| Home | About Us | Resources | Archive | Free Reports | Market Window |

Your Investing Script for the Next Two YearsBy

Tuesday, March 19, 2013

Two weeks ago, I laid out the case for "The Great Migration"...

I believe Mom and Pop America are about to buy stocks... big time. They are about to migrate from ultra-low-interest investments (like cash and bonds) and into stocks...

They don't want to do this, I explained. But they will have no choice. They can't live on zero percent interest.

In the latest issue of True Wealth, I elaborated on our Great Migration "script." It's a three-act play...

At first, Mom and Pop America will buy the big-name stocks, the dividend-paying blue chips... including Johnson & Johnson, Pfizer, and Merck.

That is Act I. True Wealth readers have already doubled their money on our holding in these stocks through the ProShares Ultra Health Care Fund (NYSE: RXL). The story is still intact, so we are not selling.

Now... I believe we're on the brink of Act II:

As the "Great Migration" moves along, Mom and Pop will move past dividend-based ideas, and start taking on more and more risk. Their next stop will be Big Tech, like Apple (NASDAQ: AAPL) and Google (NASDAQ: GOOG).

We haven't reached Act II of our script just yet. The Dow has outperformed Google so far this month. But we could be close.

Act III is when you'll make the biggest gains... Here's what I told my True Wealth readers:

After seeing their success in big, dividend-paying drug stocks and Big Tech, Mom and Pop will become emboldened... They'll be ready to take on some real risk. And that's when riskier assets like emerging-market stocks will take off. We are not at Act III yet... Emerging-market stocks are actually DOWN since the Dow began its recent run. Mining stocks definitely count as riskier assets, too... and their day is clearly not here yet either. The Toronto Venture Exchange Index, which is sort of the "Dow Jones of small mining stocks," has crashed back down near 2009 levels.

Investors have not moved toward extremely speculative stocks... yet.

I think we'll be in Act III when the Fed starts raising interest rates, inflation starts to creep up, and unemployment moves into a more "normal" range. I believe the stock market can take that news in and STILL continue to power higher.

That's when it gets dangerous... when you know you're picking up money in front of a freight train. But right before the freight train arrives, the biggest gains are possible.

To see what I mean, take a look at this chart of the Nasdaq hitting its peak in 2000:

The Nasdaq soared from 3,000 to 5,000 – and back again – in no time!

We are not near Act III yet... when we'll see those huge gains. But even now, you want to own stocks. You want to capture the gains coming your way as Mom and Pop migrate their cash to these assets in the coming years.

Don't second guess or hold back.

Sure, there will be little corrections along the way. So have your trailing stops in place in case I'm wrong. Otherwise, stay onboard as long as possible.

Good investing,

Steve

Further Reading:

As Mom and Pop America migrate into stocks over the next couple years, it will kick the market into a major bull market. "If you understand this and position yourself correctly," Steve writes, "you could make a ridiculous amount of money." See what factors he believes will lead to a dot-com-style boom in stocks here, here, and here.

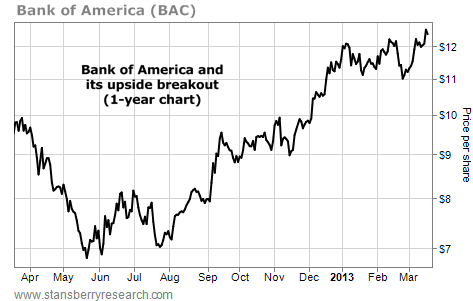

Market NotesBANK OF AMERICA AND ITS IMPORTANT NEW HIGH The government is getting what it wanted... financial stocks just hit a fresh round of 52-week highs.

Regular readers know we keep a close eye on financial stocks. The profits and share prices of big banks rise and fall with America's ability to earn money, invest money, service debts, launch new businesses, and generally just "get along."

The government knows this... and it's doing everything in its power to make things good for banks. This includes forcing interest rates lower and easing credit conditions. Today's chart shows the government's plan is working for now...

Our chart displays the past year's trading in banking giant Bank of America (NYSE: BAC). After suffering a selloff in early 2012, BAC has enjoyed a big uptrend. And just last week, it broke out of a sideways trading pattern to reach a new 52-week high. For now, the big trend in banks is up.

– Brian Hunt

|

In The Daily Crux

Recent Articles

|