| Home | About Us | Resources | Archive | Free Reports | Market Window |

Why Isn't Anyone Talking About These Incredible Investments?By

Saturday, August 1, 2009

After more than 30 years of reading investment advisories, I still shake my head in disbelief at a huge hole in the industry.

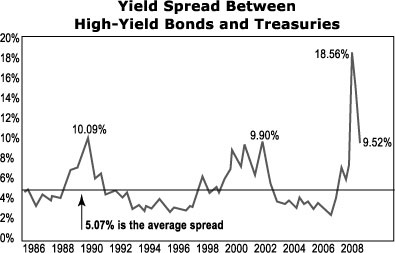

I've seen advisories from a lot of angles over the years. I've read Richard Russell's Dow Theory Letters on and off since 1978. I subscribed to the classic Kiplinger Letter in 1976. And now, I write my own: Retirement Millionaire. I can tell you the advisory business is a lot like the music business. You have to play what the majority of the people want to hear or you'll go flat broke. That's why you see little coverage of the bond market. It's easy to sell the next hot China stock or the next big trend in commodities. It's easy to sell miracle drug stocks. But it's darn difficult to sell people the idea of collecting safe annual yields in the 6%-12% range. I estimate the ratio of bond-picking letters versus stock-picking letters is around 1 to 100. Other than my colleague Mike Williams' outstanding True Income, I can think of few bond-focuses advisories. The industry is overlooking a huge swath of what should be a retiree's largest allocation... Following the classic "100 minus your age rule," you should subtract your age from 100 to determine the amount of money you should have in stocks. The rest should be in bonds and other super-safe investments. For instance, the rule says a 70-year-old should have 70% of his or her portfolio in bonds and similar assets. A bond is simply a promise from a company or government to pay back the money it has borrowed. In exchange for borrowing the money, the company or government pays a stream of interest over a period of time until "maturity," when it returns the money, called the principal. Yields are the interest payment (called the coupon) divided by the principal. For example, say we buy a bond for $100 and it pays us $8 every year for 20 years. We simply take $8 and divide by $100 to get an 8% yield. In general, the lower the yield, the safer the bond. That's why U.S. Treasuries yield so little. Everyone wants to buy them, so the borrower (in this case, the U.S. government) doesn't have to pay much interest. A high-yield bond is just a promise to pay from a riskier company. In exchange for the lender (us) taking on more risk, the company pays more interest and we get a higher yield. The chart below shows how, over the last 20 years or so, the average high-yield bond has paid about 500 basis points (5%) more income than similar Treasury bonds. As you can see, the panic last fall pushed the "spread" – the difference between Treasury yields and high-yield bond yields – up to nearly 2,000 basis points. In other words, high-yield bonds paid almost 20% more than Treasuries.  Today, the spread has come down to more reasonable levels around 10%. But that's still well above the average 5%... so we have an incredible opportunity to invest our money for the long term. But hold on for a second... Before we consider bond investing, we need to think about inflation, the archenemy of bonds. Here's the deal: Let's say you buy a $100 bond paying $6 a year. Now, imagine inflation is roaring and interest rates soar to 12%. If you wanted to sell your bond, you'd be in a tough spot. You could probably only get around $50. Think about it... Your coupon payment of $6 divided by $50 roughly equals a yield of 12% – the market rate. Bottom line: Inflation is terrible for bonds, especially if you have to sell. But I don't think inflation will appear anytime soon. The U.S. consumer is "underwater" on his mortgage, and his IRA is down 40% from the peak. He can't drive increased demand for goods and services. If anything, he's pulling back. In other words, bond buyers don't need to worry. We won't be facing interest-rate inflation for a long while. High-yield bond investors can spend time analyzing individual companies to invest in their debt. But without help, that can be tough for nonprofessionals. For a safe, easy way into high-yield bonds, I like the idea of pooling my money alongside other investors... In Retirement Millionaire, I recommended a few small bond funds selling at a discount to their assets. Out of fairness to subscribers, I can't give them away here. But I can tell you two of the biggest, most liquid high-yield bond funds are HYG from iShares and JNK from Barclays. If you're worried about putting your money in stocks... or if you're already in retirement and want to keep your nest egg secure... buying these high-yield bond funds is an easy way to collect safe income in a weak economy. Here's to our health, wealth, and a great retirement, Good investing, Doc Eifrig P.S. I also strongly believe a retiree should have a portion of his or her assets in precious metals. With governments around the world doing absolutely crazy things, the risk of a currency crisis harming your savings over the next decade is huge. I encourage you to learn about my No. 1 idea to get started investing in precious metals. It's a way to buy my favorite metal for under $1.25. Click here to learn more.

Further Reading:

I'm Earning 18% Interest from the Government. You Can Too... Market NotesTHE CASE OF THE DISAPPEARING VOLUME

Our chart of the week could be called "the case of the disappearing volume."

A truly healthy stock market is one that rises on broad participation from "big money" investors – folks who control pension plans, insurance floats, and large mutual funds. If the "big money" isn't in the pit and buying shares, it's impossible for stocks to make meaningful long-term gains. At the bottom of the chart, you'll see a series of black and red bars. These bars represent the trading volume of the benchmark S&P 500 index fund. Volume has tailed off drastically as the market has gained. The big money is participating less and less in the market rally these days. This lack of volume isn't cause to sell everything and move to cash. But until you see trading volume picking up and large money flowing into the market, the "skeptic's approach" is the best course of action. – Brian Hunt |

In The Daily Crux

Recent Articles

|