This next chart does just that... It shows the Los Angeles "Housing Affordability Index." This index looks at house prices relative to household incomes and mortgage rates. It lets us know how "affordable" homes are.

This affordability index chart gives us an even clearer picture... Houses were extremely unaffordable in 2006. Then they were extremely affordable in 2012. Today, we're somewhere in the middle. Take a look:

_JQ12T4LQ4E.png) In short, since LA homes are not near the extreme unaffordability that we saw in 2006, we are definitely not in a housing bubble in LA. Can house prices in LA go higher from here?

Absolutely! Interest rates are still very low. And most importantly of all, there's a near-record low of existing houses for sale in Los Angeles.

This is basic economics...

If supply is low and demand is high, then prices rise. And that's the case in Los Angeles today – there is no supply.

But now let's shift our story a bit... because this supply story is not just an LA story – it's a national story...

Home listings in the U.S. just hit their lowest level since people started tracking the data.

The supply is not meeting demand. And that means that NATIONWIDE, house prices can continue higher from here.

See for yourself...

In 2008, home listings hit all-time highs. Supply hit record levels. What do you think happened next? When there was too much supply relative to demand, prices crashed.

Now, house listings are at record lows. Supply is nonexistent. It's the opposite of 2008. So what do you think will happen next?

Housing starts are still well below normal levels, as well. With so few new homes and lots of demand, we have hit a major supply-and-demand imbalance in America.

And as long as there are more people searching for homes than there are homes to buy, home prices will keep rising.

I am still bullish on U.S. real estate today. As I said last month, if you buy today, you are not buying at the bottom. But there's still a lot of upside left!

If you are looking to buy a home – but you're worried that the housing market is "in a bubble" – then please, stop worrying. That "excuse" is no good with me.

There is no bubble. And because the current supply of homes can't meet the demand, prices can go dramatically higher from here.

Now is still a great time to buy a house in America!

With low interest rates, and no supply, prices can still go a lot higher...

Don't hesitate. Take advantage of it!!!

Good investing,

Steve

Further Reading:

"I think it's one of the best things Americans can do with their money," Steve says. But we've hit the middle innings of the real estate boom... That means the biggest gains are likely still to come – and time is short. Learn more here: The Free Money Is Over in Real Estate.

"Much of America's real estate is CHEAP," Steve writes. "But it won't stay this way forever." In this essay, he explains why you should make owning residential real estate a top priority this year... and points out one of the best opportunities to profit in the U.S. today. Read more here: Don't Wait Another Second... Buy!

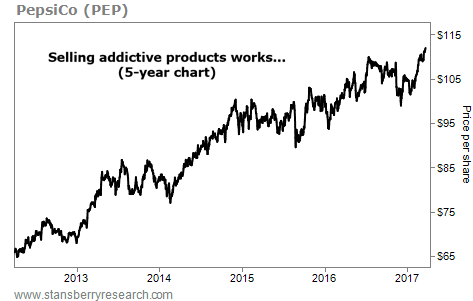

Market NotesAN ALL-TIME INVESTING SECRET Today's chart highlights one of easiest and safest ways to make dependable investments...

One of the truly great investment secrets is the idea of owning companies that sell habit-forming, or even addictive, products – things like soda, fast food, candy, cigarettes, and alcohol. It's not particularly popular, but it's one of the most reliable ways to invest. Think about it: You buy a soda, and once you drink it, you crave another. This generates big, stable cash flows for companies.

For proof, we'll look to $160 billion snack-and-beverage giant PepsiCo (PEP). The company owns 22 brands that produce $1 billion or more in annual revenue. You'll recognize many of the names; Pepsi soda, Lay's chips, Tropicana juices, Quaker Oats, and sports drink Gatorade.

In the chart below, you can see PepsiCo's steady uptrend. Shares are up around 70% over the last five years and just hit a new all-time high. As long as Americans have a sweet tooth, this company's success will likely continue...

|

Recent Articles

|