| Home | About Us | Resources | Archive | Free Reports | Market Window |

|

Editor's note: As we explained in our letter this morning, we're closing out the year with a few of our best "outside the stock market" ideas. And we're beginning with one of the most important. As you'll see, this is an unconventional way to invest and think about stock ownership. It gives you the "sleep at night" confidence that your income will rise every year, regardless of what the market is doing...

How to Find Extraordinary Income Streams That Always Go UpBy

Tuesday, December 27, 2011

For years now, I've been pounding the table on World Dominating Dividend Growers.

These companies are at the tops of their industries. They gush free cash flow and pay out ever-increasing dividends like clockwork. Some of these companies have grown their dividends for 40 years in a row.

But I realize many of you doubt the wisdom of owning these stocks. So today, I'm going to show you why dividend growth stocks are the closest to a sure thing that exists in the stock market. They're the only source of return you can count on to rise every year. They're unbeatable investments.

I've told you about this many times. But now I'd like to show you...

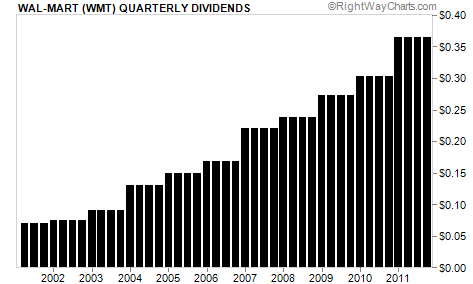

Let's start with retail dominator Wal-Mart (NYSE: WMT). Take a look at Wal-Mart's dividend growth over the last 10 years...

It's relentless. Wal-Mart's dividend has grown every year, year after year... through the biggest housing boom and bust in history... the worst financial disaster in American history... Federal Reserve inflation... higher food prices... terrorist attacks... two recessions... $150 oil... and $1,500 gold.

Through all of it, Wal-Mart has continued to grow its business and dividend payment by 15.89% per year. At that rate, if you buy today, you'll earn a double-digit yield over your original cost within eight years.

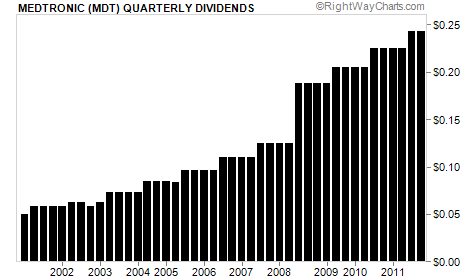

Let's look at another example: World Dominating Dividend Grower Medtronic (NYSE: MDT). Medtronic's dividend goes up every year, like all the other World Dominating Dividend Growers.

It's been paying a dividend since 1974, and it has raised that dividend every year for 34 years in a row. Its dividend has grown 14.87% per year for the last 10 years. If that growth continues, in 10 years, you'll be earning 11.87% in dividends.

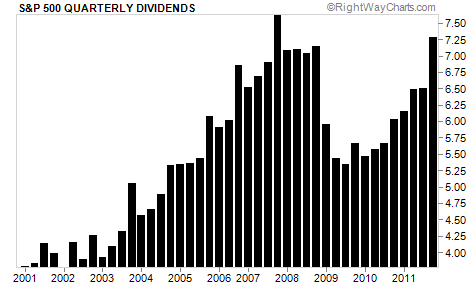

Now let's compare that to the performance of the S&P 500 as a whole. The chart below tracks the total dividend paid out by S&P 500 stocks over the same 10-year period...

It's not bad. The total dividend payment is up overall during the period. But when things got tough in 2008 and 2009, many companies slashed their dividends. And in 2011, the S&P 500 paid about the same amount it paid in 2006.

Five years of dividend growth was wiped out of existence. If you were depending on dividends from the average stock as a source of income, you took a heavy pay cut.

But while most companies cut or eliminated their dividends, Wal-Mart and Medtronic continued to raise their dividends by double digits every year.

The bottom line is, the market can't promise you growing income. It can't even promise you steady income. Only the World Dominating Dividend Growers can.

They're the best investments around. And if you're investing for income, they'll beat the stock market, year after year.

Good investing,

Dan

Further Reading:

Over the last century, buying blue-chip stocks that raise their dividends year after year has compounded your money faster than any other passive investment technique in the universe. Even better, this strategy takes no work, skill... or even attention. Get the full story here: Turn $1,000 of Your Kid's Savings Account into $168,700.

Market NotesA YEAR-END LOOK AT "SUPER-CONCENTRATION," PART 1 As we noted in our letter this morning, we haven't seen another financial publication that has warned folks of the dangers of "super-concentrated" portfolios as much as we have in DailyWealth.

To recap, many people take a position in commodities like crude oil, copper, and corn with the idea that they're diversifying their portfolio. And often, that's a reasonable idea. But not now. Almost every conventional asset has become part of a huge "risk on, risk off" trade. Stocks, commodities, and even real estate stocks are moving in the same up-and-down fashion, at the same rate. Instead of being "diversified," portfolios that hold all these assets are "super-concentrated."

So this week, alongside our "outside the stock market" essays, we're running a special Market Notes series that highlights the dangerous "super-concentrated" idea. We'll start with stocks and copper...

Copper is one of the world's most important building products. It's in everything around you... from cars and computers to refrigerators and plumbing. And while you might think a position in copper is different from a position in stocks, the two-year performance chart of these two assets shows that's not the case. Over the past two years, stocks and copper have registered almost identical returns... and moved up and down in a similar fashion.

|

Daily Crux Best of '11Top consumer tips

Wednesday, January 12, 2011

... And the one place you should NEVER keep them.

Monday, February 07, 2011

"Finding great self-defense weapons on a tight budget can be a challenge..."

Tuesday, April 26, 2011

A money-saving "secret" the average American has never considered...

Friday, October 14, 2011

New research confirms this common vitamin can be dangerous...

Recent Articles

|