| Home | About Us | Resources | Archive | Free Reports | Market Window |

The Sensible, Low-Stress Way to Own Gold and SilverBy

Saturday, April 14, 2012

Last year, I showed DailyWealth readers an unusual chart...

It proved the benefits of a unique approach to precious metals investing... an approach that can help you build a "bulletproof" portfolio able to prosper in both boom times and crisis times.

And given what's happening in the market lately, it's time to keep this idea in mind...

Over the past month, gold has dropped 7%. Silver is down 15%. There's a lot of talk that the "gold bull is dead." For most precious-metals investors, that's cause for a lot of stress. But readers who took my advice on gold and silver are enjoying profits and sleeping well at night.

You see, I don't view gold as an "investment," like shares of Coke or rental real estate. I think about it as a "chaos hedge."

I want the bulk of my money in productive assets that pay me income and give me the chance at capital gains. This includes blue-chip dividend-paying stocks and municipal bonds.

But sophisticated investors know focusing solely on "rewards" like income and capital gains is a huge mistake. It's not the key to making an investment fortune. Great investors don't focus on rewards...

They focus on risk.

That's where gold and silver come in. These assets climb during times of crisis. And they could skyrocket in value if the "gloom and doom" crowd is right. This makes them worthy "insurance" assets.

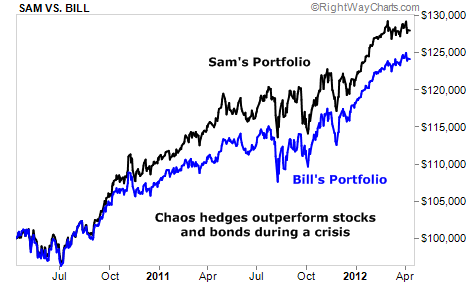

You can see this idea at work in the chart below. It's a version of a chart I showed you last year. It compares the portfolios of two investors: Bill and Sam.

Let's say both started two years ago with $100,000. Bill invested in a 50/50 mix of stocks and bonds. Sam, on the other hand, invested 45% of his portfolio in stocks, 45% in bonds, and the remaining 10% in gold and silver.

Here's how they each did...

As you can see, Sam, who owned gold and silver, did better than Bill. But that's not the big point here. I'm more interested in the fact that Sam will sleep better at night than Bill...

Sam can rest easy knowing he has some "portfolio insurance" against market calamities... like a "Flash Crash"... or a huge debt crisis in Europe.

Often, when investors get nervous about bad economic news... debt crises in Europe... and the specter of runaway inflation in the United States... stocks fall, and gold and silver rise.

When things "normalize" into a quieter environment of gradual economic growth, gold and silver tend to fall. As I've said before, I don't mind losing money on my gold and silver if my other investments are improving.

Sure... gold and silver have declined. But readers who took the "balanced" approach – by owning income-producing securities and an insurance position in precious metals – are doing just fine.

This has been the low-stress portfolio approach in the past, and will continue to be in the future.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

Further Reading:

Porter Stansberry also uses precious metals to protect his wealth. When hedging your portfolio, he recommends splitting your savings between cash and gold...

"Many investors can't get their heads around this idea," he writes. "Cash and gold represent two totally different ideas to them. But that's precisely why it's perfect advice for conservative investors..." Investors in a safe, defensive "50% cash, 50% gold" portfolio have watched their portfolios grow 25% since Porter first told his subscribers about this strategy... without touching stocks. Get the details here.

Market NotesCHART OF THE WEEK: IT'S A SIDEWAYS MARKET IN COMMODITIES This week's chart reveals an interesting fact about commodities...

If you watch mainstream financial media for a week, you're likely to hear someone say commodity prices are soaring due to the debasement of the U.S. dollar. And while this is a serious future concern, today's chart shows that commodity prices aren't soaring at all.

One of the most widely used gauges of commodity prices is the "CRB Index." It's a diversified gauge that tracks the price action in basic raw materials like copper, crude oil, natural gas, gold, sugar, cotton, and nickel.

As you can see from our chart, the CRB Index sat around 300 in early 2005. Since then, it has "boomed and busted" several times. All this wild volatility has produced zero gains, however. As of this week's trading, the CRB sits... around 300. It's a big "sideways" market in commodities.

|

Stat of the week

55%

Decline in the share price of U.S. coal giant Peabody Energy (BTU) in the past 12 months. Peabody and its competitors have crashed because of the fall in natural gas prices (which is a competitive fuel in power generation).

In The Daily Crux

Recent Articles

|