| Home | About Us | Resources | Archive | Free Reports | Market Window |

Gold Won't Protect You from Inflation... This WillBy

Wednesday, March 21, 2012

Last month, the greatest investor on Earth attacked one of the financial world's sacred cows...

Every year, Warren Buffett publishes an annual letter to shareholders of his holding company, Berkshire Hathaway. It's one of the most widely read commentaries in the financial world.

In this year's letter, he included a page-long takedown of one of the most emotionally charged investment choices people make – holding gold. His main arguments were that gold isn't useful or productive.

Gold lovers (sometimes labeled "gold bugs") responded by calling Buffett a moron, a government shill, and a senile old man.

What I'm about to say might anger you... But I think Buffett has a good point...

One "myth" that leads people to gold is the belief that the precious metal can hedge you from inflation. This is the idea that as the price of everyday goods we buy rises, the price of gold will increase in lockstep.

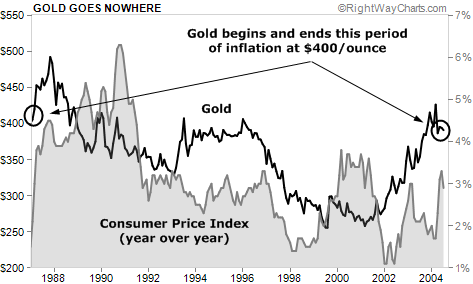

It makes some intuitive sense. But in reality, it doesn't work that way... The chart below shows that over 17 years of rising inflation (1987-2004), gold prices went nowhere...

Over my investing lifetime, the only great time to own gold has been when real returns on fixed-income securities turned negative... For example, when inflation has been more than interest rates on U.S. Treasurys, gold has been a great asset to own.

But that situation is uncommon. It's only happened 76 months out of the last 40 years (just 16% of the time). Most of the time, when the five-year Treasury note has paid more than inflation, gold has done nothing.

So a much better way to secure your retirement against inflation is to regularly invest in what Buffett prefers – "productive assets." These include everything from farms to businesses.

These assets have the power to protect against inflation because they can grow your investment faster than inflation erodes it.

Look for businesses (stocks) that hold pricing power and have brand loyalty. If inflation kicks in, the ability to raise prices right along with input costs helps maintain your wealth. And businesses with loyal customers can usually pass along those price hikes without much loss in volume. That means steady profit margins and more wealth.

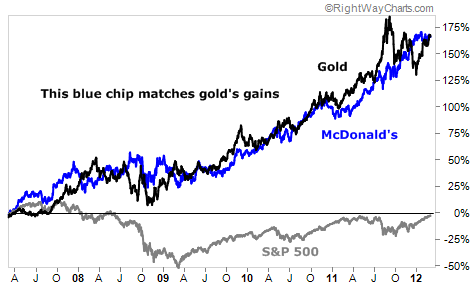

Take a company like McDonald's (NYSE: MCD). The demand for fast food will continue, and Mickey D's will surely be slinging burgers in another five or 10 years.

The company regularly responds to consumer demand. For example, it placated health-conscious parents by offering apples and milk in its Happy Meals. And it sells lattes now that compete with local coffeehouses. Some retired friends of mine just confessed to a daily trip to "their coffee shop" – the one under the Golden Arches.

If prices go up along with inflation, you can be sure MCD will retain its loyal patrons and its profits like it has for the last 50 years. Companies like MCD are perfect inflation defenses.

This chart of MCD, gold, and the S&P 500 shows how a great, blue-chip company protects you as well as gold can during tough times.

Here's another way to look at it... A recent Fortune magazine article compared three $100 investments placed in six-month U.S. Treasury bills (short-term interest-bearing securities), gold, and the S&P 500 in 1965. Today, those investments would be worth $1,336, $4,455, and $6,072, respectively.

Stocks beat gold by 36%. This shows the power of long-term investing in good stocks.

As my regular readers know, I like gold and silver as "chaos hedges." During times of great economic and political stress, gold outperforms many asset classes. But I don't recommend putting more than 15% of your portfolio here (and I prefer an allocation closer to 5%).

If you're truly interested in an "all-weather" asset to place a large chunk of your portfolio into, go with the world's best dividend-paying companies... like our portfolio holdings of Coca-Cola, McDonald's, and Johnson & Johnson.

If inflation ever gets to be a problem, you can depend on these companies to grow your nest egg, while paying cash dividends along the way. If inflation isn't a problem (like right now), these companies still grow your wealth and pay ever-rising cash dividends.

No one can make those claims for gold.

Here's to our health, wealth, and a great retirement,

Doc Eifrig

Further Reading:

Doc recently revealed a "sleep at night" investment technique that can regularly generate safe, 10%-20% income streams from blue-chip stocks. "I've taught this technique to friends, family members, and readers," Doc says. "And each time I teach it, I urge folks to keep in mind one key factor..." Get the details of Doc's plan here: How to Secure a SAFE Double-Digit Income Stream in Retirement.

Market NotesA "CHINA PLAY IN DRAG" CLIMBS HIGHER Today's chart shows that it's boom time for the stock we've labeled a "China play in drag."

Back in 2010, we noted the upside breakout in one of America's largest restaurant chains, Yum Brands (NYSE: YUM). YUM is the operator of KFC, Pizza Hut, and Taco Bell. And while most folks see this seller of fried chicken, pizza, and tacos as pure Americana, it's actually a huge play on China.

YUM is the largest fast food operator in China. Its KFC brand has over 3,700 locations in the country... and claims to be opening one new China location per day. Over 40% of YUM's profits come from its China division.

YUM also qualifies as a way to use our "basics" approach to international investing. As you can see from today's chart, the approach is working. Since our 2010 note, YUM has climbed 58%, and just yesterday, struck an all-time high. The Chinese love their fried chicken!

|

In The Daily Crux

Recent Articles

|