| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: Today's essay is a bit longer than what we normally publish in DailyWealth. But it contains one of the most important ideas we'll ever pass along to our readers here at Stansberry Research. It's an idea that we feel is at the heart of successful wealth-building. And it comes from Editor in Chief Brian Hunt. Read on to learn all about...

The Ultimate Way to Invest "Outside the Stock Market"By

Friday, May 8, 2015

"Investing outside the stock market."

Since the 2008 stock market crash, this has become one of the hottest topics in the financial industry. Investors have gone wild for investing "outside the stock market."

Instead of stocks, the regular Joe is far more interested in Silicon Valley venture capital, gold IRAs, real estate, and websites that allow him to loan money to small businesses. After getting burned badly in the crash, the average investor is interested in just about anything but the stock market.

If you're one of these people, please print this essay and read it several times.

In it, I'm going to reveal an important secret about investing "outside the stock market." You won't hear it from the people touting this idea.

Learning this secret could transform the way you invest. It could mean the difference between making millions of dollars with your investments... or struggling to ever register a positive return. It could instantly make you a much, much better investor.

As I'll show you, you can get rich investing outside the stock market... but not in the way you might think.

Before we cover this secret, I'm going to "pull back the curtain" on our business... and tell you something fascinating about the past six years at Stansberry Research.

In early 2009, True Wealth editor Steve Sjuggerud became extremely bullish on stocks. Remember, at this time, people were terrified we were about to enter another Great Depression. The banking system was on the verge of failure. Unemployment was soaring. Investors had suffered through the worst stock market drop in more than 70 years... and they were panicking.

Steve believed the Federal Reserve would respond to the panic with extraordinary fiscal stimulus... which would cause stocks to soar in value.

Since that bold call, the market has rallied for six years. During this whole time, Steve has stayed bullish. While many investors were worried about another market crash, Steve has stayed unrelentingly bullish... and unrelentingly right. The stock market has more than tripled in value. The people who listened to Steve have made a fortune.

Unfortunately, not many people listened to Steve.

Although Steve has been phenomenally successful with his calls, we've been phenomenally unsuccessful selling Steve's True Wealth service with bullish sales messages. People simply don't want to hear them. They either don't want to invest at all or they want to invest in anything but the stock market.

It's understandable. For many folks, the financial losses were so large – and the memories are so painful – that they never want to hear about stocks again.

Despite the stock market soaring in value since 2009, less than half of American families say they own stocks.

This disinterest in stocks has helped fuel the rise of "crowdfunding" websites that allow people to invest in startup companies.

It has fueled the rise of lending websites, like Lending Club. These websites allow individual investors to loan money directly to small businesses. In less than 10 years, Lending Club has gone from a tiny firm to a $6 billion business.

I'm sure some of these "outside the stock market" investments make sense.

But there's a much more powerful idea to keep in mind here...

There's a valuable piece of investment wisdom that says, "It's not a stock market, it's a market of stocks."

There is power in this old quote. It makes the crucial point that when you buy a stock, you are not "buying the market." You are not buying a lottery ticket or a hot potato to pass back and forth to other investors.

When you buy a stock, you buy a business.

When you buy a stock, you become an owner of its real estate... its equipment... its brand... its patents... and its intellectual property. As a stock owner, you are entitled to a share of the business' cash flows and dividends. The portion of your wealth in that stock rises and falls with the success of the underlying business.

That's why the sophisticated investor doesn't see his stock holdings as investing "in the stock market."

He sees his stock holdings as ownership stakes in real businesses.

Sure, shares of his ownership stake trade on the market, but that's irrelevant to him. What's relevant is the condition of the business... just as if it was a private business investment.

For example, let's say you own a share of your town's most popular restaurant.

It's in a great location. Everyone in town knows it's the place to go for a business dinner or an anniversary celebration. It's co-owned and managed by an honest, hard-working family.

Six years ago, your ownership stake in the restaurant put $30,000 cash in your pocket. That amount has grown each year since then.

As an owner of this business, would you care if the Nasdaq rises 3% next Tuesday? Would you care if the Dow dropped 15% next year? No way. You would only care that the business is still pleasing customers and producing cash flow. The level of the Dow Jones Industrials would have no effect on the value you, your partners, or a potential buyer would place on your business. Zip. Zero.

This is how sophisticated investors view their investments in public stocks.

The sophisticated long-term stock investor doesn't see himself as "playing the market." The world's greatest investor, Warren Buffett, has famously said they could close the stock market for five years and he wouldn't care. Buffett built his fortune by being an owner of high-quality businesses that generate cash... not by investing "in the stock market."

Adopting Buffett's approach to stocks is a huge step forward for individual investors. Buffett approaches his stock purchases as ownership stakes in businesses. He doesn't "buy the market." He buys high-quality businesses with great brand names and big competitive advantages.

This is the real secret of investing "outside the stock market."

This approach can radically improve your investment results. It can also radically reduce your stress levels.

To show you how it works, consider someone who bought an ownership stake in Johnson & Johnson (JNJ) in 1990. At the time, J&J was an established blue-chip leader in consumer products and pharmaceuticals. It was one of the elite businesses in America.

In April 1990, someone who bought an ownership stake in J&J began earning the company's $0.15-per-share annual dividend payment. This translated into a 2% yield on his capital.

Over the next 25 years, J&J's focus on strong brand-name products helped it grow from $11 billion in sales to $74 billion in sales. It also increased its dividend payment every single year. This dividend has increased through bear markets, recessions, terrorist attacks, and stock market crashes.

As I write in 2015, the person who bought an ownership stake in J&J in 1990 has seen the value of his stake grow 1,321%... He is now earning a 42% annual yield on his original investment. And he's earning it by owning one of the world's best businesses.

Stock market declines don't concern this business owner. Why care about a 10% decline in the Dow when you're earning 42% in dividends from one of the world's best businesses?

And recessions? He has seen them before and survived them. He knows that during a recession, people will still buy cough drops, cold medicine, Band-Aids, mouthwash, and prescription drugs from his business.

These situations are common when you buy high-quality businesses like J&J, Apple, Hershey, McDonald's, Starbucks, Wal-Mart, Disney, and Budweiser... and hold them for the long term.

Our publishing company is so committed to helping investors identify high-quality businesses that we've devoted an entire section of our flagship Stansberry's Investment Advisory to it. We screen and research the world's best businesses. We detail them for readers. When one gets cheap enough to buy, we recommend buying as much as you can afford. Many sophisticated investors consider this research a "cheat sheet" for buying the world's best businesses. It's one of the most important services we'll ever publish.

You might have noticed that I didn't use the words "buy stock" during this example. I used words like "owner" and "business."

That's because seeing yourself as an owner of a business is so critical to this mindset... the mindset of an elite investor.

If you're willing to put in a little time... if you're willing to learn what makes a great business... and if you're patient enough to only buy when great values are present, you can build incredible wealth with "outside the stock market" investments. You can build incredible wealth as an owner of high-quality businesses.

Consider beverage giant Coca-Cola (KO)... It sells more than 3,500 different products in more than 200 countries. It has 20 brands that each generate more than $1 billion in annual sales. And it earns thick, 20% profit margins.

Do you think people will still be drinking soda, water, and juice 25 years from now? So do I... And Coke will be selling them. According to Forbes, Coca-Cola is the fourth most valuable brand in the world.

Over the last 25 years, Coke has increased sales from $10 billion to $46 billion. It has increased its annual dividend payout in each of the last 50 years. If you had bought a stake in Coke's business 25 years ago, you would have paid $4.70 a share and started earning its $0.10 annual dividend. That's a 2.1% yield.

Today, your share of the business would be worth more than eight times what you originally paid... a 770% increase. And you would be earning a 28% annual yield on your investment. Meanwhile, the broad market has returned 520% during that time.

Or... consider fast-food icon McDonald's (MCD). It has more than 35,000 restaurants in more than 100 countries... And it serves 70 million customers a day. It earns large, 17% profit margins.

Do you think people will still want fast food at low prices 25 years from now? So do I... And they'll get it at McDonald's. According to Forbes, McDonald's is the sixth most valuable brand in the world.

Over the last 25 years, McDonald's has increased its revenues from $7 billion to $27 billion. It has increased its annual dividend payout in each of the last 38 years. If you had bought a stake in McDonald's business 25 years ago, you would have paid $7.60 a share and started earning its $0.08 annual dividend. That's a 1% yield.

Today, your share of the business would be worth more than 12 times what you originally paid... a 1,178% gain. And you would be earning a 45% annual yield on your investment.

These incredible results don't even take into account the amazing power of reinvesting your dividends. This is the practice of taking the money you earn in dividends and using it to buy more shares.

If you bought a stake in J&J 25 years ago and reinvested your dividends, the value of your piece of the business would have grown 2,361% instead of "just" 1,321%. The value of your Coca-Cola stake would have grown 1,313% instead of 770%. Your stake in McDonald's would have grown 1,891% instead of 1,178%.

With this in mind, I encourage you to build a "shopping list" of high-quality businesses... and look to buy them when they go on sale.

These sales are often caused by serious-but-solvable business problems that produce share-price declines. Sales can also come in the form of stock market crashes. These occur every 10 or 15 years. They give you spectacular times to buy high-quality businesses.

For example, during the 2008-2009 credit crisis, the value of ownership stakes in entertainment blue chip Disney dropped more than 50%. In early 2009, you could have bought a stake in the company for $20 per share. Six years later, the economy had improved... people spent more money on entertainment... and the value of Disney's ownership stakes climbed 400% to $100 per share.

As I mentioned, you can get rich investing outside the stock market.

There you have it... an enlightened way to view an idea many Americans are concerned about... but have totally wrong.

Don't want to invest "in the stock market" by owning the Dow? Great. Invest outside the stock market. Buy a world-class business like McDonald's the next time it's selling for the bargain price of 10 times cash flow. Become a shareholder in one of the world's greatest businesses.

Don't want to invest "in the stock market" by owning mutual fund shares? Great. Invest outside the stock market. Buy an elite business like Starbucks or Hershey or Disney after the next market crash leaves them selling for bargain prices.

If you're interested in making great investments outside the stock market, then don't "buy the market"... and don't view stocks as hot potatoes to buy and sell every week.

Take a radically different approach than amateur investors...

Do what sophisticated investors do... Buy businesses.

Regards,

Brian Hunt

Further Reading:

Brian recently told readers about one of his favorite sectors of the market. "One of the strongest uptrends in the world is gaining ground," he writes. "And it's making some investors lots of money." Learn which sector Brian is talking about here.

He also showed readers how to know when the next bear market has arrived. "Since some market analysts say a bear market is around the corner, we know this is a big concern for many investors," he writes. "But how do you know when a bear market has actually arrived?" Get all the details here.

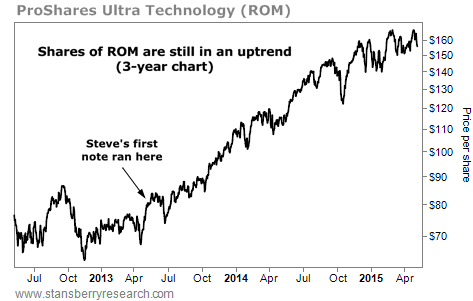

Market NotesSTEVE'S "BIG CHEAP TECH" IDEA IS STILL WORKING If you took our advice to take a "double long" position in cheap tech stocks, you've done extremely well...

Since May 2013, Steve has made a strong case for buying blue-chip technology stocks like Intel, Microsoft, and Google. These companies hold dominant positions in their industries, huge cash hoards, and low valuations.

Steve's favorite way to get exposure to this sector has been the ProShares Ultra Technology Fund (ROM). This fund aims to double the return of a basket of tech stocks.

As you can see below, the trend is still up. Since Steve's original note, ROM is up more than 105%... and just last week, shares reached a new all-time high. The rally in tech stocks is still on.

|

Recent Articles

|