| Home | About Us | Resources | Archive | Free Reports | Market Window |

Taking Advantage of the Secret of the "Money Flows"By

Tuesday, January 24, 2012

Most investors don't understand how this works... but I KNOW it's true, because I did it myself.

I'm talking about the Secret of the "Money Flows."

It's a secret that I used every day as the vice president of a mutual fund years ago. And you can use this secret to position yourself for safe profits. I'll show you my favorite way to use it right now.

Let me explain...

Part of my job description as vice president of a global mutual fund in the mid-1990s was to put the fund's excess cash "to work" overnight.

So I parked our money overnight where it was "treated best." I was looking for a safe country that paid a high amount of interest. I wasn't the only one doing this. Thousands of institutional investors, controlling trillions of dollars, were doing the same thing.

In short, that money flowed to where it was treated best.

Today, the Australian dollar is a good example...

You earn more interest in Aussie dollars than in any other safe, major currency. And that's caused the Aussie dollar to jump 60% in the last three years.

You can use the Secret of the Money Flows in more than just currencies, too. The same things happen in the stock market...

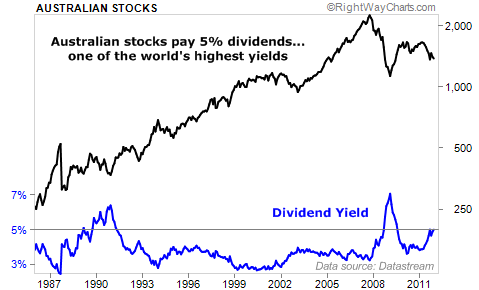

Right now, Australian stocks are dirt-cheap. Currently, Australian stocks pay a ridiculous 5% dividend yield.

As you can see, Aussie stocks haven't paid this kind of yield in over 20 years (excluding the financial crisis).

A 5% dividend yield is enormous compared to the rest of the world... The S&P 500 pays just 2.1%. Japanese stocks pay just 2.2%. And even the demolished German stock market pays just 3.8%.

What's more important, it's nearly impossible to find a 5% yield on any asset, anywhere. The bank pays 0%. CDs aren't much better. The U.S. government pays just 2% on 10-year debt. Quality corporate bonds pay around 4%.

Finding a 5% yield is just about impossible. But Australian stocks are paying it right now...

Investors are desperate for yield... And like I said, money flows where it's treated best.

Therefore, I expect the Australian stock market could go much higher from here.

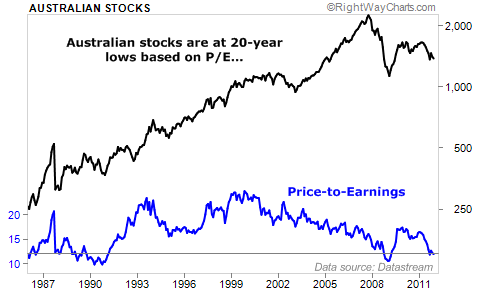

Aussie stocks are a great deal just based on dividends. But Aussie stocks are also ridiculously cheap based on price-to-earnings (P/E)...

Aussie stocks are at 20-year lows (excluding the financial crisis), trading at about 12 times earnings.

I like to buy Australian stocks through the iShares Australia Fund (EWA). It's a simple fund that trades on the U.S. stock market.

Major commodity companies (like BHP Billiton and Rio Tinto) and four large banks dominate the Australian stock market. These banks are in good shape... none of them lost money in the global economic crisis.

I believe investors will reevaluate the merits of having money in Australia... and they will push Aussie stocks higher. Trade accordingly...

Good investing,

Steve

Further Reading:

Australian stocks are dirt-cheap. And its currency is much safer than the U.S. dollar or euro. Steve shares the simplest way to play it here: Where to Earn Safe, 4% Yields on Your Cash.

To further diversify your portfolio, you can also consider Doc Eifrig's "outside the box" way to collect super-safe income overseas. "All you need is an Internet connection and a regular brokerage account," he writes, "and you're ready to participate in one of the easiest, safest ways to diversify a portion of your wealth out of the depreciating dollar."

Market NotesTHE NEW MOMENTUM TRADE FOR 2012 A trading idea for you to consider: dividends are sizing up to be this year's "momentum trade."

Over the past few years, we've stressed the importance of dividends and high-quality stocks dozens of times in DailyWealth. In a world full of risk and fraud, getting paid steady and growing dividends is one of the market's best strategies. You can read a few of our best pieces on the idea here, here, and here.

This idea was heavily "stress tested" in 2011. The broad market went through huge swings... and was crushed during the summer panic. Some of the market's riskier companies fell 25%-50% in just a few months. But most of our favorite dividend payers – like Coke, Intel, and Wal-Mart – held up just fine. Read about this phenomenon right here.

Our guess is that, in 2012, more and more people recognize the safety and income-producing power of basic dividend payers. With interest rates low, the fashionable thing on Wall Street will be for fund managers to say, "I own blue-chip dividend payers." This will send a flood of new money into these stocks. Corporate managers will see the share prices of divided payers rise... so they will hike payouts. This will create a "momentum" trade in dividends. You can see how this "momentum trade" has pushed the share price of Wal-Mart from $52 per share to $61 in less than four months.

|

In The Daily Crux

Recent Articles

|