| Home | About Us | Resources | Archive | Free Reports | Market Window |

A Major Ominous Sign for StocksBy

Tuesday, November 7, 2017

Rejoice, my friend – almost everyone who wants a job has one today!

This is good news, right?

Not for stock investors. It's actually terrible news for stocks... if you believe history repeats.

Let me explain...

The unemployment rate just hit a 17-year low of 4.1%. With the exception of the year 2000, that's actually the lowest unemployment rate in nearly 50 years.

But you remember what happened in 2000. We suffered through the greatest stock market bust of our lifetimes...

The Nasdaq Composite Index fell 56% in the 18-month period following the best unemployment number of my lifetime – 3.8% on April 30, 2000.

"But that was the tech bust, Steve," you might be thinking. And you're right. Plenty of factors led to the tech bust... And we've rarely seen anything so extreme. So was that an isolated incident?

Let's take a look at the other extreme lows in unemployment in the last 50 years, and see what happened to stock prices in the 18 months that followed...

Before today, the most recent low in the unemployment rate was 10 years ago... It hit a low of 4.4% on October 31, 2007. What happened to stock prices over the next 18 months? They fell 44%.

In the last 50 years, the only other period of unemployment lower than today was late 1968. Back then, the unemployment rate hit an extreme low of 3.4%. And over the next 18 months, stock prices fell by 30%.

All told, we've seen four "good" extremes in the unemployment rate in the last 50 years – four times when just about everyone who wanted a job could get one. In each of those cases, when unemployment finally hit its extreme low for that cycle, stocks prices crashed over the next 18 months.

Take a look:

Does this mean that stocks will crash over the next 18 months? Does this mean that today's 4.1% is the ultimate low? No... and no.

"But Steve, don't you keep talking about a stock market 'Melt Up?' And now you're talking about a dramatic fall in the markets? Doesn't that go against your Melt Up thesis?"

My friend, here's the deal... We are in the very late innings of the what could turn out to be the greatest stock market boom in our lifetimes.

Yes, I believe today's stock market boom will end with very big gains – the Melt Up. However, I'm going into it with my eyes open. I understand the risks. Markets do not go up indefinitely.

It's much better to know what can go wrong and when – and to guard against it – than it is to buy based on hope and blind faith.

We know it's getting late in this great bull market. But the important thing is, it's not too late to make good money – yet.

Someday in the not-too-distant future, we will live in a terrible time to be an investor... Stock prices could struggle for a decade or more.

When that time comes, we will be conservative. But that time isn't here yet...

Now – today – might be your last great moment to make big gains in the stock market. The window of opportunity is relatively short. But it's worth it...

Good investing,

Steve

Further Reading:

It's not too late to make good money from the Melt Up. And Steve recently shared the perfect way to do it – while you can. "Now is a great moment to swoop in and buy," he writes. Read more here.

"When this market goes down – and it will – that move will scare people," Steve says. The Melt Up is here. And that means you need to prepare for what happens next... Learn what to expect right here.

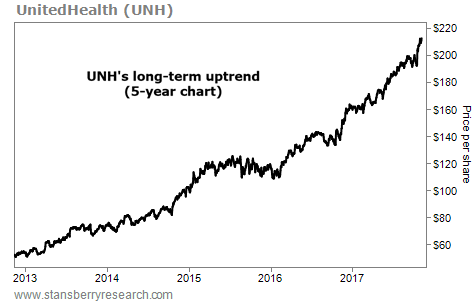

Market NotesTHE BULL MARKET IN HEALTH CARE COVERAGE Today's chart highlights another winner in the insurance business...

Regular readers are familiar with our colleague Dave Eifrig's bullish argument on health care. As Baby Boomers grow older, they'll need more medicine, testing, and doctor's visits. This trend has been one of the market's greatest tailwinds over the past few years. And we've seen it driving share prices higher for many companies, like major health insurers Aetna (AET) and Cigna (CI).

Today, we can see this trend's success with UnitedHealth (UNH). The company is the largest health care insurer in the nation. And as aging Americans take more trips to the doctor's office, UnitedHealth's revenues keep growing... The company brought in more than $185 billion in revenue over the past 12 months. That's 18% higher than $157 billion in revenue the year before.

As you can see below, the stock has soared over the long term. Shares are up around 280% over the past five years... and just reached an all-time high. It's more proof that the big health care trend is still thriving...

|

Recent Articles

|