| Home | About Us | Resources | Archive | Free Reports | Market Window |

Emerging Markets Typically Soar From Current LevelsBy

Monday, October 3, 2011

You REALLY need to catch a mega-bull market in emerging markets at least once in your lifetime...

If you just buy an emerging markets fund, a bull market here is usually good for a few times your money... without a whole lot of risk.

Right now, the conditions are ripe for another mega-bull market in emerging markets. Let me show you...

According to our True Wealth Systems databases, emerging market stocks are incredibly cheap right now.

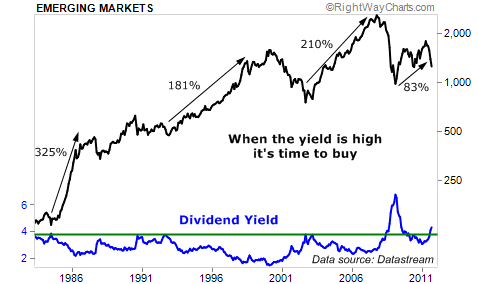

For example, they're paying a 4% dividend yield. Dividends reached this high in 1985... And emerging market stocks soared fourfold in less than a year.

Yields came close in 1993 and 2003. In both cases, emerging market stocks soared threefold. It happened in the bust of 2008-2009, and emerging market stocks nearly doubled after that.

It's happening again right now... and now is a much better time than in 1985 or any other time in history, for two significant reasons...

First, many of these emerging economies were a mess back then, with piles of debt and "garbage" currencies. Today, many have their acts together. (Brazil is a good example.)

Second, interest rates are much lower in the world today – U.S. Treasury bonds pay less than 2%. So a 4% dividend in emerging market stocks today is a better deal than a 4% dividend was back in 1985.

Another way to look at how cheap these stocks are is the price-to-book ratio. It just hit its cheapest level since 1985... Price-to-book is a rough gauge of liquidation value. (It's VERY rough. But it's all we have to go on that's easy to obtain with a long history.)

Right now, emerging market stocks are trading below book value... This is a rare occurrence.

It's happened twice: in 1985... and in 2009. If you'd bought when emerging markets traded below book value both times, you'd have made a heck of a lot of money in a short period of time. Take a look:

My point is simple: Emerging markets' stock markets are dirt-cheap. When they get this cheap, you can make a lot of money.

The usual way to trade emerging markets is through shares of iShares' popular MSCI Emerging Markets Index Fund (NYSE: EEM). But the WisdomTree Emerging Markets Equity Income Fund (NYSE: DEM) is paying a high 4% dividend yield. In our zero-percent world, that's worth considering, too.

You want to catch at least one emerging markets mega-bull market in your lifetime. The setup conditions we're seeing now are near-identical to previous mega-bull markets.

When the uptrend returns to emerging markets, we'll be buyers... You should be, too.

Good investing,

Steve

Further Reading:

A few months ago, Doc Eifrig told DailyWealth readers of a way to get "exposure to rapidly growing emerging markets." The best part is, it "still gives you plenty of 'sleep at night' peace of mind." Read more here: How to Easily Diversify Your Wealth Overseas... and Collect Super Safe Income.

Steve is personally pursuing some of the greatest values he's ever seen. He found an investment opportunity that is "cheap, hated (as an investment), and we can see the glimmer of an uptrend," he writes. "We should be very close to the right time to buy... if it's not here already."

Market NotesNEW HIGHS OF NOTE LAST WEEK

Not many

NEW LOWS OF NOTE LAST WEEK

Netflix (NFLX)... selling fewer flix

Books-A-Million (BAMM)... selling fewer books

CarMax (KMX)... selling fewer cars

E*Trade Financial (ETFC)... selling fewer trades

Diamond Offshore Drilling (DO)... fewer drills offshore

Transocean (RIG)... fewer drills in the ocean

Mosaic (MOS)... not a pretty picture for this fertilizer giant

Smith & Wesson (SWHC)... guns

Rosetta Stone (RST)... language company

Silver Standard (SSRI)... large silver miner

Hecla Mining (HL)... large silver miner

West Marine (WMAR)... major boat seller

Rare Element Resources (REE)... rare earth rally blowing up

Nabors Industries (NBR)... major oil & gas driller

EnCana (ECA)... natural gas producer

Ultra Petroleum (UPL)... natural gas producer

Peabody Energy (BTU)... largest public U.S. coal producer

Vale (VALE)... largest public pure play iron ore producer

Freeport McMoRan (FCX)... largest public copper producer

Vulcan Materials (VMC)... giant construction aggregate producer

|

In The Daily Crux

Recent Articles

|