| Home | About Us | Resources | Archive | Free Reports | Market Window |

This Is a Sign That a Stock Market Boom Is Headed Our WayBy

Friday, April 5, 2013

Last week, I showed you a handful of charts that dispel a common misconception... one that is keeping thousands of retirees up at night.

I dispelled the idea that the U.S. economy is running off the rails... that we are in a recession, or worse, a depression.

Despite the facts I showed you... and despite the fact that stocks are still a good value (read more here), the stock market still hasn't boomed like I believe it will.

But that's about to change. Here's why...

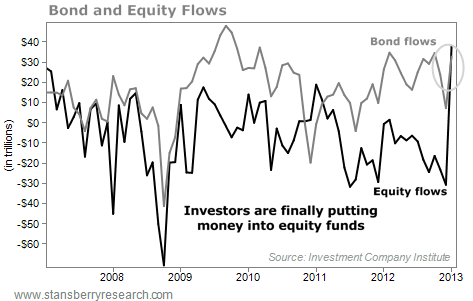

Investors spent much of 2012 "stampeding" into bond funds. Bonds are seen as "super safe" investment vehicles... much safer than stocks. A stampede into bonds is a classic sign that people are scared of a volatile and uncertain stock market.

And even with interest rates near all-time lows, people were still moving gobs of money into bonds and bond funds.

As the chart below shows, they're still putting money into bond funds... but they're finally starting to put money back into stocks as well.

This chart displays the amount of money flowing into bond funds (the gray line) and the amount of money flowing into stock funds (the black line). As you can see on the right side of the chart, the money flow into stocks just spiked higher... It's now equal to the money flowing into bonds.

This spike higher in equity flows tells us that "Mom and Pop" investors are finally getting interested in stocks again.

Yes, stocks have enjoyed big returns in the past few years... but it usually takes several years of great performance to draw in the public after it has been burned like it was in 2008.

The charts in last week's essay show that the economy is growing slowly. And despite what some folks tell you, inflation is still not a major concern right now. This is a good environment for stocks and – under normal times – bonds.

But after the "stampede" into bonds, I think the risk here is too high. Plus, the dividend yields on stable (and even growing) blue-chip companies like Automatic Data Processing, Wal-Mart, and Wells Fargo make stocks a better choice for your portfolio in 2013.

We've had low interest rates, muted inflation, and relatively cheap stock market valuations for a while. And no surprise, the market has responded by approaching all-time highs.

Now, shifting investor sentiment could kick the rally into a higher gear. The recent spike in money flow is a clue that this is happening. That's why it's best to stay long stocks right now. They've had a great first quarter (up 10%)... but they're going to go up even more in 2013.

Here's to our health, wealth, and a great retirement,

Further Reading:

"The economy is slowly growing," Doc writes. "It's not growing so fast that inflation is a problem... but it's certainly not near 'recession' levels that so many people are afraid of." See four charts that prove the U.S. economy is healthy here: A Common-Sense Guide on America... And How to Invest in it.

And in addition to stocks, Doc recently told DailyWealth readers about another great investing opportunity. Get the details here: A Gift from the Market: Safe 6% Interest You Won't Pay Taxes On.

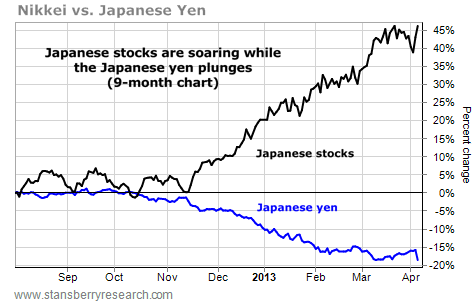

Market NotesJAPAN IS TRYING TO PRINT ITS WAY TO PROSPERITY Today's chart shows that you can score big gains when a government tries to "print its way to prosperity."

A few months ago, Japan elected a government whose main plan was to lower interest rates and print "unlimited" amounts of the country's currency, the Japanese yen. A cheaper yen helps Japan's export-driven economy. (Costs are paid in yen, while goods are sold in stronger currencies.) And low interest rates push money into stocks.

Money printing doesn't actually create wealth, of course. But until the bubble bursts, it can goose asset prices higher. And that's what's happening in Japan's major stock index – the Nikkei. Last month, the yen fell to a three-year low, while the Nikkei touched its highest levels in four years.

Despite the Nikkei's big run higher, Steve Sjuggerud says Japanese stocks are still his "favorite recommendation for 2013." He expects more money printing from Japan will push its stock market even higher. It's an important lesson for anyone wondering what to do when a government decides to "turn on the printing press."

– Larsen Kusick

|

In The Daily Crux

Recent Articles

|