| Home | About Us | Resources | Archive | Free Reports | Market Window |

An Extraordinary Fact You Didn't Know About ChinaBy

Thursday, August 12, 2010

When it comes to investing in energy, one of the most important numbers you need to know is: 5.3.

That's the number of Chinese people who live on the electricity the average American consumes in a year. While China is always in the headlines for its growing consumption of coal, oil, and electricity, it still consumes just 20% of our electrical supply, on a "per person" basis.

And how about the other Asian giant, India? It uses even less per-capita. Nearly 30 Indians live on the electricity of a single American.

These are incredible differences in the per-person consumption of energy... and they present incredible opportunities for investors. China and India are the world's largest populations. They're growing wealthier... which means more Internet, more iPods, more refrigerators, more air conditioners, more everything that consumes electricity.

This is going to make uranium one of the world's most coveted assets in the coming years...

Uranium fuels nuclear power generation – one of the few non-fossil-fuel sources of energy that works on the kind of huge scale needed by the likes of China and India.

According to the U.S. Energy Information Administration, China's consumption of nuclear electricity will double over the next five years. By 2020, its consumption of nuclear electricity will exceed both Canada and Russia.

To achieve this growth, China plans to build 60 new nuclear reactors within the next 10 years. India needs 40 new reactors in the next 20 years. That would increase the number of nuclear power plants in the world by 23%.

This new Asian nuclear boom is expected to be the largest period of nuclear power growth since OPEC's oil embargo. At its peak, back in the 1980s, the nuclear industry started up a new reactor every 15 days. By 2015, we could see a new reactor coming online every five days.

Both China and India are planning ahead for this boom. Bloomberg recently detailed how both countries are stockpiling the fuel. China could purchase more than twice the volume of uranium than it will actually use this year. The proposed reactors in China alone could consume more than 30% of the uranium mined today. That's why the country signed a 10-year, 10,000-ton deal with giant uranium miner Cameco.

And that's why I think the recent strength in the price of uranium is a sign the market is realizing the bullish case for uranium.

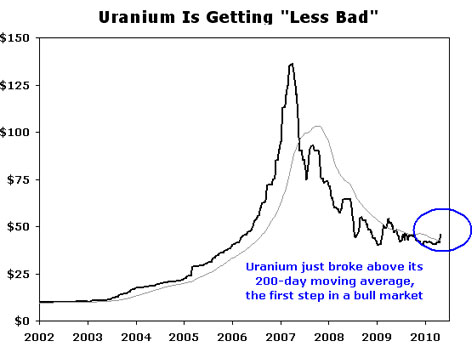

Because of the long-term bullish case, uranium enjoyed a more than 10-fold rise from 2003 to 2007... The end of that rally was fueled by speculators, who helped produce a subsequent crash. This crash hammered uranium prices and the companies associated with the stuff.

But as you can see from the chart below, uranium is getting a little "less bad" these days. It just broke above its 200-day moving average, which acts as a signpost for bull and bear markets.

I love investing in commodities that are trading near blown-out levels but have a bullish fundamental case going for them. In these cases, the downside risk is already beaten out of the commodity... but you have tremendous potential for upside gains.

This strategy has helped my readers make terrific gains in the natural gas ideas I showed them four months ago... and it's going to help investors make gains in uranium stocks.

The biggest, most liquid uranium play is Cameco (CCJ). You can consider it the "ExxonMobil of uranium." The $10 billion company is by far the biggest pure uranium miner.

As folks in China and India close the yawning gap in energy consumption, expect the price of uranium and miners like Cameco to rise over the next decade.

Good investing,

Further Reading:

Like uranium, natural gas is a commodity with bullish fundamentals trading near blown-out levels. If you can stomach the volatility, you could buy a natural gas producer to profit on a long-term price increase. But if you're a conservative investor, Matt has a super-safe "sleep at night" way to put your money to work in natural gas – or any commodity, for that matter. Get the details here: One of the Great Secrets of Commodity Investing.

Market NotesTHE BIG MONEY IS STILL SELLING Some of that big money we've been monitoring for the past few months returned yesterday... to sell.

The stock market enjoyed a 10% rally from early July to early August. But during the rally, there was little buying enthusiasm from huge institutional investors like mutual funds, pension funds, and insurance funds. A healthy bull market can only take place with strong buying interest from these mega players.

Below, we look at the recent price and volume action in the benchmark S&P 500. As you can see, the S&P suffered several high-volume selling periods in May and June (A). The subsequent July rally was marked by tepid buying volume (B).

Now note the past few days of negative action, which came on stronger volume (C). The index also sliced through its 200-day moving average... a "line in the sand" many investors use to demarcate bull and bear markets.

|

In The Daily Crux

Recent Articles

|