| Home | About Us | Resources | Archive | Free Reports | Market Window |

A Series of Shocking Inflation StatisticsBy

Friday, December 23, 2011

It's one of the biggest fears of every retiree...

The thought that rampant inflation will eat away at your nest egg... leaving you to live out your final years in poverty.

Because inflation is such a big fear, it's easy for folks to swallow any sort of statement about how bad it is... or how much worse it's going to get. There's practically an entire industry based on claims of how bad inflation is.

As I'll show you in today's essay, that industry is wrong.

Inflation is no problem right now... and if you think otherwise, your investments could suffer a terrible 2012. All you have to do is ignore the hype and focus on the numbers and facts.

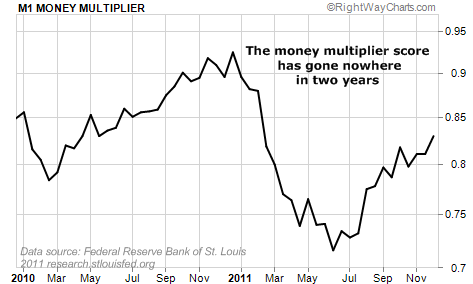

Back in January of this year, I showed readers of my Retirement Millionaire advisory how inflation was no near-term investment concern. That's because the "M1 money multiplier" was below 1.0.

The M1 multiplier is a measure of how quickly money is flowing around the economy. All you need to know about this statistic is if it's over 1.0, banks are taking their depositors' money and loaning it out – money is flowing. As long as it stays below 1.0, the money is not circulating.

Back then, with such a low score, it just wasn't pointing to trouble ahead. Almost a year later, it's still below 1.0. As you can see in the chart below, we're right back where we were two years ago...

This tells us one major thing...

In spite of the government's best attempts to stimulate the economy, things remain slow. Factories aren't buzzing. Jobs aren't being created. And prices have decreased. This is not inflation, but deflation.

Today, when I look at other charts of commercial loans, construction spending, business inventories, and manufacturing utilization rates, I see the same thing. The economy, while not in the pits, sure isn't moving at a high enough rate of speed to generate inflation.

You can also see the economy's sluggishness by looking at this chart of the CRB Commodity Index below. This index is a gauge of raw material prices (things like crude oil, copper, corn, sugar, gold, and platinum). It's near its lowest level in a year... which is also the level it was at seven years ago.

The bottom line for you as an investor or retiree is that inflation is no near-term worry... certainly not in 2012.

That's why I still encourage readers to hold onto blue-chip, dividend-paying businesses like Exelon, Johnson & Johnson, and Microsoft. These provide safety, growth potential, and stable income.

I'm also going against the crowd and recommending you hold onto municipal bonds. Like inflation fears, worries over municipal bonds are overblown. The default rates are still miniscule... and some of my favorite bond funds pay nearly 6% in income (which equates to a 9% rate in a taxable bond for someone in the 35% tax bracket). These are still great income vehicles for retirees.

Don't get me wrong. I've been in the financial markets for over 30 years, and I've never seen such extreme government overreactions to economic problems. The government's bungling will likely cause inflation down the road. But for at least the next year or two, we need to invest as I've described. All you have to do is look at the facts to realize it.

Here's to our health, wealth, and a great retirement,

Doc Eifrig

Further Reading:

Strong, blue-chip businesses are the core of what Dan Ferris calls his World Dominating Dividend Grower strategy. "These are the biggest and best companies on the planet," Editor in Chief Brian Hunt says about Dan's system. "If you're really greedy, if you want to safely make a ton of money in stocks, use this system exclusively…"

Market NotesTHE BEARS ARE WINNING THE WAR OF SALESFORCE It finally happened. The great glamour stock juggernaut known as Salesforce is entering a bear market...

Back in August, we highlighted the stalled uptrend in software firm Salesforce. Over the past few years, it's been one of highest-performing and most controversial stocks in the market. Shares gained around 500% from early-2009 to mid-2011.

During this rise, many bright investors pointed out the stock was absurdly expensive... trading for crazy multiples of its book value and cash flows. They called it a share price disaster waiting to happen. But for a good while, the stock continued to soar... and continued to get more expensive.

As you can see from the chart below, the "soaring" is over for Salesforce. After suffering a sharp selloff in August, the stock staged a "relief rally" and attempted to resume its uptrend. This rally ended pathetically. The stock is now suffering high-volume selloffs, which indicate the big "hot money" crowd is fleeing the trade. And shares just staged an important one-year downside breakout. Share price weakness plus extreme overvaluation is a recipe for a big fall.

.png) |

In The Daily Crux

Recent Articles

|