| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Biggest Mistake My Readers MakeBy

Tuesday, April 25, 2017

"What's the biggest mistake you see your subscribers making?" Meb Faber asked me on his podcast recently.

It's a great question... And I'll share my answer with you today...

"It's always the same," I began...

You can see this idea at work every single day. Here's an example I gave on the podcast...

Keeping your losses small is one of the best ways to protect your gains. But as I explained on the show, it can be hard to let go of your losing trades...

My friend Alex Green said it well... "Think of your portfolio like a rose garden – you need to trim your weeds and let your roses bloom." Most individual investors do the opposite... They let their weeds become bigger weeds. And they trim their roses before they even start to bloom. Do that long enough, and all you're left with is a worthless pile of weeds.

Check out my interview on Meb Faber's podcast... The episode comes out on his website tomorrow.

And I urge you to listen to more of Meb's podcasts... In my opinion, he's one of the world's top investing analysts. He has his guests discuss the most important questions in investing. And he's a super nice guy.

You can learn more about Meb and his podcasts at www.MebFaber.com.

Good investing,

Steve

Further Reading:

"You probably learn more from your losers than your winners," Steve writes. "You dig in and say, 'What did I do wrong?'" On Meb's podcast, Steve shares a key way to limit your risk – and one dangerous kind of trade you should never make. Read more here: Lessons Learned From My Worst-Ever Trade.

If your portfolio is bogged down in go-nowhere investments, Meb has a solution. "In essence, you're forcing yourself to start with a mental clean slate," he explains. Learn his step-by-step method to trim the "weeds" and boost your portfolio's productivity right here.

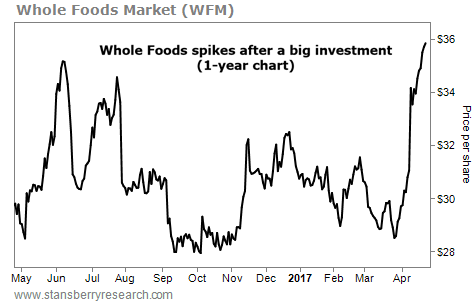

Market NotesTHIS HEALTH-FOODS GIANT IS BOUNCING BACK It was a tough three years for the country's biggest organic- and natural-foods grocer... that is, until recently.

Last week, we showed you that even the best businesses (like Chipotle Mexican Grill) can suffer temporary setbacks. When times get tough, these businesses work through their issues. And the strength of their brands ensures their customers will return. We're seeing this play out again today with Whole Foods Market (WFM)...

The $11 billion grocer has struggled with increased competition and falling sales in recent years. But Whole Foods is still the leader in its sector. And the company is taking steps to improve its competitive position, like opening less expensive stores.

Two weeks ago, shares shot higher after JANA Partners – a big, activist hedge fund – announced that it had taken a nearly 9% stake in the company. It's clear that JANA sees these beaten-down shares as a good value. Remember, when great businesses suffer temporary setbacks, it can be a rare opportunity to buy shares "on sale"...

|

Recent Articles

|