| Home | About Us | Resources | Archive | Free Reports | Market Window |

Mortgage Rates at 2.75%? Yes! I'm Refinancing RIGHT NOWBy

Tuesday, October 2, 2012

"Steve, I just refinanced a guy at 2.75% on a 15-year mortgage," a mortgage-broker friend told me over the weekend.

I knew we were at record-low mortgage rates... But 2.75%? Really?

Sign me up! (Seriously. I am refinancing as I write.)

This is free money... Literally... This is money you have to take.

You see, the government is manipulating the mortgage market – in your favor.

It won't last forever. Sure, rates can go lower... But I'm locking this in as I write.

I say it's "free money" because, over the last 25 years, inflation has averaged just under 3%. Meanwhile, my friend is refinancing mortgages for just under 3%. So adjusted for inflation, I consider this "free money."

This is crazy. At the very least, banks need to earn more than the rate of inflation to turn a profit. But the thing is, the banks aren't keeping these loans...

Specifically, the Federal Reserve is trying to stimulate the economy. (This is a key part of the Bernanke Asset Bubble I've been telling you about.)

The Fed decided its preferred way of stimulating the economy is buying mortgages – and therefore, pushing mortgage rates down to record lows. For the last few weeks, the government has spent $20 billion a week buying mortgages.

To me, the government buying mortgages is a bit ridiculous... But I will surely take advantage of it.

To give you an idea of just how low 2.75% is today, consider that four years ago, 15-year mortgage rates were over 6%. This ultra-low 2.75% rate isn't just reserved for people with perfect credit – it turns out the national average is 2.73%. (Here's the proof.)

So don't assume you won't qualify. You should find out...

My friend the mortgage broker told me the banks are not preventing you from getting a mortgage... Heck, the banks want to sell you a mortgage, because they can now easily turn around and sell it to the government.

My friend explained it... "It's not much different than it used to be, as far as requirements – the bank just needs to verify those requirements more than it did before."

The down payment requirements are still very low, too... "For a couple percent down, you can get an FHA loan," my friend told me. FHA stands for the Federal Housing Administration. It has programs that allow people who wouldn't otherwise qualify to buy a home with a super-low down payment.

"For 5% down, you can get a 'traditional' mortgage." (By a "traditional" mortgage, he means a mortgage, under $417,000, with mortgage insurance.)

"But what about people who are underwater on their loans?" I asked my friend.

"We can even lend to them," he told me, "as long as they have verifiable monthly income that reasonably exceeds their debt service."

Here's how I look at it... Borrowing money in U.S. dollars and investing it in a real asset is exactly where I want to be... In a sense, you're "shorting" the dollar and "going long" U.S. real estate.

Mortgage rates are at record-low levels. I'm personally not waiting around. As I write, I am in the middle of the refinancing process... locking in a rate below 3%.

At these artificially low rates – below the historical rate of inflation – you should consider a new mortgage if you can afford it... whether it's buying a new house or refinancing your existing one.

I'm doing it. I'm not waiting around. What are you waiting for?

Good investing,

Steve

Further Reading:

Steve recently called housing "the most awesome opportunity in American history." Between bottoming housing prices, record-low mortgage rates, and more money printing from the government, he's personally taking advantage of the deals in real estate.

Catch up on Steve's "cheap housing" argument here:

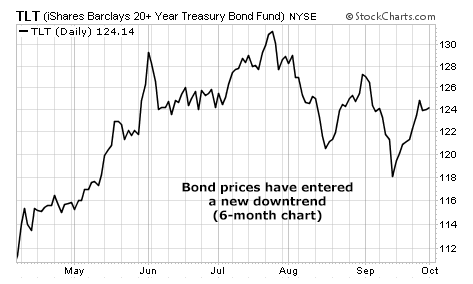

Market NotesA WARNING FOR BOND BUYERS Investors who've piled into the bond market over the last year may soon be disappointed.

A month ago, my colleague Jeff Clark told readers it was "decision time for interest rates." The 10-year Treasury yield popped above resistance, signaling a possible trend change. For the last several weeks, rates have crept higher. And that's bad news for bond investors.

Treasury bonds have an "inverse" relationship with interest rates – when one goes up, the other goes down. And falling interest rates since 2008 have provided a massive boost to Treasury bonds. During that time, big bond funds like the iShares Barclays 20+ Year Treasury Bond Fund (TLT) are up 70%-plus. But TLT has just shifted into a downtrend...

As you can see in today's chart, since interest rates bottomed in late July, TLT has made a series of "lower highs" and "lower lows." The uptrend in Treasury bonds may be over...

– Larsen Kusick

|

In The Daily Crux

Recent Articles

|