| Home | About Us | Resources | Archive | Free Reports | Market Window |

Missed the Move in Health Care? There's Still a Triple-Digit TradeBy

Monday, August 20, 2012

Spain is broke...

"There's no money in the public coffers. There's no money to pay for public services," the country's Budget Minister, Cristobal Montoro, said last month in Parliament.

Like Greece before it, Spain will now have to rely on the kindness of strangers simply to pay its bills and survive.

But while European countries continue to go broke, one investment fund full of European companies is currently hitting fresh all-time highs. The last time our opportunity was this good, this sector returned more than 600%. Let me explain...

How could this happen?

Health care stocks have kicked into a major uptrend. (I told DailyWealth readers about the incredible value in health care last fall. My preferred investment – RXL – is up 44% since then.) Even the terrible economic times in Europe can't hold back health care stocks any more.

The S&P International Health Care Sector Fund (NYSE: IRY), which holds many major European drugmakers, is taking off... It just broke out to an all-time high.

Today, IRY is in a powerful uptrend. Longtime readers know how important it is to get onboard these moves. And importantly, even after the recent run, these companies are still cheap.

Let's take a closer look at the fund's top holdings... Some of the biggest health care names on the planet make up nearly half its holdings. And they're trading at incredibly cheap valuations. Take a look...

On a price-to-earnings basis, these stocks haven't been this cheap since 1980... Back then, the DataStream index soared over 600% in the next six years. (Interestingly, that year was roughly the last time investors were seriously concerned about government finances like they are today.)

Dating back to 1973, these are the highest dividend yields we've seen on international health care stocks. If these stocks doubled from here, those dividend yields would fall in half... And the stocks would still pay more in dividends than just about any other investment today.

In short, right now, we have the ability to buy the planet's greatest names in health care at valuations not seen in at least 30 years. The last time they were this cheap, they soared over 600% in six years.

The current share-price action tells us the time is right. These companies are reaching new highs while Europe is in shambles. And we haven't missed this opportunity yet...

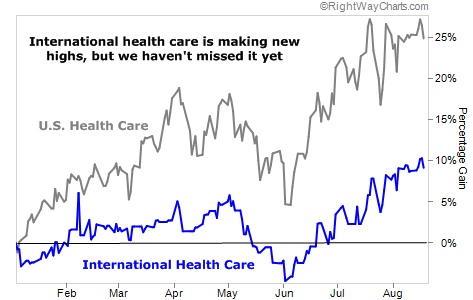

My True Wealth readers currently have exposure to health care through the ProShares Ultra Health Care Fund (RXL, the gray line on the chart below), which holds U.S. stocks. It's up 25% this year.

But the International Health Care Sector Fund (IRY, the blue line below) is only up a little this year. It's been held back by Europe's problems. Its uptrend is just getting going now. Take a look...

A little caveat here: Shares of IRY are thinly traded. So if you buy, make sure you use a limit order. This lets you determine the price you're willing to pay... and you won't get stuck chasing the fund higher, because your trade won't go through if shares are trading above it.

These international health care stocks are the cheapest they've been in history. And the uptrend is in place.

International health care returned 600% the last time our opportunity was this good. If you missed the move in health care, these are the stocks to own today. You haven't missed it yet. Get onboard this trend through shares of IRY today.

Good investing,

Steve

Further Reading:

According to Doc Eifrig, health care stocks "are among the best in the world at safely growing your money and paying dividends." With the Baby Boomer generation aging, he says these stocks have a terrific tailwind at their back. Get the full story here: Your Chance to Buy Dividend Machines on the Cheap.

Market NotesWATCH THIS GOLD NUMBER Keep your eye on the $1,640-per-ounce level for gold. If the yellow metal manages to hit that number, it's bullish news for gold owners.

Most readers know gold enjoyed a huge rally in 2011. As the European debt crisis grew worse and worse, gold shot from $1,550 an ounce to a high of around $1,900. This rally was followed by a long, grinding decline... one that took gold back down to the $1,550 level.

Now, note the right side of today's chart. It shows how gold has held the $1,550 level... and moved higher. Over the past three months, gold has traded in a tight price range. In this range, gold's day-to-day volatility has fallen to its lowest point in over a year. These periods of tight price ranges and low volatility often precede big price moves.

Gold is trading for around $1,613 right now. The highest point the precious metal hit during its latest trading range is $1,636 (as measured by the October futures contract). If gold breaks through this price level, it will likely kick off a rally.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|