| Home | About Us | Resources | Archive | Free Reports | Market Window |

A Simple Way to Beat the Market, Year after YearBy

Tuesday, September 2, 2014

There's nothing better than a simple, stupid investment idea.

Most folks think you have to reinvent the wheel to beat the market. They think the only way to produce outsized returns is with complex strategies. The kind the average person can't follow.

They're wrong.

Today, I'll show a simple way to beat the stock market. Importantly, this idea makes intuitive sense. And there's an easy way to make the trade today.

This simple idea beats the market by 1.8% a year. That might not sound like much, but over time, it leads to hundreds of percent in excess returns.

Let me explain...

Today's simple market-beating strategy requires us to rethink what "the market" actually is.

In the U.S., our benchmark for stocks is the S&P 500. This index holds the largest 500 companies that trade in the U.S.

That makes sense. If you want to own the U.S., own the biggest and the best. But there's a problem with this approach. As my colleague Porter Stansberry points out...

Porter's describing "market cap weighting." It puts more of the index value into the largest companies, and less into the smaller companies. In the case of the S&P 500, the top 50 companies make up nearly half of the index. That's a problem... as the largest companies tend to be the most mature, and tend to provide lower returns over the long term.

But history shows there's an easy way to beat this formula.

The simple change is moving from market cap weighting to equal weighting. In the equal weight S&P 500, each stock is 0.2% (one 500th) of the index, regardless of size.

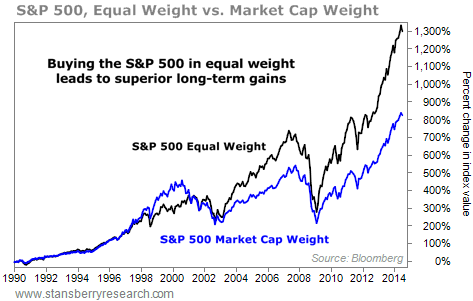

That might seem like a minor change. But the increase to returns is enormous. Take a look...

Since its inception in 1989, the equal-weight S&P 500 is up 1,297% (including dividends). The normal S&P returned just 823% over the same period (also including dividends). Over that 25-year period, the equal weight S&P 500 returned 11.3% a year versus 9.5% in the market cap-weighted S&P 500... a 1.8% annual outperformance.

Again, an extra 1.8% a year might not sound like much. But it adds up. And during the "lost decade" of the 2000s, the equal weight S&P 500 doubled while the normal index went nowhere.

The great news for investors is that there's an easy way to make this trade today. It's called the Guggenheim S&P 500 Equal Weight Fund (RSP).

While you've likely never heard of RSP, it's a seasoned fund that has been available for over a decade. It does a fantastic job tracking the equal weight S&P 500. And it makes following this idea easy.

Like I said, this is a simple idea. But that's a good thing. We don't need to reinvent the wheel to beat the market.

It takes an index everyone knows about, makes a small change, and increases long-term returns. Perfect.

If you're a long-term investor looking to maximize gains, forget about the S&P 500. Put money to work the smart way. Shares of RSP are the easy way to do it.

Good investing,

Brett Eversole

Further Reading:

Brett Eversole says a market extreme is pointing to higher stock prices from here. "Three weeks ago, it correctly showed that the market's mini-correction was likely over. And today, it says higher prices should continue..." Get all the details here.

But Brett sees even bigger gains ahead for one of the world's cheapest markets – China. "Of course, we can't know for sure if this is the start of the next bull market," Brett writes. "But Chinese stocks are breaking out and they're dirt-cheap." Learn a simple way to buy these stocks right here.

Market NotesNEW HIGHS OF NOTE LAST WEEK

Apple (AAPL)... Big Cheap Tech

Xerox (XRX)... copy machines Berkshire Hathaway (BRK-A)... Warren Buffett's holding company W.R. Berkley (WRB)... insurance Allstate (ALL)... insurance Merck (MRK)... Big Pharma Gilead Sciences (GILD)... biotech Celgene (CELG)... biotech Netflix (NFLX)... home entertainment Morgan Stanley (MS)... financial services Wyndham Worldwide (WYN)... hotels Marriott (MAR)... hotels Walt Disney (DIS)... entertainment Southwest Airlines (LUV)... airlines Spirit Airline (SAVE)... airlines Tiffany (TIF)... expensive jewelry Nike (NKE)... shoes and apparel Family Dollar (FDO)... dollar stores Advanced Auto Parts (AAP)... auto parts Gap (GPS)... clothing stores Kohl's (KSS)... department stores Macy's (M)... department stores Home Depot (HD)... home improvement Sherwin-Williams (SHW)... paint Anadarko Petroleum (APC)... oil and gas production AK Steel (AKS)... steel production Lockheed Martin (LMT)... "offense" contractors General Dynamics (GD)... "offense" contractors PepsiCo (PEP)... beverage and snacks giant NEW LOWS OF NOTE LAST WEEK

Not many... it's a bull market!

|

Recent Articles

|