| Home | About Us | Resources | Archive | Free Reports | Market Window |

How to Pocket 91% Profits in Real Estate... in the Stock MarketBy

Thursday, February 7, 2013

An exclusive group of Stansberry & Associates subscribers just safely pocketed 91% profits in real estate... through the stock market.

Today, I'll share with you EXACTLY how we did it – with unprecedented access to some of our most expensive research.

I'll also share the best way for you to safely make money in U.S. housing now – again, through the stock market. It's a fantastic way to own real estate, without all the hassles of buying actual property...

It typically takes months to conduct a real estate transaction. But you can buy and sell property in seconds through the stock market. You can also get a diversified portfolio of properties for a couple thousand dollars or less. And you know the price you can sell your property stocks for every day.

Let me show you a real example of how I made money for my paid subscribers investing in real estate through the stock market...

In July 2010, I wrote a special issue of Phase 1 Investor. This newsletter features Stansberry & Associates' most in-depth (and most expensive) research. I occasionally contribute to Phase 1 when I come across a fantastic stock that is simply too small to share with my regular True Wealth subscribers.

I recommended shares of Alico (NASDAQ: ALCO), which owns over 100,000 acres of land in South Florida. At the time, the stock was trading around $22. That price valued Alico's acres at only $1,600 per acre... and assumed the rest of its operations were worthless.

Back then, I believed that real estate was bottoming in Florida and that Alico was super-cheap. Here's what I told readers...

By the end of last month, Alico had risen above $44 per share. So Phase 1 editor Frank Curzio told readers to sell Alico in his latest issue, out earlier this week.

Could Alico go higher from here? Absolutely. But there's no need to get greedy. We bought for $0.40 on the dollar and sold for $0.80. That's fine with me.

Where can you get a deal like Alico today?

Sean Goldsmith asked me that question on the phone this week. Sean writes the S&A Digest, an excellent daily letter for paid Stansberry subscribers. He published my answer on Tuesday.

I told Sean that my favorite opportunity is still residential real estate. Prices are still cheap, and mortgage rates are still ridiculously low. Here's what I said:

Regular readers should be familiar with this opportunity... I described it in a December DailyWealth. In short, Silver Bay owns thousands of homes, bought at distressed prices in distressed markets including Florida and Arizona. You are not paying a premium for these properties.

By buying Silver Bay, you own a national portfolio of properties that were bought at cheap prices and are currently earning rental income. I expect Silver Bay will start paying dividends out of this rent.

Between capital appreciation and dividends, you could do very well in this stock. And I believe your downside is limited, as Silver Bay simply owns the homes, debt-free.

As I've explained, I like owning real estate through the stock market... You can own a diversified portfolio of real estate by buying just a few shares. And you can buy and sell those shares at any time.

Silver Bay is the most direct way for you to play the housing recovery in the stock market. Check it out...

Good investing,

Steve

P.S. I've asked my publisher to "unlock" my original recommendation of Alico in the July 2010 special issue of Phase 1 Investor. You can't miss this write-up. Access it here.

Further Reading:

There aren't a lot of easy ways to own real estate. But last month, Steve showed DailyWealth readers another excellent opportunity to invest in it THROUGH the stock market. This investment is cheap and could double your money in as little as two years. Get the full story here: This Company Has Done the "Dirty Work" for You in U.S. Real Estate.

Market NotesDESPITE A BIG MOVE, PLATINUM IS STILL CHEAP Big news in precious metals: Platinum is jumping in price... but it's still cheap relative to gold.

About a month ago, we pointed out that with stocks at five-year highs, "investment bargains" were difficult to find. One exception is platinum.

Remember... platinum is technically a precious metal, which means many people see it as jewelry and a "store of wealth," like gold. But platinum also serves as an industrial metal. It's used heavily in automobile production. Because of this industrial component, worries about the global economy have depressed its price.

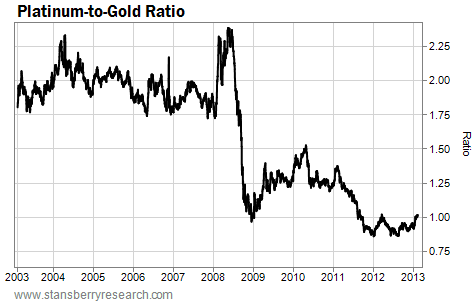

Just after our write-up, platinum surged $100 an ounce in a few weeks, sending the precious metal to its highest price in months. Despite this big short-term move, we remind you to consider the "long view" of how cheap platinum is relative to gold. The chart below shows you the story...

The chart tracks the ratio of platinum to gold. For many years, an ounce of platinum was twice as expensive as an ounce of gold, and this ratio stood around 2. But since the credit crash, this ratio has fallen below 1. Platinum is cheap relative to gold. If the global economy continues to gradually strengthen, we'll want more cars... and more platinum.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|