| Home | About Us | Resources | Archive | Free Reports | Market Window |

Four Ways I'm Investing My Own Capital in Natural Resources TodayBy

Friday, September 4, 2015

I still believe there's a great opportunity to put some money to work in the beaten-down natural resources sector...

That's why I'm personally putting money to work in select natural resources stocks.

And in today's essay, I'm sharing the four key things I look for when deciding where to invest my money...

1) I invest in businesses that I believe are highly likely to continue generating substantial cash flows, even if the resource market bottom is south of here. That's a small group of companies.

Cash flow is what gives equity its value. It's one of the most important variables for all outside, passive, minority investors, and the financial linchpin of my approach to investing in stocks. For me, if there's no cash flow, it's a no-go most of the time.

2) I invest in stocks I believe are more likely to become acquisition targets, based on what the more acquisitive companies have bought recently. A good acquisition target might look like International Royalty Corporation did when Royal Gold finally bought it six years ago: Great assets with the potential to reduce operating expenses and/or balance sheet liabilities.

In other words, look at what the busiest and best acquirers are buying today, and try to beat them to it.

Maybe these actions seem out of reach for the individual investor. They're not. Anybody can look around at what acquisitive companies are buying. Anybody can send an e-mail to the management of a company with an idea or two that might increase shareholder value.

Many tiny, ultra-risky mining companies have market caps of less than $10 million. They're so small that they're way off most investors' radar screens, their cash balances are shrinking by the day, and they're desperate to get investors interested.

Odds are better that an individual, outside, passive minority investor might get a CEO or other executive officer on the phone with these companies than with larger ones.

3) I do what I can to bring companies together with sources of capital and other opportunities to create lasting shareholder value. For example, I heard the CEO of one of my mining-stock holdings say he wouldn't mind talking to private equity, but that private-equity investors didn't seem interested in his company. So I put a bug in the ear of a natural resource-focused private equity firm I know and respect.

The basic idea is that the private-equity investor could provide capital when capital is scarce (as it is across the mining sector) for a contrarian deal that would transform the business.

I'm hoping I'll wake up one day to news of a deal, and that the market will like it and make a deeply undervalued stock less undervalued.

Another example: A London-based colleague of mine is working with one of our favorite prospect generators – in which I own shares – to do some small deals in Europe. You can't get that intimate with the folks running Apple or IBM.

If you can't get anybody from a small company on the phone who really knows the business well, that might be a caution flag.

4) I invest in companies in which I know the management team well and trust it to make good decisions as the resource market crawls across the bottom and possibly heads lower.

Today I own four resource stocks and I'm bidding on a fifth. I'm down about 13% on my largest position and about 24% on my much smaller fourth-largest position. I've been down as much as 22% on the bigger one and 40% on the smaller one.

This would make most folks soil their underwear. But I've done my homework on these stocks. I know they have strong business models and management teams that will see them through the downturn. I'm confident enough in these companies, and have enough intestinal fortitude, to believe sticking with them will pay off huge in the long term.

I view this knowledge and fortitude as a competitive advantage. Without it, I'd be crazy to buy these dangerous little stocks.

Author and mutual fund legend Peter Lynch once said about management teams: "You want a business so good, any idiot can run it."

Exploration mining is exactly the opposite. It's so unlikely to succeed that you can't afford not to team up with the best people in the industry, those who've found success on multiple occasions in the past. Getting to know them will take some work on your part.

To sum up, I'm buying small-cap mining-related stocks with strong cash flows. I'm trying to help the companies I buy source new opportunities. And I'm buying stocks I believe are good acquisition targets.

You can still make money in the hated natural resources sector... if you do it right. A well-chosen portfolio of natural resources stocks could make you several times your money over the next five to 10 years.

This is what I'm doing today, and what I would encourage any investor to do.

Good investing,

Dan Ferris

Further Reading:

On Wednesday, Brian Weepie told Growth Stock Wire readers about an opportunity shaping up in the resource sector. There's a bidding war currently taking place... and certain pipeline companies could be headed higher. Learn which five names Brian suggests looking into right here.

Before you invest one dime in natural resources, this classic interview with master resource investor Rick Rule is a must-read. In it, he reveals everything you need to know to master the resource market's cyclicality. If you catch one of these big cycles at the wrong time, you can lose a fortune. But if you catch one early, you may never have to work again.

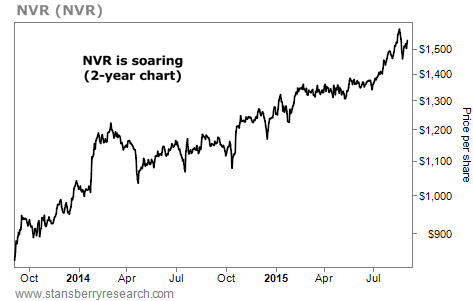

Market NotesCAPITAL EFFICIENCY: HOMEBUILDER EDITION Today, we take a look at one of the most powerful concepts of investing: owning capital-efficient businesses.

Porter Stansberry has written many times about the concept of capital efficiency over the years (you can learn more here, here, and here). These companies generate high returns on capital with little additional ongoing investment. They have strong customer loyalty and can gradually raise prices when they need to, which allows them to return more money to shareholders.

One of Porter's favorite examples of this idea is homebuilder NVR (NVR). NVR is the most capital-efficient homebuilder in America. It was profitable throughout the housing crisis. Even if you had bought NVR at the worst time possible (at its peak in 2005, just before the crisis began) you still would have nearly doubled your money in 10 years.

This is a classic example of a company that is able to return money to shareholders without investing heavily in expensive machinery, research and development, or factory maintenance. As you can see below, NVR's success is continuing today, even through the recent selloff. Shares have climbed 15% in the past two months. Longer term, the stock has soared 85% in two years. It's a clear picture of capital efficiency at work...

|

Recent Articles

|