| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why This Week May Be Your Best Chance at a 10-BaggerBy

Thursday, December 18, 2014

I hate the idea of timing the market.

It's impossible to predict short-term movements in individual stock prices, let alone whole markets containing thousands of stocks. Much of the time, it's a fool's errand.

I recommend you buy, hold, and sell stocks based solely on business value and business results. But as I mentioned in yesterday's DailyWealth, there's a timing opportunity in dirt-cheap small-cap natural resource stocks right now that you should take advantage of.

It could be the beginning of the five- and 10-bagger returns I expect to see in a lot of small resource stocks over the next few years.

Let me explain...

Humans aren't built for the stock market. They LOVE to hang onto a losing position way too long. They say they'll sell "when it bounces back." Despite a brutal three-year thrashing, investors have hoped and prayed to sell their small-cap resource stocks at less embarrassing price levels.

The market doesn't care about your desire to exit with some shred of dignity. The Market Vectors Junior Gold Miners Fund (GDXJ) has fallen 34% since January 1, to all-time lows. The Market Vectors Gold Miners Fund (GDX) is down 44% in the past three months alone.

And that's where our opportunity lies. We could be a couple weeks away from one of the greatest buying opportunities in natural resource stocks of the next decade or two. The opportunity comes from a phenomenon that's well-known among the best resource investors...

Investors who lose money in small-cap mining stocks often sell their shares late in the year, so they can write off the losses on their taxes. They wait until late in the year because they remain hopeful the stocks will bounce back.

To exit as quickly as possible, desperate resource investors start accepting lower and lower bids on their shares. That pushes resource-stock prices down. After the first of the year, the selling stops and the share prices spring back to life.

The general idea is you can buy when everybody is selling in November and December and sell when they're buying early the next year. Buy low, sell high.

Since 1982, there have been 32 opportunities to take advantage of the so-called "tax-loss rally" effect in small-cap resource stocks (buying at the end of the year and selling early the next year).

It makes intuitive sense that this would start with some heavier selling after the Thanksgiving holiday. And so far, it has...

The first trading day after Thanksgiving was November 28. The TSX/Venture Exchange closed that day at 741.87. Yesterday, it closed at 659.03. Since November 28, the entire index is down about 11% and has closed down 11 of 14 trading sessions.

All this selling has kept share prices depressed... and created an excellent buying opportunity.

To test this idea, I looked at historical trades for this timeframe since 1982. I assumed we bought the TSX Venture Exchange on or before December 24 (the last trading day before Christmas) and sold on or before March 31 (the last day of the first quarter of the following year).

Using these guidelines, the trade made money 26 out of 32 times, or 81% of the time. It lost money only six times. The average gain was 15%. The average loss was 3.9%.

As trades go, that's good. Your average reward potential is almost four times your average loss potential.

But I don't recommend trading to try to capture the tax-loss rally. That's not my style at all. I recommend simply initiating or adding to positions in small-cap resource stocks that you already view as attractive businesses trading at dirt-cheap valuations.

These stocks are down this year, providing excellent buying opportunities for the tax-loss rally. Over the next week or so, I recommend you take advantage of heavy selling in resource stocks.

Good investing,

Dan Ferris

Further Reading:

Learn how Dan picks great buy-and-hold businesses in these must-read essays:

"If you study what I'm about to teach you, you will be able to identify companies that 'jump off the page' as wonderful investments you'd like to own one day."

"What should a customer do with IBM? IBM is dropping... so should he still buy?"

"Owning these businesses allows you to do something you're not supposed to be able to do... "

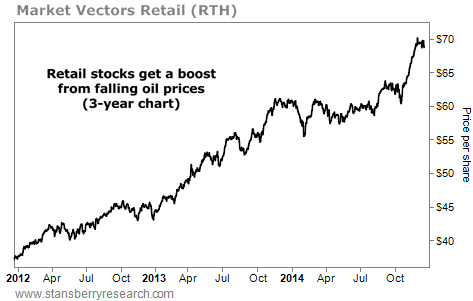

Market NotesFALLING OIL PRICES ARE GOOD FOR THESE STOCKS Last month we showed you that falling oil prices were boosting retail stocks... that's still the case today.

Read investment newsletters for a week and you're bound to come across people who claim the U.S. economy is in shambles. They say the "consumer is dead." The market is saying that idea is bunk, however...

We can monitor this idea with the Market Vectors Retail Fund (RTH). It's an investment fund that holds a basket of "spending stocks" like Wal-Mart, Home Depot, Macy's, Target, Amazon, and Lowe's. It's a fund that rises and falls with the health of the American consumer.

As you can see below, the American consumer is alive and well. RTH has doubled since late 2011... and is up nearly 15% in the last two months alone. Since oil's byproduct, gasoline, is a large expense for families, falling oil prices are giving this uptrend a boost. As we often say, with cockroach-like resiliency, the American consumer lives on.

|

Recent Articles

|