| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why the Falling Dollar Is Good News for This AssetBy

Tuesday, September 19, 2017

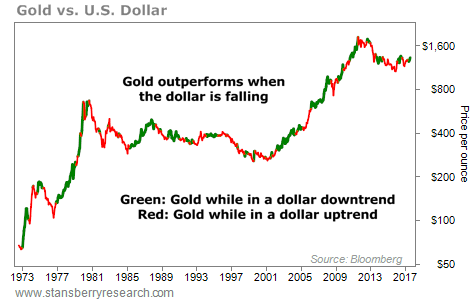

When the U.S. dollar is going down, the price of gold goes up.

The reason is simple... It's basic math.

Gold is priced in U.S. dollars... so if the U.S. dollar is weakening, it takes more dollars to buy the same ounce of gold.

That's the logic, anyway. But does the logic actually work in the financial markets?

Sometimes it doesn't... As the economist John Maynard Keynes famously said, "The market can remain irrational longer than you can remain solvent."

But as it turns out, the logic works with gold and the dollar...

Gold's compound annual return since the early 1970s has been about 6.9% a year. But when the dollar is weakening, gold goes up at 12.2% a year. And when the dollar is strengthening, gold only goes up 1.8% a year.

This table shows it simply...

To identify uptrends and downtrends, we looked at whether the dollar was above or below its 10-month moving average at the end of a month. Then, starting at the date of that signal, we measured gold's performance over the following month. You can see dollar downtrends led to strong gains in gold...

So... why is this important today? Because we are now in one of those times when gold has historically delivered double-digit compound annual gains.

"The dollar could be starting a multiyear bear market," my colleague Brett Eversole wrote yesterday...

His conclusion was that the dollar could decline for the next two years. If that's true, then gold could be starting a multiyear bull market.

Don't be too worried about the short-term fluctuations... We actually think the dollar could go up a bit more before it resumes its fall. But the dollar's long-term trend is clearly down. And we are finally on board with gold again.

Gold could be starting a multiyear bull market. You want to be on board.

Good investing,

Steve

Further Reading:

"Gold hasn't looked this good in years," Steve says. The metal is on pace to outperform stocks – for the first time since 2011. History shows this could be the turning point for big gains ahead. Learn more here: This 'Stealth' Bull Market Could See Triple-Digit Gains.

"The U.S. dollar's plunge has been one of the major financial stories of 2017," Brett writes. "This quick fall could be a sign of a much larger downtrend." Read more about what it means for your investments right here: The Dollar Could be Starting a Multiyear Bear Market.

Market NotesANOTHER HUGE WINNER FROM THIS HOT SECTOR Today's chart highlights a leader in the semiconductor business...

Longtime readers know we are always looking for big secular trends to invest in. Since personal computers and cellphones became central to our daily lives, the need for semiconductors has been growing... These little devices power most of the electronics we use today. We last checked in on this trend with shares of chipmaker Nvidia (NVDA). Today, we can see this concept at work with shares of Lam Research (LRCX)...

The company is a leading manufacturer of specialized equipment for semiconductor chipmakers. Lam's products allow chipmakers to build device features that are more than 1,000 times smaller than a grain of sand. And its major innovations have led to big profits and higher share prices...

As you can see in the chart below, shares are up nearly 150% over the past two years... And they just hit new all-time highs. This big trend is not showing signs of a slowdown. Keep an eye on semiconductor stocks for more upside...

_9BOPO74AQ5.png) |

Recent Articles

|

|||||||||||||